Author: lboivin

OSISKO WINDFALL 2023 DRILLING UPDATE REGIONAL EXPLORATION TO RESUME

New Results Include 413 g/t Au Over 8.0 Metres

and 623 g/t Au Over 3.0 Metres

(Toronto, October 26, 2023) Osisko Mining Inc. (OSK:TSX. “Osisko” or the “Corporation”) is pleased to provide an update from the ongoing drill program at its 50% owned Windfall gold project located in the Abitibi greenstone belt, Urban Township, Eeyou Istchee James Bay, Québec.

The 2023 drilling campaign primarily targeted infill areas. Since the start of the year, over 95,000 metres have been drilled by 8 underground rigs focused on the Lynx segment of the deposit.

Highlights from the 2023 drill program are presented below and include 320 intercepts from 248 drill holes and 1 wedge. These highlights are intercepts with a metal factor (grams*meters) greater than 20. The intercepts are all located within the defined mineral resource estimate (“MRE”) blocks as described in Osisko’s feasibility study on Windfall (see FS Technical Report (as defined herein), a copy of which is available on SEDAR+ under Osisko’s issuer profile), and have targeted upgrading inferred mineral resources to measured or indicated mineral resources or indicated minerals resources to measured mineral resources as applicable.

Osisko Chief Executive Officer John Burzynski commented: “Infill drilling at the Windfall deposit is progressing well and confirming our models. High-grade gold continues to be intercepted in the Lynx areas including Triple Lynx, once again highlighting the world-class nature of the deposit. Of note, we have more than ten intervals in this set of numbers that returned values over one kilogram per tonne of gold. Infill drilling will continue into next year. We and our joint venture partner are very much looking forward to resuming exploration on our greater than 2,300 square kilometer land package around Windfall in the coming months”.

Regional exploration in the Urban Barry area will recommence on near-deposit and regional grassroots targets. Exploration will include ground geophysics and diamond drilling of various targets.

Maps showing Windfall hole locations are available at www.osiskomining.com. Maps: Top_Intersect_2023, PR_Longsections_ 20231026_EN.

2023 Drilling

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t) uncut | Au (g/t) cut to 100 g/t | Zone |

| OSK-W-23-2671 | 112.8 | 115.0 | 2.2 | 210 | 33 | LXM |

| including | 113.2 | 113.9 | 0.7 | 658 | 100 | |

| WST-22-1082 | 425.3 | 427.6 | 2.3 | 57.9 | 56.1 | LX4 |

| including | 425.7 | 426.0 | 0.3 | 104 | 100 | |

| including | 426.0 | 426.6 | 0.6 | 105 | 100 | |

| WST-22-1154 | 113.5 | 115.8 | 2.3 | 35.2 | 31.3 | TLX |

| WST-22-1171 | 76.0 | 78.0 | 2.0 | 35.0 | 30.1 | LXM |

| 81.4 | 84.0 | 2.6 | 39.3 | 21.4 | ||

| including | 81.4 | 81.7 | 0.3 | 255 | 100 | |

| 128.0 | 130.0 | 2.0 | 15.4 | |||

| WST-22-1182A | 526.8 | 528.8 | 2.0 | 99.3 | 54.9 | TLX |

| including | 527.6 | 528.4 | 0.8 | 211 | 100 | |

| 553.0 | 556.0 | 3.0 | 15.4 | |||

| WST-22-1182A-W1 | 553.8 | 562.2 | 8.4 | 29.6 | 29.2 | TLX |

| including | 557.4 | 558.1 | 0.7 | 105 | 100 | |

| and | 558.6 | 559.3 | 0.7 | 92.5 | ||

| WST-22-1218 | 101.0 | 104.4 | 3.4 | 74.0 | 48 | TLX |

| including | 102.0 | 102.5 | 0.5 | 274 | 100 | |

| 235.3 | 238.0 | 2.7 | 223 | 15 | ||

| including | 235.8 | 236.1 | 0.3 | 1970 | 100 | |

| WST-22-1219 | 230.0 | 233.0 | 3.0 | 15.9 | TLX | |

| WST-22-1237 | 119.5 | 121.7 | 2.2 | 376 | 41.4 | LXM |

| including | 119.5 | 120.4 | 0.9 | 919 | 100 | |

| WST-22-1240 | 144.5 | 146.6 | 2.1 | 24.1 | LXM | |

| WST-22-1241 | 139.5 | 141.5 | 2.0 | 27.9 | TLX | |

| WST-22-1246 | 154.0 | 156.4 | 2.4 | 12.5 | LXM | |

| WST-22-1249A | 296.1 | 298.1 | 2.0 | 204 | 22.3 | TLX |

| including | 296.6 | 297.0 | 0.4 | 1010 | 100 | |

| WST-22-1250 | 91.0 | 93.1 | 2.1 | 11.3 | TLX | |

| WST-22-1252 | 95.8 | 99.3 | 3.5 | 192 | 75 | TLX |

| including | 95.8 | 96.4 | 0.6 | 525 | 100 | |

| WST-22-1253 | 96.0 | 99.0 | 3.0 | 90.8 | 50.8 | TLX |

| including | 96.7 | 97.1 | 0.4 | 216 | 100 | |

| and | 97.6 | 98.4 | 0.8 | 192 | 100 | |

| 216.5 | 218.5 | 2.0 | 12.0 | |||

| WST-22-1254 | 95.3 | 98.3 | 3.0 | 154 | 50.5 | TLX |

| including | 97.0 | 98.0 | 1.0 | 410 | 100 | |

| 216.1 | 218.3 | 2.2 | 20.6 | TLX | ||

| WST-22-1255 | 98.0 | 100.4 | 2.4 | 9.49 | TLX | |

| WST-22-1256 | 479.5 | 483.4 | 3.9 | 24.0 | 16.5 | TLX |

| including | 482.4 | 482.7 | 0.3 | 197 | 100 | |

| WST-22-1261 | 112.4 | 114.6 | 2.2 | 39.8 | 14.2 | LXM |

| 178.9 | 181.0 | 2.1 | 19.6 | |||

| WST-22-1262 | 138.9 | 141.1 | 2.2 | 22.7 | TLX | |

| WST-22-1264 | 126.1 | 128.5 | 2.4 | 23.8 | TLX | |

| WST-22-1265 | 135.5 | 137.9 | 2.4 | 13.2 | TLX | |

| WST-22-1266 | 133.3 | 136.5 | 3.2 | 135 | 57.2 | TLX |

| including | 133.3 | 134.5 | 1.2 | 308 | 100 | |

| WST-22-1270A | 305.8 | 308.0 | 2.2 | 12.3 | TLX | |

| WST-22-1273 | 356.9 | 358.9 | 2.0 | 21.7 | TLX | |

| 487.8 | 490.2 | 2.4 | 16.0 | |||

| 511.0 | 513.4 | 2.4 | 16.5 | |||

| WST-22-1275 | 168.6 | 174.6 | 6.0 | 9.38 | LXM | |

| WST-22-1276 | 117.4 | 119.4 | 2.0 | 12.6 | LXM | |

| WST-22-1279 | 80.0 | 82.0 | 2.0 | 57.8 | 25.3 | LXM |

| including | 80.5 | 81.0 | 0.5 | 230 | 100 | |

| 125.9 | 128.7 | 2.8 | 9.82 | |||

| WST-22-1280 | 84.2 | 86.5 | 2.3 | 14.5 | LXM | |

| WST-22-1285 | 116.1 | 120.0 | 3.9 | 25.0 | TLX | |

| WST-22-1286 | 101.7 | 105.5 | 3.8 | 101 | 37.9 | TLX |

| including | 102.5 | 103.0 | 0.5 | 577 | 100 | |

| 163.5 | 166.9 | 3.4 | 34.8 | |||

| including | 165.6 | 166.0 | 0.4 | 75.5 | ||

| WST-22-1287 | 132.0 | 134.0 | 2.0 | 171 | 56.2 | LXM |

| including | 132.6 | 133.2 | 0.6 | 483 | 100 | |

| WST-22-1288 | 214.0 | 216.0 | 2.0 | 77.8 | 41.3 | TLX |

| including | 214.9 | 215.4 | 0.5 | 241 | 100 | |

| 215.7 | 216.0 | 0.3 | 108 | |||

| WST-22-1290 | 103.0 | 105.1 | 2.1 | 10.7 | LXM | |

| WST-22-1292 | 199.1 | 201.3 | 2.2 | 18.2 | TLX | |

| WST-22-1293 | 100.3 | 102.3 | 2.0 | 127 | 35.9 | TLX |

| including | 101.0 | 101.6 | 0.6 | 405 | 100 | TLX |

| WST-22-1294 | 59.0 | 61.1 | 2.1 | 20.5 | LXM | |

| WST-22-1296 | 65.0 | 71.6 | 6.6 | 12.4 | LXM | |

| WST-22-1297 | 84.0 | 86.4 | 2.4 | 112 | 51.3 | LXM |

| including | 84.0 | 84.4 | 0.4 | 462 | 100 | |

| WST-22-1298A | 75.0 | 78.3 | 3.3 | 304 | 41.6 | LXM |

| including | 75.6 | 76.3 | 0.7 | 1335 | 100 | |

| WST-23-1304 | 46.5 | 49.4 | 2.9 | 10.9 | LXM

|

|

| 115.0 | 117.3 | 2.3 | 19.0 | |||

| WST-22-1305 | 103.0 | 105.4 | 2.4 | 17.8 | TLX | |

| WST-22-1306 | 114.9 | 123.0 | 8.1 | 24.8 | TLX | |

| including | 115.3 | 116.0 | 0.7 | 76.1 | ||

| and | 120.9 | 121.5 | 0.6 | 69.4 | ||

| WST-22-1307 | 119.0 | 121.0 | 2.0 | 30.7 | TLX | |

| 114.0 | 116.4 | 2.4 | 12.2 | LXM | ||

| WST-22-1308 | 57.0 | 59.0 | 2.0 | 13.6 | ||

| WST-23-1309 | 60.9 | 63.0 | 2.1 | 18.1 | LXM | |

| 143.0 | 145.0 | 2.0 | 16.0 | |||

| WST-23-1310 | 65.7 | 69.0 | 3.3 | 78.2 | 60.9 | LXM |

| including | 68.0 | 69.0 | 1.0 | 157 | 100 | |

| WST-23-1316 | 114.7 | 117.0 | 2.3 | 18.6 | LXM | |

| WST-23-1317 | 70.6 | 72.6 | 2.0 | 305 | 40.7 | LXM |

| including | 71.0 | 71.5 | 0.5 | 1135 | 100 | |

| 72.6 | 74.7 | 2.1 | 16.9 | |||

| WST-23-1319 | 72.2 | 74.8 | 2.6 | 16.1 | LXM | |

| WST-23-1320 | 75.2 | 78.5 | 3.3 | 11.1 | LXM | |

| WST-23-1322 | 71.4 | 74.3 | 2.9 | 138 | 43.9 | TLX |

| including | 72.0 | 73.0 | 1.0 | 372 | 100 | |

| 127.8 | 131.0 | 3.2 | 49.6 | 27.4 | ||

| including | 128.9 | 129.5 | 0.6 | 218 | 100 | |

| 126.5 | 133.0 | 6.5 | 25.7 | 14.8 | ||

| including | 128.9 | 129.5 | 0.6 | 218 | 100 | |

| 156.6 | 158.9 | 2.3 | 13.7 | |||

| WST-23-1323 | 113.4 | 116.0 | 2.6 | 56.9 | 40.8 | TLX |

| including | 114.2 | 114.7 | 0.5 | 153 | 100 | |

| and | 115.2 | 115.5 | 0.3 | 152 | 100 | |

| WST-23-1326 | 63.7 | 66.0 | 2.3 | 89.4 | 31.6 | LXM |

| including | 64.7 | 65.4 | 0.7 | 290 | 100 | |

| WST-23-1329 | 113.0 | 117.5 | 4.5 | 25.6 | TLX | |

| including | 114.0 | 114.3 | 0.3 | 53.0 | ||

| and | 116.6 | 117.2 | 0.6 | 53.8 | ||

| 120.9 | 125.0 | 4.1 | 17.8 | |||

| 145.6 | 146.0 | 2.1 | 10.8 | |||

| WST-23-1332 | 99.0 | 102.6 | 3.6 | 39.1 | 36.8 | LXM |

| including | 101.0 | 101.4 | 0.4 | 121 | 100 | |

| WST-23-1343 | 127.1 | 129.5 | 2.4 | 129 | 29.6 | LXM |

| including | 127.1 | 127.8 | 0.7 | 442 | 100 | |

| 62.0 | 64.0 | 2.0 | 20.0 | LXM | ||

| WST-23-1345 | 56.1 | 59.0 | 2.9 | 16.7 | LXM | |

| WST-23-1347 | 119.5 | 121.8 | 2.3 | 25.8 | LXM | |

| WST-23-1348 | 65.0 | 67.3 | 2.3 | 11.4 | LXM | |

| 102.3 | 104.9 | 2.6 | 9.66 | |||

| WST-23-1350 | 114.0 | 116.0 | 2.0 | 23.0 | LXM | |

| WST-23-1353 | 91.6 | 93.9 | 2.3 | 37.1 | 32.3 | LXM |

| WST-23-1354 | 93.3 | 95.8 | 2.5 | 11.1 | LXM | |

| WST-23-1357 | 89.6 | 91.6 | 2.0 | 14.3 | TLX | |

| WST-23-1358 | 92.6 | 94.8 | 2.2 | 12.8 | TLX | |

| WST-23-1360 | 46.1 | 50.3 | 4.2 | 18.0 | LXM | |

| WST-23-1364 | 46.9 | 49.0 | 2.1 | 12.0 | LXM | |

| WST-23-1365 | 56.0 | 60.6 | 4.6 | 4.61 | LXM | |

| WST-23-1366 | 57.6 | 61.7 | 4.1 | 7.90 | LXM | |

| WST-23-1371 | 87.6 | 89.7 | 2.1 | 9.58 | TLX | |

| WST-23-1373 | 184.5 | 186.6 | 2.1 | 69.7 | 47.2 | TLX |

| including | 185.4 | 186.2 | 0.8 | 159 | 100 | |

| 161.5 | 163.5 | 2.0 | 28.0 | TLX | ||

| WST-23-1374 | 77.2 | 80.0 | 2.8 | 19.9 | LXM | |

| 81.5 | 83.6 | 2.1 | 43.7 | 14.5 | LXM | |

| WST-23-1375 | 102.0 | 104.0 | 2.0 | 10.4 | LXM | |

| WST-23-1381 | 86.0 | 88.0 | 2.0 | 12.8 | LXM | |

| WST-23-1384 | 54.5 | 56.7 | 2.2 | 228 | 31.8 | LXM |

| including | 56.0 | 56.7 | 0.7 | 717 | 100 | |

| WST-23-1387 | 59.0 | 61.0 | 2.0 | 34.7 | LXM | |

| WST-23-1388 | 84.5 | 86.6 | 2.1 | 29.4 | LXM | |

| WST-23-1389 | 84.5 | 87.0 | 2.5 | 10.2 | TLX | |

| WST-23-1390 | 84.7 | 87.0 | 2.3 | 13.6 | TLX | |

| WST-23-1391A | 89.0 | 91.0 | 2.0 | 23.5 | 22.1 | TLX |

| WST-23-1395 | 125.2 | 127.5 | 2.3 | 177 | 71.6 | TLX |

| including | 126.2 | 126.8 | 0.6 | 460 | 100 | |

| 134.8 | 137.0 | 2.2 | 54.9 | 23.5 | ||

| including | 135.3 | 135.7 | 0.4 | 273 | 100 | |

| 146.0 | 150.9 | 4.9 | 4.91 | |||

| WST-23-1396 | 182.8 | 184.9 | 2.1 | 20.3 | TLX | |

| WST-23-1398 | 95.3 | 98.7 | 3.4 | 35.1 | 28.9 | LXM |

| including | 95.3 | 96.2 | 0.9 | 124 | 100 | |

| WST-23-1406 | 73.5 | 75.6 | 2.1 | 27.0 | LXM | |

| WST-23-1410 | 95.0 | 97.2 | 2.2 | 10.9 | TLX | |

| WST-23-1414 | 121.0 | 123.0 | 2.0 | 17.4 | LXM | |

| WST-23-1416 | 83.0 | 85.2 | 2.2 | 9.88 | LXM | |

| WST-23-1419 | 89.9 | 92.0 | 2.1 | 110 | 39.8 | LXM |

| including | 90.3 | 90.6 | 0.3 | 499 | 100 | |

| WST-23-1422 | 137.3 | 141.3 | 4.0 | 68.0 | 49.1 | TLX |

| including | 138.8 | 139.6 | 0.8 | 195 | 100 | |

| WST-23-1424 | 135.5 | 137.7 | 2.2 | 29.3 | TLX | |

| 130.0 | 132.7 | 2.7 | 14.5 | |||

| WST-23-1425 | 132.2 | 135.2 | 3.0 | 283 | 61.3 | TLX |

| including | 134.6 | 135.2 | 0.6 | 1165 | 100 | |

| 107.0 | 109.8 | 2.8 | 10.0 | |||

| WST-23-1426 | 121.0 | 123.6 | 2.6 | 24.3 | TLX | |

| 175.0 | 177.0 | 2.0 | 12.2 | |||

| WST-23-1427 | 61.0 | 63.0 | 2.0 | 25.4 | LXM | |

| WST-23-1429 | 63.3 | 65.5 | 2.2 | 24.2 | LXM | |

| 47.0 | 49.0 | 2.0 | 10.7 | |||

| WST-23-1430 | 69.0 | 71.5 | 2.5 | 13.6 | LXM | |

| WST-23-1432 | 88.0 | 90.5 | 2.5 | 9.85 | TLX | |

| WST-23-1441 | 203.3 | 205.8 | 2.5 | 22.5 | TLX | |

| WST-23-1442 | 338.5 | 340.6 | 2.1 | 17.4 | TLX | |

| WST-23-1443 | 166.0 | 168.3 | 2.3 | 71.9 | 25.4 | LHW |

| including | 166.0 | 166.5 | 0.5 | 314 | 100 | |

| 60.0 | 62.0 | 2.0 | 25.2 | LXM | ||

| 68.0 | 70.0 | 2.0 | 13.9 | |||

| WST-23-1444 | 61.2 | 63.3 | 2.1 | 57.3 | 40.7 | LXM |

| including | 61.7 | 62.3 | 0.6 | 158 | 100 | |

| WST-23-1445 | 61.9 | 64.0 | 2.1 | 44.7 | 28.9 | LXM |

| 64.0 | 66.4 | 2.4 | 26.8 | |||

| WST-23-1448 | 100.0 | 102.2 | 2.2 | 18.3 | TLX | |

| WST-23-1450 | 93.0 | 95.0 | 2.0 | 38.4 | 25.2 | TLX |

| WST-23-1451 | 92.7 | 94.7 | 2.0 | 46.1 | 26.5 | TLX |

| WST-23-1453 | 68.5 | 73.1 | 4.6 | 48.4 | 28.7 | LXM |

| including | 72.4 | 73.1 | 0.7 | 229 | 100 | |

| 75.2 | 85.0 | 9.8 | 18.7 | 17.8 | LXM | |

| including | 76.6 | 77.1 | 0.5 | 119 | 100 | |

| and | 81.4 | 82.8 | 1.4 | 47.2 | ||

| WST-23-1455 | 92.3 | 94.9 | 2.6 | 46.2 | 40.8 | LXM |

| including | 92.3 | 93.3 | 1.0 | 114 | 100 | |

| WST-23-1456 | 39.5 | 41.5 | 2.0 | 59.5 | 30.0 | LXM |

| including | 40.0 | 40.6 | 0.6 | 198 | 100 | |

| 64.5 | 68.9 | 4.4 | 18.2 | LXM | ||

| WST-23-1457 | 39.0 | 41.2 | 2.2 | 27.2 | LXM | |

| WST-23-1458 | 39.6 | 41.6 | 2.0 | 52.6 | 30.4 | LXM |

| including | 39.6 | 40.2 | 0.6 | 174 | 100 | |

| WST-23-1465 | 121.0 | 123.0 | 2.0 | 10.3 | TLX | |

| WST-23-1466 | 103.8 | 106.0 | 2.2 | 15.4 | TLX | |

| 92.5 | 95.4 | 2.9 | 16.7 | |||

| WST-23-1467 | 91.7 | 94.0 | 2.3 | 24.3 | TLX | |

| WST-23-1468 | 91.5 | 93.7 | 2.2 | 9.59 | TLX | |

| WST-23-1470 | 85.4 | 87.5 | 2.1 | 17.5 | LXM | |

| WST-23-1471 | 67.0 | 69.0 | 2.0 | 11.9 | LXM | |

| WST-23-1472 | 71.9 | 74.1 | 2.2 | 9.51 | LXM | |

| WST-23-1473 | 72.5 | 74.6 | 2.1 | 26.9 | LXM | |

| WST-23-1474 | 74.4 | 77.0 | 2.6 | 109 | 37.5 | LXM |

| including | 74.4 | 75.2 | 0.8 | 332 | 100 | |

| WST-23-1475 | 175.4 | 180.0 | 4.6 | 45.6 | 25.8 | LXM |

| including | 176.0 | 176.7 | 0.7 | 230 | 100 | |

| WST-23-1476 | 177.2 | 180.0 | 2.8 | 18.2 | LXM | |

| WST-23-1478 | 102.0 | 104.1 | 2.1 | 30.7 | 29.8 | TLX |

| WST-23-1480 | 100.0 | 102.0 | 2.0 | 20.5 | TLX | |

| WST-23-1482 | 171.0 | 173.0 | 2.0 | 51.4 | 40.8 | LXM |

| including | 172.2 | 173.0 | 0.8 | 127 | 100 | |

| WST-23-1484 | 89.6 | 92.0 | 2.4 | 15.3 | TLX | |

| WST-23-1485 | 89.9 | 92.0 | 2.1 | 31.0 | TLX | |

| 110.0 | 112.2 | 2.2 | 12.8 | |||

| WST-23-1486 | 88.8 | 91.0 | 2.2 | 38.1 | TLX | |

| 156.0 | 158.0 | 2.0 | 24.5 | TLX | ||

| WST-23-1487 | 152.9 | 155.0 | 2.1 | 118 | 58.2 | LXM |

| including | 152.9 | 153.3 | 0.4 | 354 | 100 | |

| WST-23-1490 | 150.0 | 152.0 | 2.0 | 10.2 | LXM | |

| WST-23-1491 | 59.3 | 61.5 | 2.2 | 80.4 | 23.2 | LXM |

| including | 59.3 | 59.6 | 0.3 | 520 | 100 | |

| WST-23-1492 | 56.3 | 59.7 | 3.4 | 35.2 | 32.3 | LXM |

| including | 56.3 | 56.9 | 0.6 | 117 | 100 | |

| WST-23-1494 | 46.0 | 48.1 | 2.1 | 22.8 | LXM | |

| WST-23-1495 | 131.8 | 134.1 | 2.3 | 14.1 | 13.1 | LXM |

| WST-23-1496 | 134.2 | 137.1 | 2.9 | 66.1 | 17.5 | LXM |

| including | 134.6 | 135.1 | 0.5 | 382 | 100 | |

| 49.4 | 51.7 | 2.3 | 17.3 | |||

| WST-23-1497 | 47.7 | 50.6 | 2.9 | 39.8 | 39.3 | LXM |

| including | 48.1 | 48.5 | 0.4 | 104 | 100 | |

| WST-23-1500 | 115.2 | 117.4 | 2.2 | 14.1 | LXM | |

| WST-23-1501 | 107.5 | 109.6 | 2.1 | 12.9 | LXM | |

| WST-23-1503 | 140.0 | 142.0 | 2.0 | 14.2 | TLX | |

| WST-23-1514 | 59.9 | 62.0 | 2.1 | 44.4 | 19.2 | LXM |

| WST-23-1515 | 64.0 | 66.1 | 2.1 | 17.4 | LXM | |

| WST-23-1516 | 65.5 | 68.6 | 3.1 | 110 | 56.0 | LXM |

| including | 67.9 | 68.6 | 0.7 | 229 | 100 | |

| 133.0 | 135.0 | 2.0 | 14.8 | |||

| WST-23-1519 | 135.0 | 137.0 | 2.0 | 24.4 | TLX | |

| WST-23-1520 | 121.0 | 123.8 | 2.8 | 85.2 | 75.3 | TLX |

| WST-23-1522 | 122.0 | 124.0 | 2.0 | 10.2 | TLX | |

| WST-23-1523 | 120.5 | 124.0 | 3.5 | 444 | 59.0 | TLX |

| including | 121.4 | 121.7 | 0.3 | 3910 | 100 | |

| WST-23-1524 | 119.1 | 121.6 | 2.5 | 121 | 50.4 | TLX |

| including | 120.7 | 121.6 | 0.9 | 296 | 100 | |

| WST-23-1525 | 148.3 | 150.4 | 2.1 | 19.6 | TLX | |

| 123.0 | 125.1 | 2.1 | 17.7 | |||

| 159.0 | 161.2 | 2.2 | 9.22 | |||

| 127.0 | 129.0 | 2.0 | 16.0 | |||

| WST-23-1530 | 89.0 | 91.1 | 2.1 | 15.1 | LXM | |

| 75.2 | 77.4 | 2.2 | 11.5 | |||

| WST-23-1532 | 77.0 | 79.5 | 2.5 | 22.7 | LXM | |

| 85.4 | 88.5 | 3.1 | 67.9 | 38.5 | ||

| including | 86.5 | 86.8 | 0.3 | 404 | 100 | |

| 91.0 | 93.1 | 2.1 | 66.0 | 49.3 | ||

| including | 91.3 | 92.2 | 0.9 | 139 | 100 | |

| WST-23-1533 | 72.0 | 74.3 | 2.3 | 15.7 | LXM | |

| WST-23-1534 | 40.0 | 42.0 | 2.0 | 19.9 | LXM | |

| WST-23-1535 | 64.8 | 68.0 | 3.2 | 23.9 | LXM | |

| WST-23-1538 | 124.6 | 126.5 | 1.9 | 32.2 | 30.9 | LXM |

| WST-23-1541 | 104.0 | 106.0 | 2.0 | 23.5 | 20.3 | LXM |

| WST-23-1542 | 55.5 | 57.5 | 2.0 | 43.7 | 30.5 | LXM |

| WST-23-1543 | 59.5 | 64.8 | 5.3 | 27.8 | 25.9 | LXM |

| including | 59.5 | 60.4 | 0.9 | 89.3 | 78.4 | |

| and | 63.4 | 63.9 | 0.5 | 80.3 | ||

| WST-23-1549 | 135.0 | 137.6 | 2.6 | 31.8 | LXM | |

| WST-23-1550 | 132.0 | 134.5 | 2.5 | 18.4 | LXM | |

| WST-23-1555 | 111.2 | 113.3 | 2.1 | 35.0 | 34.9 | TLX |

| WST-23-1557 | 83.8 | 86.1 | 2.3 | 78.0 | 24.5 | LXM |

| including | 84.1 | 84.6 | 0.5 | 346 | 100 | |

| WST-23-1560 | 94.0 | 96.0 | 2.0 | 11.5 | LXM | |

| WST-23-1575 | 44.1 | 46.5 | 2.4 | 8.38 | LXM | |

| WST-23-1577 | 63.3 | 66.3 | 3.0 | 64.9 | 36.9 | LXM |

| including | 64.0 | 64.6 | 0.6 | 240 | 100 | |

| WST-23-1578 | 41.8 | 44.2 | 2.4 | 18.1 | LXM | |

| WST-23-1579 | 47.3 | 50.8 | 3.5 | 26.9 | 26.2 | LXM |

| WST-23-1580 | 48.2 | 52.2 | 4.0 | 36.1 | LXM | |

| including | 51.6 | 52.2 | 0.6 | 97.3 | ||

| WST-23-1581 | 50.5 | 52.7 | 2.2 | 224 | 58.5 | LXM |

| including | 51.7 | 52.1 | 0.4 | 501 | 100 | |

| 136.4 | 139.6 | 3.2 | 24.7 | LXM | ||

| WST-23-1583 | 41.9 | 44.0 | 2.1 | 16.6 | LXM | |

| WST-23-1585 | 102.9 | 105.4 | 2.5 | 39.4 | LXM | |

| WST-23-1591 | 60.0 | 62.0 | 2.0 | 19.4 | LXM | |

| WST-23-1592 | 59.6 | 62.0 | 2.4 | 31.4 | 29.4 | LXM |

| WST-23-1593 | 42.0 | 44.0 | 2.0 | 10.9 | LXM | |

| WST-23-1596 | 58.0 | 60.0 | 2.0 | 117 | 25.1 | LXM |

| including | 58.0 | 58.5 | 0.5 | 466 | 100 | |

| WST-23-1602 | 129.0 | 131.1 | 2.1 | 71.5 | 52.0 | TLX |

| including | 129.8 | 130.5 | 0.7 | 159 | 100 | |

| WST-23-1603 | 123.3 | 126.1 | 2.8 | 322 | 59.1 | TLX |

| including | 123.9 | 124.8 | 0.9 | 918 | 100 | |

| WST-23-1604 | 122.2 | 125.0 | 2.8 | 21.3 | 15.4 | TLX |

| WST-23-1605 | 123.0 | 125.7 | 2.7 | 692 | 57.8 | TLX |

| including | 124.2 | 125.0 | 0.8 | 2240 | 100 | |

| WST-23-1606 | 121.7 | 124.6 | 2.9 | 183 | 42.6 | TLX |

| including | 122.0 | 122.5 | 0.5 | 916 | 100 | |

| WST-23-1607 | 119.3 | 122.4 | 3.1 | 171 | 34.1 | TLX |

| including | 121.6 | 122.1 | 0.5 | 947 | 100 | |

| 157.0 | 159.0 | 2.0 | 11.9 | TLX | ||

| WST-23-1608 | 104.9 | 107.5 | 2.6 | 43.0 | 12.0 | LXM |

| including | 106.2 | 106.5 | 0.3 | 369 | 100 | |

| WST-23-1614 | 98.0 | 100.2 | 2.2 | 20.0 | TLX | |

| WST-23-1615 | 84.0 | 87.2 | 3.2 | 33.9 | 32.7 | TLX |

| including | 85.2 | 85.6 | 0.4 | 68.0 | ||

| and | 85.9 | 86.2 | 0.3 | 113 | 100 | |

| and | 86.6 | 86.9 | 0.3 | 83.0 | ||

| WST-23-1616 | 83.0 | 85.3 | 2.3 | 85.3 | 50.9 | TLX |

| including | 84.4 | 85.0 | 0.6 | 232 | 100 | |

| WST-23-1618 | 72.0 | 74.0 | 2.0 | 16.7 | LXM | |

| WST-23-1619 | 89.4 | 92.0 | 2.6 | 28.4 | TLX | |

| WST-23-1620 | 89.5 | 91.6 | 2.1 | 23.4 | TLX | |

| WST-23-1631 | 86.6 | 88.6 | 2.0 | 21.5 | TLX | |

| WST-23-1640 | 95.0 | 97.1 | 2.1 | 18.0 | LXM | |

| 123.0 | 125.0 | 2.0 | 68.5 | 25.0 | ||

| including | 123.8 | 124.3 | 0.5 | 274 | 100 | |

| WST-23-1642 | 100.5 | 102.8 | 2.3 | 71.3 | 45.7 | LXM |

| including | 100.9 | 101.9 | 1.0 | 159 | 100 | |

| WST-23-1650 | 54.8 | 57.4 | 2.6 | 63.3 | LXM | |

| WST-23-1652 | 27.0 | 29.1 | 2.1 | 41.6 | LXM | |

| 68.4 | 75.4 | 7.0 | 124 | 37.1 | LXM | |

| including | 74.0 | 75.0 | 1.0 | 711 | 100 | |

| WST-23-1661 | 129.1 | 132.0 | 2.9 | 9.21 | LXM | |

| WST-23-1662 | 115.3 | 117.6 | 2.3 | 18.4 | LXM | |

| WST-23-1664 | 118.8 | 121.0 | 2.2 | 30.6 | 18.3 | LXM |

| WST-23-1665 | 124.3 | 126.3 | 2.0 | 16.1 | LXM | |

| 143.2 | 145.2 | 2.0 | 12.2 | |||

| WST-23-1673 | 56.0 | 58.8 | 2.8 | 77.1 | 18.0 | LXM |

| including | 58.4 | 58.8 | 0.4 | 514 | 100 | |

| WST-23-1674 | 60.0 | 62.0 | 2.0 | 108 | 37.4 | LXM |

| including | 60.5 | 61.2 | 0.7 | 302 | 100 | |

| WST-23-1675 | 60.8 | 63.0 | 2.2 | 91.0 | 39.4 | LXM |

| including | 61.3 | 62.1 | 0.8 | 242 | 100 | |

| WST-23-1676 | 62.6 | 64.6 | 2.0 | 48.5 | 30.3 | LXM |

| WST-23-1677 | 45.3 | 48.0 | 2.7 | 62.3 | 57.4 | LXM |

| including | 47.5 | 48.0 | 0.5 | 127 | 100 | |

| 64.0 | 66.0 | 2.0 | 12.8 | |||

| WST-23-1678 | 120.6 | 123.0 | 2.4 | 270 | 79.0 | TLX |

| including | 121.0 | 121.3 | 0.3 | 1435 | 100 | |

| WST-23-1679 | 122.8 | 124.9 | 2.1 | 97.7 | 53.5 | TLX |

| including | 123.2 | 124.0 | 0.8 | 216 | 100 | |

| WST-23-1680 | 127.6 | 129.6 | 2.0 | 32.5 | TLX | |

| WST-23-1681 | 133.0 | 135.0 | 2.0 | 50.9 | 16.4 | TLX |

| including | 134.2 | 134.5 | 0.3 | 330 | 100 | |

| 258.7 | 261.1 | 2.4 | 13.3 | TLX | ||

| WST-23-1683 | 129.2 | 137.0 | 7.8 | 13.0 | LXM | |

| including | 129.2 | 129.6 | 0.4 | 62.0 | ||

| and | 136.0 | 137.0 | 1.0 | 52.2 | ||

| WST-23-1687 | 107.9 | 110.3 | 2.4 | 10.4 | TLX | |

| WST-23-1688 | 113.2 | 115.3 | 2.1 | 20.2 | TLX | |

| WST-23-1690 | 124.0 | 126.0 | 2.0 | 10.4 | TLX | |

| WST-23-1692 | 373.5 | 375.5 | 2.0 | 10.0 | LX4 | |

| WST-23-1693 | 374.2 | 376.5 | 2.3 | 23.7 | TLX | |

| WST-23-1695 | 115.0 | 117.0 | 2.0 | 41.7 | 35.0 | LXM |

| WST-23-1700 | 109.3 | 111.4 | 2.1 | 31.9 | LXM | |

| WST-23-1701 | 141.7 | 143.9 | 2.2 | 18.4 | LHW | |

| WST-23-1704 | 77.9 | 79.9 | 2.0 | 21.5 | LXM | |

| 44.1 | 46.1 | 2.0 | 13.7 | |||

| WST-23-1705 | 82.7 | 91.2 | 8.5 | 55.3 | 13.4 | LXM |

| including | 82.7 | 83.3 | 0.6 | 694 | 100 | |

| 96.7 | 98.7 | 2.0 | 33.0 | 20.1 | ||

| WST-23-1706 | 74.6 | 77.0 | 2.4 | 498 | 84.6 | LXM |

| including | 74.6 | 75.4 | 0.8 | 1045 | 100 | |

| WST-23-1707* | 83.0 | 91.0 | 8.0 | 413 | LXM | |

| including | 84.4 | 85.4 | 1.0 | 1580 | 100 | |

| and | 87.6 | 88.0 | 0.4 | 962 | 100 | |

| WST-23-1714 | 105.1 | 109.6 | 4.5 | 65.0 | 58.7 | TLX |

| including | 105.5 | 106.4 | 0.9 | 132 | 100 | |

| WST-23-1715 | 93.4 | 95.4 | 2.0 | 171 | 81.9 | TLX |

| including | 95.0 | 95.4 | 0.4 | 543 | 100 | |

| WST-23-1719 | 121.5 | 123.5 | 2.0 | 77.3 | 42.3 | TLX |

| including | 121.8 | 122.6 | 0.8 | 188 | 100 | |

| 97.0 | 99.0 | 2.0 | 11.0 | TLX | ||

| WST-23-1720 | 78.6 | 80.7 | 2.1 | 44.9 | 33.6 | TLX |

| 124.3 | 126.3 | 2.0 | 232 | 45.3 | ||

| including | 124.6 | 125.3 | 0.7 | 632 | 100 | |

| WST-23-1721 | 132.1 | 135.0 | 2.9 | 54.0 | 40.8 | TLX |

| including | 133.3 | 134.2 | 0.9 | 143 | 100 | |

| WST-23-1723A | 104.0 | 106.1 | 2.1 | 17.3 | LXM | |

| 118.0 | 120.2 | 2.2 | 11.6 | LXM | ||

| WST-23-1736 | 100.3 | 103.0 | 2.7 | 16.5 | TLX | |

| 320.4 | 322.5 | 2.1 | 39.4 | LX4 | ||

| WST-23-1737 | 143.5 | 145.7 | 2.2 | 13.8 | TLX | |

| WST-23-1741 | 65.0 | 67.0 | 2.0 | 12.7 | LXM | |

| WST-23-1742 | 62.0 | 64.2 | 2.2 | 37.3 | LXM | |

| WST-23-1743 | 59.8 | 62.0 | 2.2 | 160 | 72.9 | LXM |

| including | 59.8 | 60.4 | 0.6 | 420 | 100 | |

| 134.5 | 139.0 | 4.5 | 12.4 | LXM | ||

| 51.7 | 54.4 | 2.7 | 12.5 | |||

| 129.0 | 131.0 | 2.0 | 14.7 | |||

| WST-23-1745 | 57.0 | 59.4 | 2.4 | 50.7 | ||

| WST-23-1746 | 185.9 | 188.0 | 2.1 | 22.0 | TLX | |

| 363.8 | 366.0 | 2.2 | 25.8 | 19.1 | TLX | |

| 369.9 | 372.1 | 2.2 | 282 | 15.1 | ||

| including | 370.3 | 370.6 | 0.3 | 2060 | 100 | |

| WST-23-1748 | 108.8 | 111.8 | 3.0 | 35.3 | LXM | |

| including | 110.5 | 111.0 | 0.5 | 72.7 | ||

| and | 111.4 | 111.8 | 0.4 | 92.8 | ||

| WST-23-1753 | 127.7 | 130.1 | 2.4 | 12.2 | TLX | |

| WST-23-1756 | 126.0 | 128.0 | 2.0 | 17.5 | LXM | |

| 131.4 | 133.6 | 2.2 | 46.5 | 27.1 | LXM | |

| including | 133.1 | 133.6 | 0.5 | 186 | 100 | |

| WST-23-1760 | 56.6 | 58.6 | 2.0 | 120 | 50.1 | LXM |

| including | 56.6 | 57.6 | 1.0 | 240 | 100 | |

| 192.0 | 194.0 | 2.0 | 266 | 54.8 | ||

| including | 192.6 | 192.9 | 0.3 | 1050 | 100 | |

| WST-23-1768 | 115.9 | 120.0 | 4.1 | 10.2 | TLX | |

| WST-23-1769 | 101.8 | 105.3 | 3.5 | 36.7 | TLX | |

| including | 104.5 | 105.3 | 0.8 | 84.9 | ||

| WST-23-1775 | 131.0 | 133.0 | 2.0 | 16.9 | LXM | |

| 137.1 | 139.5 | 2.4 | 100 | 38.3 | ||

| including | 139.2 | 139.5 | 0.3 | 593 | 100 | |

| 144.6 | 147.0 | 2.4 | 24.4 | |||

| WST-23-1781 | 136.1 | 138.2 | 2.1 | 38.9 | 24.3 | TLX |

| WST-23-1782 | 129.0 | 131.2 | 2.2 | 48.4 | 31.9 | TLX |

| including | 130.0 | 130.6 | 0.6 | 161 | 100 | |

| WST-23-1783 | 124.0 | 126.3 | 2.3 | 50.3 | 45.1 | TLX |

| including | 125.1 | 125.7 | 0.6 | 120 | 100 | |

| WST-23-1786 | 99.8 | 103.0 | 3.2 | 37.0 | 33.5 | TLX |

| including | 101.8 | 102.6 | 0.8 | 107 | 92.5 | |

| WST-23-1788 | 95.8 | 100.6 | 4.8 | 39.3 | 30.4 | TLX |

| including | 95.8 | 96.7 | 0.9 | 148 | 100 | |

| 111.4 | 115.5 | 4.1 | 8.68 | TLX | ||

| WST-23-1789 | 131.7 | 134.0 | 2.3 | 36.1 | 16.5 | LXM |

| WST-23-1793 | 150.0 | 152.0 | 2.0 | 10.3 | LXM | |

| WST-23-1794 | 149.7 | 151.7 | 2.0 | 32.2 | LXM | |

| WST-23-1796 | 117.8 | 120.0 | 2.2 | 12.2 | TLX | |

| WST-23-1810 | 131.5 | 133.6 | 2.1 | 167 | 43.2 | LXM |

| including | 132.3 | 133.2 | 0.9 | 388 | 100 | |

| 148.6 | 150.6 | 2.0 | 11.4 | |||

| WST-23-1812 | 124.8 | 126.8 | 2.0 | 15.6 | LXM | |

| WST-23-1829 | 116.0 | 118.0 | 2.0 | 11.7 | LXM |

Notes: True widths are estimated at 55 – 80% of the reported core length interval. See “Quality Control and Reporting Protocols” below. LXM = Lynx Main, LHW = Lynx Hanging Wall, and TLX = Triple Lynx. *0.5 meters of core not recovered in this interval.

Drill hole location

| Hole Number | Azimuth (°) | Dip (°) | Length (m) | UTM E | UTM N | Elevation | Section |

| OSK-W-23-2671 | 337 | -66 | 126 | 453338 | 5435040 | 398 | 3525E |

| WST-22-1082 | 166 | -23 | 516.6 | 453444 | 5435276 | -99 | 3725E |

| WST-22-1154 | 163 | 2 | 123.6 | 453342 | 5435282 | -187 | 3650E |

| WST-22-1171 | 139 | -13 | 242.7 | 453180 | 5435128 | 174 | 3425E |

| WST-22-1182A | 112 | -76 | 761.1 | 453647 | 5435347 | -189 | 3950E |

| WST-22-1182A-W1 | 112 | -76 | 810.6 | 453647 | 5435347 | -189 | 3950E |

| WST-22-1218 | 162 | -49 | 279.3 | 453542 | 5435311 | -173 | 3825E |

| WST-22-1219 | 163 | -42 | 243.5 | 453542 | 5435311 | -173 | 3825E |

| WST-22-1237 | 143 | -9 | 183.4 | 453701 | 5435376 | -197 | 4000E |

| WST-22-1240 | 141 | 9 | 177.5 | 453701 | 5435376 | -196 | 4000E |

| WST-22-1241 | 152 | 12 | 153.5 | 453343 | 5435283 | -186 | 3650E |

| WST-22-1246 | 159 | 7 | 183.5 | 453600 | 5435324 | -179 | 3900E |

| WST-22-1249A | 186 | -3 | 384.6 | 453442 | 5435275 | -98 | 3725E |

| WST-22-1250 | 182 | 0 | 381.7 | 453442 | 5435275 | -98 | 3725E |

| WST-22-1252 | 169 | -41 | 252.4 | 453542 | 5435311 | -173 | 3825E |

| WST-22-1253 | 165 | -38 | 252.3 | 453542 | 5435311 | -172 | 3825E |

| WST-22-1254 | 169 | -36 | 252.5 | 453541 | 5435311 | -172 | 3825E |

| WST-22-1255 | 162 | -32 | 240.5 | 453542 | 5435311 | -172 | 3825E |

| WST-22-1256 | 165 | -70 | 585.5 | 453757 | 5435406 | -208 | 4075E |

| WST-22-1261 | 163 | 2 | 204.6 | 453258 | 5435210 | 97 | 3525E |

| WST-22-1262 | 147 | 9 | 165.5 | 453344 | 5435283 | -186 | 3650E |

| WST-22-1264 | 147 | 1 | 171.5 | 453344 | 5435283 | -187 | 3650E |

| WST-22-1265 | 143 | 4 | 168.5 | 453344 | 5435283 | -187 | 3650E |

| WST-22-1266 | 140 | 1 | 168.4 | 453344 | 5435283 | -187 | 3650E |

| WST-22-1270A | 162 | -18 | 417.5 | 453278 | 5435248 | -145 | 3575E |

| WST-22-1273 | 138 | -68 | 559.1 | 453758 | 5435406 | -208 | 4075E |

| WST-22-1275 | 161 | -10 | 192.3 | 453258 | 5435210 | 97 | 3525E |

| WST-22-1276 | 161 | -11 | 192.4 | 453258 | 5435210 | 97 | 3525E |

| WST-22-1279 | 141 | -9 | 198.7 | 453180 | 5435128 | 174 | 3425E |

| WST-22-1280 | 137 | -3 | 99.5 | 453180 | 5435128 | 174 | 3425E |

| WST-22-1285 | 145 | -7 | 195.6 | 453344 | 5435283 | -187 | 3650E |

| WST-22-1286 | 152 | -55 | 183.6 | 453646 | 5435347 | -188 | 3950E |

| WST-22-1287 | 134 | -52 | 253.1 | 453758 | 5435406 | -207 | 4075E |

| WST-22-1288 | 158 | -42 | 255 | 453543 | 5435312 | -173 | 3825E |

| WST-22-1290 | 148 | 42 | 264.1 | 453646 | 5435347 | -184 | 3950E |

| WST-22-1292 | 170 | 2 | 360.5 | 453279 | 5435248 | -144 | 3575E |

| WST-22-1293 | 172 | -47 | 390.5 | 453543 | 5435311 | -173 | 3825E |

| WST-22-1294 | 173 | -22 | 159.5 | 453756 | 5435405 | -207 | 4075E |

| WST-22-1296 | 136 | -18 | 196 | 453758 | 5435406 | -207 | 4075E |

| WST-22-1297 | 136 | -17 | 150.6 | 453180 | 5435128 | 174 | 3425E |

| WST-22-1298A | 141 | -18 | 156.5 | 453179 | 5435127 | 174 | 3425E |

| WST-22-1305 | 151 | -8 | 174.6 | 453344 | 5435283 | -187 | 3650E |

| WST-22-1306 | 149 | -4 | 174.1 | 453343 | 5435283 | -187 | 3650E |

| WST-22-1307 | 152 | -1 | 177.5 | 453343 | 5435282 | -187 | 3650E |

| WST-22-1308 | 151 | -2 | 168.3 | 453601 | 5435324 | -179 | 3900E |

| WST-23-1304 | 149 | -19 | 174.6 | 453700 | 5435376 | -197 | 4000E |

| WST-23-1309 | 157 | 5 | 174.6 | 453600 | 5435324 | -179 | 3900E |

| WST-23-1310 | 152 | 10 | 177.3 | 453600 | 5435324 | -179 | 3900E |

| WST-23-1316 | 159 | -2 | 204.5 | 453259 | 5435210 | 97 | 3525E |

| WST-23-1317 | 152 | -18 | 93.6 | 453179 | 5435127 | 174 | 3425E |

| WST-23-1319 | 160 | -7 | 126.5 | 453179 | 5435127 | 174 | 3425E |

| WST-23-1320 | 164 | 0 | 129.5 | 453179 | 5435127 | 174 | 3425E |

| WST-23-1322 | 217 | -43 | 165.5 | 453540 | 5435311 | -173 | 3825E |

| WST-23-1323 | 209 | -37 | 177.5 | 453541 | 5435311 | -173 | 3825E |

| WST-23-1326 | 152 | 21 | 219.7 | 453646 | 5435347 | -186 | 3950E |

| WST-23-1329 | 143 | -7 | 180.3 | 453344 | 5435283 | -187 | 3650E |

| WST-23-1332 | 119 | -10 | 120.2 | 453180 | 5435128 | 174 | 3425E |

| WST-23-1343 | 156 | 6 | 162.5 | 453646 | 5435346 | -187 | 3950E |

| WST-23-1345 | 148 | -21 | 150.5 | 453646 | 5435347 | -187 | 3950E |

| WST-23-1347 | 159 | 8 | 144.4 | 453258 | 5435210 | 97 | 3525E |

| WST-23-1348 | 156 | -30 | 120.6 | 453757 | 5435406 | -207 | 4075E |

| WST-23-1350 | 173 | -6 | 135.5 | 453258 | 5435210 | 97 | 3525E |

| WST-23-1353 | 183 | 13 | 111.5 | 453442 | 5435275 | -98 | 3725E |

| WST-23-1354 | 180 | 19 | 114.7 | 453443 | 5435276 | -97 | 3725E |

| WST-23-1357 | 150 | -20 | 102.6 | 453542 | 5435311 | -172 | 3825E |

| WST-23-1358 | 145 | -24 | 114.7 | 453542 | 5435311 | -172 | 3825E |

| WST-23-1360 | 154 | -17 | 150.6 | 453701 | 5435376 | -197 | 4000E |

| WST-23-1364 | 156 | -2 | 156.6 | 453700 | 5435375 | -197 | 4000E |

| WST-23-1365 | 153 | 1 | 159.6 | 453700 | 5435375 | -197 | 4000E |

| WST-23-1366 | 155 | 5 | 165.6 | 453701 | 5435376 | -196 | 4000E |

| WST-23-1371 | 153 | -14 | 114.6 | 453279 | 5435248 | -145 | 3575E |

| WST-23-1373 | 138 | -59 | 249.6 | 453646 | 5435347 | -188 | 3950E |

| WST-23-1374 | 147 | -8 | 141.5 | 453179 | 5435127 | 174 | 3425E |

| WST-23-1375 | 172 | -2 | 126.5 | 453179 | 5435127 | 174 | 3425E |

| WST-23-1381 | 164 | 21 | 102.4 | 453443 | 5435276 | -97 | 3725E |

| WST-23-1384 | 170 | -14 | 84.5 | 453645 | 5435346 | -187 | 3950E |

| WST-23-1387 | 180 | -5 | 81.5 | 453645 | 5435346 | -187 | 3950E |

| WST-23-1388 | 136 | -7 | 96.5 | 453543 | 5435311 | -172 | 3825E |

| WST-23-1389 | 154 | -13 | 201.5 | 453543 | 5435311 | -172 | 3825E |

| WST-23-1390 | 150 | -15 | 201.5 | 453543 | 5435311 | -172 | 3825E |

| WST-23-1391A | 153 | -16 | 204.4 | 453542 | 5435311 | -172 | 3825E |

| WST-23-1395 | 183 | -9 | 159.5 | 453442 | 5435339 | -204 | 3750E |

| WST-23-1396 | 149 | -53 | 231.6 | 453757 | 5435406 | -207 | 4075E |

| WST-23-1398 | 185 | 20 | 123.5 | 453442 | 5435275 | -97 | 3725E |

| WST-23-1406 | 168 | -26 | 102.6 | 453179 | 5435127 | 174 | 3425E |

| WST-23-1410 | 143 | -10 | 111.3 | 453279 | 5435248 | -145 | 3575E |

| WST-23-1414 | 161 | -18 | 201.6 | 453259 | 5435210 | 97 | 3525E |

| WST-23-1416 | 173 | 24 | 117.3 | 453442 | 5435276 | -97 | 3725E |

| WST-23-1419 | 123 | 4 | 108.4 | 453446 | 5435277 | -98 | 3725E |

| WST-23-1422 | 179 | -8 | 210.4 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1424 | 176 | -7 | 210.3 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1425 | 172 | -3 | 210.2 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1426 | 168 | -12 | 201.4 | 453443 | 5435339 | -205 | 3750E |

| WST-23-1427 | 164 | 6 | 84.6 | 453645 | 5435346 | -187 | 3950E |

| WST-23-1429 | 153 | 15 | 126.4 | 453646 | 5435346 | -186 | 3950E |

| WST-23-1430 | 152 | 29 | 129.4 | 453646 | 5435347 | -186 | 3950E |

| WST-23-1432 | 165 | 1 | 102.5 | 453278 | 5435248 | -144 | 3575E |

| WST-23-1441 | 112 | -50 | 219.9 | 453759 | 5435409 | -207 | 4075E |

| WST-23-1442 | 103 | -53 | 480.3 | 453759 | 5435409 | -207 | 4075E |

| WST-23-1443 | 162 | 3 | 186.6 | 453600 | 5435324 | -179 | 3900E |

| WST-23-1444 | 145 | 5 | 168.5 | 453601 | 5435324 | -179 | 3900E |

| WST-23-1445 | 129 | -3 | 87.4 | 453602 | 5435325 | -180 | 3900E |

| WST-23-1448 | 175 | -17 | 114.5 | 453541 | 5435311 | -172 | 3825E |

| WST-23-1450 | 181 | -20 | 114.6 | 453541 | 5435311 | -172 | 3825E |

| WST-23-1451 | 183 | -29 | 111.7 | 453540 | 5435311 | -172 | 3825E |

| WST-23-1453 | 140 | 29 | 120.4 | 453646 | 5435347 | -185 | 3950E |

| WST-23-1455 | 140 | 14 | 105.6 | 453646 | 5435347 | -186 | 3950E |

| WST-23-1456 | 129 | 12 | 111.6 | 453646 | 5435347 | -186 | 3950E |

| WST-23-1457 | 129 | 24 | 117.6 | 453646 | 5435347 | -186 | 3950E |

| WST-23-1458 | 130 | 29 | 123.2 | 453646 | 5435347 | -185 | 3950E |

| WST-23-1465 | 180 | 26 | 150.4 | 453278 | 5435248 | -143 | 3575E |

| WST-23-1466 | 183 | 22 | 141.4 | 453278 | 5435248 | -143 | 3575E |

| WST-23-1467 | 182 | 17 | 144.6 | 453278 | 5435248 | -144 | 3575E |

| WST-23-1468 | 180 | 12 | 114.2 | 453278 | 5435248 | -144 | 3575E |

| WST-23-1470 | 172 | 19 | 114.5 | 453443 | 5435276 | -97 | 3725E |

| WST-23-1471 | 126 | 3 | 174.4 | 453602 | 5435325 | -179 | 3900E |

| WST-23-1472 | 129 | 11 | 90.4 | 453602 | 5435325 | -179 | 3900E |

| WST-23-1473 | 130 | 18 | 93.4 | 453601 | 5435325 | -179 | 3900E |

| WST-23-1474 | 135 | 24 | 90.4 | 453601 | 5435324 | -178 | 3900E |

| WST-23-1475 | 107 | -22 | 232.2 | 453760 | 5435409 | -207 | 4075E |

| WST-23-1476 | 105 | -27 | 232.1 | 453760 | 5435409 | -207 | 4075E |

| WST-23-1478 | 180 | -14 | 117.6 | 453541 | 5435311 | -172 | 3825E |

| WST-23-1480 | 195 | -9 | 120.6 | 453540 | 5435311 | -172 | 3825E |

| WST-23-1482 | 193 | -19 | 204.6 | 453541 | 5435311 | -172 | 3825E |

| WST-23-1484 | 176 | -7 | 138.2 | 453278 | 5435248 | -145 | 3575E |

| WST-23-1485 | 173 | -20 | 171.1 | 453278 | 5435248 | -145 | 3575E |

| WST-23-1486 | 176 | -14 | 177.2 | 453278 | 5435248 | -145 | 3575E |

| WST-23-1487 | 115 | -9 | 222.3 | 453506 | 5435326 | -89 | 3800E |

| WST-23-1490 | 123 | -3 | 162.4 | 453506 | 5435326 | -88 | 3800E |

| WST-23-1491 | 160 | 8 | 165.6 | 453701 | 5435376 | -196 | 4000E |

| WST-23-1492 | 160 | 4 | 159.5 | 453701 | 5435376 | -196 | 4000E |

| WST-23-1494 | 160 | -10 | 159.5 | 453700 | 5435375 | -197 | 4000E |

| WST-23-1495 | 158 | -14 | 160 | 453700 | 5435376 | -197 | 4000E |

| WST-23-1496 | 159 | -18 | 171.5 | 453700 | 5435376 | -197 | 4000E |

| WST-23-1497 | 154 | -21 | 189.6 | 453700 | 5435376 | -197 | 4000E |

| WST-23-1500 | 168 | -32 | 126.5 | 453259 | 5435210 | 96 | 3525E |

| WST-23-1501 | 167 | -28 | 123.5 | 453259 | 5435210 | 96 | 3525E |

| WST-23-1503 | 183 | -14 | 153.1 | 453278 | 5435248 | -145 | 3575E |

| WST-23-1514 | 135 | 3 | 93 | 453601 | 5435325 | -179 | 3900E |

| WST-23-1515 | 137 | 10 | 83 | 453601 | 5435324 | -179 | 3900E |

| WST-23-1516 | 146 | 12 | 168.3 | 453601 | 5435324 | -179 | 3900E |

| WST-23-1519 | 174 | -11 | 201.2 | 453443 | 5435339 | -205 | 3750E |

| WST-23-1520 | 170 | -7 | 330.4 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1522 | 163 | -1 | 150.4 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1523 | 164 | -6 | 147.4 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1524 | 166 | -10 | 195.4 | 453443 | 5435339 | -205 | 3750E |

| WST-23-1525 | 162 | -20 | 189.4 | 453443 | 5435339 | -205 | 3750E |

| WST-23-1530 | 134 | 34 | 117.1 | 453646 | 5435346 | -185 | 3950E |

| WST-23-1532 | 122 | 25 | 126.4 | 453647 | 5435347 | -185 | 3950E |

| WST-23-1533 | 121 | 18 | 117.4 | 453647 | 5435347 | -186 | 3950E |

| WST-23-1534 | 122 | 10 | 117.5 | 453647 | 5435347 | -186 | 3950E |

| WST-23-1535 | 118 | -2 | 83.9 | 453647 | 5435347 | -187 | 3950E |

| WST-23-1538 | 171 | -36 | 141.5 | 453259 | 5435210 | 96 | 3525E |

| WST-23-1541 | 177 | -20 | 126.6 | 453258 | 5435210 | 97 | 3525E |

| WST-23-1542 | 140 | -4 | 81.3 | 453601 | 5435324 | -180 | 3900E |

| WST-23-1543 | 129 | -12 | 75.4 | 453602 | 5435325 | -180 | 3900E |

| WST-23-1549 | 126 | -15 | 159.5 | 453506 | 5435326 | -89 | 3800E |

| WST-23-1550 | 129 | -15 | 156.5 | 453505 | 5435326 | -89 | 3800E |

| WST-23-1555 | 189 | 21 | 144.2 | 453277 | 5435248 | -143 | 3575E |

| WST-23-1557 | 182 | 12 | 99.4 | 453179 | 5435127 | 175 | 3425E |

| WST-23-1560 | 182 | 24 | 114.2 | 453179 | 5435127 | 176 | 3425E |

| WST-23-1575 | 132 | -3 | 184.5 | 453646 | 5435347 | -187 | 3950E |

| WST-23-1577 | 129 | 4 | 156.3 | 453647 | 5435347 | -187 | 3950E |

| WST-23-1578 | 142 | 6 | 153.1 | 453646 | 5435347 | -187 | 3950E |

| WST-23-1579 | 161 | 0 | 162 | 453700 | 5435375 | -197 | 4000E |

| WST-23-1580 | 165 | -2 | 177.6 | 453700 | 5435375 | -197 | 4000E |

| WST-23-1581 | 169 | -5 | 177.6 | 453700 | 5435375 | -197 | 4000E |

| WST-23-1583 | 164 | -13 | 150.5 | 453700 | 5435375 | -197 | 4000E |

| WST-23-1585 | 156 | -42 | 120.7 | 453179 | 5435127 | 173 | 3425E |

| WST-23-1591 | 143 | 1 | 180.5 | 453646 | 5435346 | -187 | 3950E |

| WST-23-1592 | 143 | -4 | 180.5 | 453646 | 5435347 | -187 | 3950E |

| WST-23-1593 | 147 | -7 | 168.5 | 453646 | 5435346 | -187 | 3950E |

| WST-23-1596 | 141 | -20 | 153.5 | 453646 | 5435347 | -187 | 3950E |

| WST-23-1602 | 155 | 2 | 147.5 | 453444 | 5435339 | -204 | 3750E |

| WST-23-1603 | 159 | -1 | 147.6 | 453444 | 5435339 | -204 | 3750E |

| WST-23-1604 | 162 | -4 | 312.5 | 453444 | 5435339 | -204 | 3750E |

| WST-23-1605 | 157 | -5 | 144.6 | 453444 | 5435339 | -204 | 3750E |

| WST-23-1606 | 159 | -10 | 231.4 | 453444 | 5435339 | -205 | 3750E |

| WST-23-1607 | 161 | -10 | 288.5 | 453442 | 5435339 | -205 | 3750E |

| WST-23-1608 | 142 | -6 | 168.6 | 453321 | 5435227 | 104 | 3600E |

| WST-23-1614 | 170 | -35 | 111.6 | 453600 | 5435324 | -180 | 3900E |

| WST-23-1615 | 158 | -39 | 108.6 | 453600 | 5435324 | -181 | 3900E |

| WST-23-1616 | 148 | -40 | 105.3 | 453601 | 5435324 | -181 | 3900E |

| WST-23-1618 | 133 | -32 | 105.5 | 453601 | 5435325 | -180 | 3900E |

| WST-23-1619 | 133 | -39 | 105.5 | 453601 | 5435325 | -181 | 3900E |

| WST-23-1620 | 134 | -44 | 117.2 | 453601 | 5435325 | -181 | 3900E |

| WST-23-1631 | 165 | -11 | 114.4 | 453542 | 5435311 | -172 | 3825E |

| WST-23-1640 | 160 | -23 | 156.6 | 453321 | 5435227 | 104 | 3600E |

| WST-23-1642 | 166 | -19 | 132.6 | 453320 | 5435227 | 104 | 3600E |

| WST-23-1650 | 176 | -15 | 75.3 | 453699 | 5435375 | -197 | 4000E |

| WST-23-1652 | 170 | -35 | 78.4 | 453700 | 5435375 | -198 | 4000E |

| WST-23-1661 | 133 | 0 | 144.5 | 453322 | 5435228 | 105 | 3600E |

| WST-23-1662 | 137 | 4 | 165.6 | 453322 | 5435228 | 105 | 3600E |

| WST-23-1664 | 138 | -4 | 165.4 | 453322 | 5435227 | 104 | 3600E |

| WST-23-1665 | 146 | 1 | 171.6 | 453321 | 5435227 | 105 | 3600E |

| WST-23-1673 | 151 | -7 | 162.6 | 453646 | 5435346 | -187 | 3950E |

| WST-23-1674 | 148 | -2 | 156.5 | 453646 | 5435347 | -187 | 3950E |

| WST-23-1675 | 149 | 3 | 177.4 | 453646 | 5435346 | -187 | 3950E |

| WST-23-1676 | 150 | 7 | 159.5 | 453646 | 5435346 | -186 | 3950E |

| WST-23-1677 | 148 | 11 | 159.5 | 453646 | 5435346 | -186 | 3950E |

| WST-23-1678 | 155 | -13 | 192.5 | 453443 | 5435339 | -205 | 3750E |

| WST-23-1679 | 150 | -13 | 177.2 | 453443 | 5435339 | -205 | 3750E |

| WST-23-1680 | 150 | -2 | 147.3 | 453444 | 5435339 | -204 | 3750E |

| WST-23-1681 | 149 | 2 | 282.3 | 453444 | 5435339 | -204 | 3750E |

| WST-23-1683 | 128 | -2 | 174.5 | 453322 | 5435228 | 105 | 3600E |

| WST-23-1687 | 194 | 11 | 123.3 | 453277 | 5435248 | -144 | 3575E |

| WST-23-1688 | 199 | 13 | 375.3 | 453277 | 5435248 | -144 | 3575E |

| WST-23-1690 | 199 | 22 | 141.4 | 453277 | 5435248 | -143 | 3575E |

| WST-23-1692 | 153 | -35 | 422.8 | 453700 | 5435375 | -198 | 4000E |

| WST-23-1693 | 159 | -34 | 393.5 | 453257 | 5435209 | 96 | 3525E |

| WST-23-1695 | 144 | -17 | 144.6 | 453504 | 5435325 | -89 | 3800E |

| WST-23-1700 | 148 | 5 | 144.6 | 453504 | 5435325 | -88 | 3800E |

| WST-23-1701 | 151 | 11 | 153.5 | 453504 | 5435325 | -88 | 3800E |

| WST-23-1704 | 151 | 35 | 102.2 | 453646 | 5435347 | -185 | 3950E |

| WST-23-1705 | 159 | 39 | 105.1 | 453645 | 5435346 | -185 | 3950E |

| WST-23-1706 | 163 | 33 | 96.4 | 453645 | 5435346 | -185 | 3950E |

| WST-23-1707 | 169 | 38 | 108.1 | 453645 | 5435346 | -185 | 3950E |

| WST-23-1714 | 130 | -53 | 198.1 | 453600 | 5435326 | -181 | 3900E |

| WST-23-1715 | 132 | -49 | 126.4 | 453601 | 5435326 | -181 | 3900E |

| WST-23-1719 | 156 | -18 | 291.3 | 453443 | 5435339 | -205 | 3750E |

| WST-23-1720 | 153 | -8 | 138.4 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1721 | 156 | 5 | 171.3 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1723A | 139 | -3 | 170.8 | 453322 | 5435228 | 104 | 3600E |

| WST-23-1736 | 154 | -46 | 342.3 | 453543 | 5435312 | -173 | 3825E |

| WST-23-1737 | 184 | -3 | 210.5 | 453442 | 5435339 | -204 | 3750E |

| WST-23-1741 | 157 | 13 | 165.6 | 453646 | 5435346 | -186 | 3950E |

| WST-23-1742 | 160 | 9 | 171.4 | 453646 | 5435346 | -186 | 3950E |

| WST-23-1743 | 159 | 4 | 165.4 | 453645 | 5435346 | -187 | 3950E |

| WST-23-1745 | 153 | -4 | 162.6 | 453646 | 5435346 | -187 | 3950E |

| WST-23-1746 | 204 | 15 | 387.3 | 453277 | 5435248 | -143 | 3575E |

| WST-23-1748 | 164 | 7 | 195.6 | 453503 | 5435325 | -88 | 3800E |

| WST-23-1753 | 201 | 26 | 141.4 | 453277 | 5435248 | -143 | 3575E |

| WST-23-1756 | 146 | -2 | 171.5 | 453322 | 5435227 | 104 | 3600E |

| WST-23-1760 | 148 | -15 | 348.6 | 453646 | 5435346 | -187 | 3950E |

| WST-23-1768 | 152 | -40 | 198.4 | 453279 | 5435248 | -145 | 3575E |

| WST-23-1769 | 149 | -45 | 351.3 | 453543 | 5435312 | -173 | 3825E |

| WST-23-1775 | 152 | 1 | 174.5 | 453321 | 5435227 | 105 | 3600E |

| WST-23-1781 | 140 | -7 | 153.3 | 453444 | 5435339 | -205 | 3750E |

| WST-23-1782 | 145 | -9 | 144.5 | 453444 | 5435339 | -204 | 3750E |

| WST-23-1783 | 150 | -11 | 141.2 | 453444 | 5435339 | -205 | 3750E |

| WST-23-1786 | 161 | -40 | 189.4 | 453279 | 5435248 | -145 | 3575E |

| WST-23-1788 | 165 | -32 | 153.7 | 453278 | 5435248 | -145 | 3575E |

| WST-23-1789 | 126 | -3 | 177.1 | 453323 | 5435236 | 55 | 3600E |

| WST-23-1793 | 131 | -10 | 165.5 | 453323 | 5435236 | 55 | 3600E |

| WST-23-1794 | 127 | -13 | 168.5 | 453323 | 5435236 | 55 | 3600E |

| WST-23-1796 | 171 | -32 | 156.6 | 453278 | 5435248 | -145 | 3575E |

| WST-23-1810 | 134 | -19 | 168.5 | 453323 | 5435236 | 55 | 3600E |

| WST-23-1812 | 135 | -8 | 165.6 | 453323 | 5435236 | 55 | 3600E |

| WST-23-1829 | 140 | -23 | 165.5 | 453323 | 5435236 | 54 | 3600E |

Lynx Zone

Mineralization occurs as grey to translucent quartz-carbonate-pyrite-tourmaline veins and pyrite replacement zones and stockworks. Vein-type mineralization is associated with haloes of pervasive sericite-pyrite ± silica alteration and contain sulphides (predominantly pyrite with minor amounts of chalcopyrite, sphalerite, galena, arsenopyrite, and pyrrhotite) and local visible gold. Replacement mineralization is associated with strong pervasive silica-sericite-ankerite ± tourmaline alteration and contains disseminated pyrite from trace to 80% with local visible gold. Pyrite stockworks can form envelopes that reach several tens of metres thick. Fuchsite alteration is common and is spatially constrained to near the gabbros. Mineralization occurs at or near geological contacts between felsic porphyritic or fragmental intrusions and the host rhyolites or gabbros and locally can be hosted along the gabbro-rhyolite contact.

Qualified Person

The scientific and technical content of this news release has been reviewed, prepared, and approved by Ms. Isabelle Roy, P.Geo. (OGQ 535), Director of Technical Services for Osisko’s Windfall gold project, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Quality Control and Reporting Protocols

True width determination is estimated at 55-80% of the reported core length interval for the zone. Assays are uncut except where indicated. Intercepts occur within geological confines of major zones but have not been correlated to individual vein domains at this time. Reported intervals include minimum weighted averages of 3.5 g/t Au diluted over core lengths of at least 2.0 metres. NQ core assays were obtained by either 1-kilogram screen fire assay or standard 50-gram fire-assaying-AA finish or gravimetric finish at (i) ALS Laboratories in Val d’Or, Québec, Vancouver, British Colombia, Lima, Peru or Vientiane, Laos (ii) Bureau Veritas in Timmins, Ontario. The 1-kilogram screen assay method is selected by the geologist when samples contain coarse gold or present a higher percentage of pyrite than surrounding intervals. Selected samples are also analyzed for multi-elements, including silver, using a Four Acid Digestion-ICP-MS method at ALS Laboratories. Drill program design, Quality Assurance/Quality Control (“QA/QC”) and interpretation of results is performed by qualified persons employing a QA/QC program consistent with NI 43-101 and industry best practices. Standards and blanks are included with every 20 samples for QA/QC purposes by the Corporation as well as the lab. Approximately 5% of sample pulps are sent to secondary laboratories for check assay.

About the Windfall Gold Deposit

The Windfall gold deposit is located between Val-d’Or and Chibougamau in the Abitibi region of Québec, Canada. The mineral resource estimate on Windfall (with an effective date of June 7, 2022 ) (the “Windfall Resource Estimate”) and the mineral reserve estimate on Windfall (with an effective date of November 25, 2022) (the “Windfall Reserve Estimate”) are described in the technical report entitled “Feasibility Study for the Windfall Project, Eeyou Istchee James Bay, Québec, Canada” (the “FS Technical Report”) and dated January 10, 2023 (with an effective date of November 25, 2022). The Windfall Resource Estimate, assuming a cut-off grade of 3.50 g/t Au, comprises 811,000 tonnes at 11.4 g/t Au (297,000 ounces) in the measured mineral resource category, 10,250,000 tonnes at 11.4 g/t Au (3,754,000 ounces) in the indicated mineral resource category and 12,287,000 tonnes at 8.4 g/t Au (3,337,000 ounces) in the inferred mineral resource category. The Windfall Mineral Reserve, assuming 3.5 g/t operating, 2.5 g/t incremental, and 1.7 g/t development cut-off grade, comprises 12,183,000 tonnes at 8.06 g/t Au (3,159,000 ounces) in the probable mineral reserves category. The key assumptions, parameters, limitations and methods used in the feasibility study for Windfall, including the related Windfall Resource Estimate and Windfall Reserve Estimate, are described in the FS Technical Report, which was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The FS Technical Report is available on SEDAR+ (www.sedarplus.com) under Osisko’s issuer profile. The Windfall gold deposit is currently one of the highest-grade resource-stage gold projects in Canada and has world-class scale. Mineralization occurs in three principal areas: Lynx, Main, and Underdog. Mineralization is generally comprised of sub-vertical lenses following intrusive porphyry contacts plunging to the northeast. The resources are defined from surface to a depth of 1,600 metres, including the Triple 8 (TP8) zone. The reserves are defined from surface to a depth of 1,100 metres. The deposit remains open along strike and at depth. Mineralization has been identified at surface in some areas and as deep as 2,625 metres in others with significant potential to extend mineralization down-plunge and at depth.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 50% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 50% interest in a large area of claims in the surrounding Urban Barry area and nearby Quévillon area (over 2,300 square kilometers).

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always, using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “potential”, “feasibility”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This news release contains the forward-looking information pertaining to, among other things: the Windfall gold deposit being one of the highest-grade resource-stage gold projects in Canada and having world-class scale; the expected timing (if at all) to hook-up the power line; the expected allocation of power under the power allocation agreement being realized (if any); the expected power demand for Windfall; the assumptions limitations and qualifications in the FS Technical Report, including relating to the Windfall Resource Estimate and Windfall Reserve Estimate; reliance on third-parties for infrastructure, including power lines, with reference to the agreement with Miyuukaa for the transmission of hydroelectric power to the Windfall site; the results of the FS Technical Report, including NPV, IRR, production, tax-free cash flows, capex, AISC, milling operations, average recovery, job creation; the Lynx zone remaining open to expansion down plunge. Such factors include, among others, risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; reliance on third-parties, including governmental entities, for mining activities, including for infrastructure; the timing and ability, if at all, to obtain permits; the reliance on third-parties for infrastructure critical to build and operate the Windfall project, including power lines; our ability to obtain power for the Windfall project, if at all or on terms economic to the Corporation; the status of third-party approvals or consents; errors in management’s geological modelling; the ability of Osisko to complete further exploration activities, including (infill) drilling; property and royalty interests in the Windfall gold deposit; the ability of the Corporation to obtain required approvals; the results of exploration activities; risks relating to mining activities; the Canadian/United States dollar exchange rate; the global economic climate; metal (including gold) prices; dilution; environmental risks; and community and non-governmental actions. For additional information with respect to these and other factors and assumptions underlying the forward-looking information in this news release, please see the section entitled “Risk Factors” in the most recent annual information form of Osisko for the year ended December 31, 2022, a copy of which is available on SEDAR+ (www.sedarplus.com) under Osisko’s issuer profile. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

CONTACT INFORMATION:

John Burzynski

Chief Executive Officer

Telephone (416) 363-8653

OSISKO MINING SIGNS BINDING LETTER AGREEMENT WITH BONTERRA RESOURCES FOR EXPLORATION EARN-IN AND JOINT VENTURE ON URBAN-BARRY PROPERTIES

Toronto, Ontario (September 25, 2023) – Osisko Mining Inc. (TSX:OSK) (“Osisko“) is pleased to announce that it has entered into a binding letter agreement with Bonterra Resources Inc. (TSXV:BTR) (“Bonterra“) for a 70% exploration earn-in and joint venture on all of the Urban-Barry properties held by Bonterra (hosting the Gladiator and Barry deposits), in addition to the adjoining Duke and Lac Barry properties (collectively, the “Properties“), all located in Quebec’s Eeyou Istchee James Bay region. The Duke property is currently 70% owned by Bonterra and 30% owned by Osisko, and the Lac Barry property is currently 85% owned by Bonterra and 15% owned by Gold Royalties Corp. The Properties total 496 claims over 22,508 hectares.

Under the binding letter agreement, Osisko has agreed to pay Bonterra an initial upfront payment of $1 million in cash (payable within one business day of the signing of the binding letter agreement) and an additional $4 million in cash upon the parties entering into the definitive agreement. Under the Exploration Earn-In, Osisko has agreed to fund $30 million in work expenditures over a three-year period to earn a 70% undivided interest in the Properties, in accordance with annual work expenditures $10 million in each year (which can be pre-paid at Osisko’s option).

After completion of the Exploration Earn-In, Osisko and Bonterra have agreed to form a joint venture entity or contractual joint venture in such form as the parties may agree, each acting reasonably, taking into consideration any tax and other factors relevant to the parties.

During the Exploration Earn-In and upon and following the formation of the joint venture, Osisko will be the operator of the Properties. Upon completion of the Exploration Earn-In and the formation of the joint venture, Osisko and Bonterra will form a management committee to provide direction to the operator on exploration programs for the Urban-Barry Properties.

Osisko and Bonterra have agreed to negotiate in good faith, settle, and enter into definitive documentation providing for the Exploration Earn-In as soon as practicable following the date hereof, subject to the satisfaction of certain customary conditions precedent.

Osisko may withdraw from the Exploration Earn-In at any time upon written notice to Bonterra. In the event of an election to withdraw from the Exploration Earn-In, Osisko will forfeit all rights and interests in the Properties with no further liability, and the definitive documentation shall be immediately terminated upon such election.

About the Urban-Barry Properties

Barry Deposit

The Barry deposit is a shear-hosted gold deposit with multiple parallel, sub-vertical, shear zones and a second set of veins dipping 25 to 60 degrees to the southeast. The gold mineralization consists of disseminated sulfides within the shear zones and the veins with local visible gold. The Barry deposit has been delineated over 1.4 kilometres along strike and 700 metres vertical and the deposit remains open for expansion.

SLR Consulting (Canada) completed a mineral resource estimate for Bonterra on the Barry deposit for both open pit and underground scenarios. The combined open pit and underground mineral resource estimate for the Barry deposit are (i) measured mineral resources of 2,076,000 tons at 3.04 g/t Au for 203,000 oz Au, (ii) indicated mineral resources of 3,023,000 tons at 5.01 g/t Au for 487,000 oz Au, and (iii) inferred mineral resources of 4,379,000 tons at 4.89 g/t Au for 689,000 oz Au. The Barry mineral resource estimate is supported by the Technical Report (as defined herein).

Gladiator Deposit

Gold mineralization at the Gladiator deposit is hosted within sheared veins of quartz-carbonate composition, with sericite, chlorite, tourmaline with pyrite, chalcopyrite, sphalerite, galena and visible gold. The veins are divided into four groupings. The Gladiator deposit has been outlined by diamond drilling to a strike length of 1,600 metres and depth of 1,100 metres.

SLR Consulting (Canada) completed a mineral resource estimate for Bonterra on the Gladiator deposit. The mineral resource estimate for the Gladiator deposit are (i) indicated mineral resources of 1,413,000 t at 8.61 g/t Au for 391,000 oz Au, and (ii) inferred mineral resources of 4,174,000 t at 7.37 g/t Au for 989,000 oz Au. The Gladiator mineral resource estimate is supported by the Technical Report.

Duke Property

The Duke property consists of 81 strategic mineral claims totaling 3,590 hectares adjacent to the Gladiator Deposit. The Duke property mineralization is associated with multiple sub-parallel, moderately dipping to subvertical, shear hosted quartz-carbonate-chlorite veins and stockworks with minor pyrite and gold trending northeast to east west hosted within intermediate to mafic volcanics and tuffs with local felsic intrusions. Bonterra and Osisko have a 70% and 30% interest, respectively, in the Duke property.

Technical Report

The mineral resource estimates for the Barry and Gladiator deposits are supported by the technical report (the “Technical Report“) entitled “Technical Report on the Gladiator and Moroy Deposits and the Bachelor Mine and Preliminary Economic Assessment on the Barry Deposit, Northwestern Québec, Canada, Report for NI 43-101” dated July 25, 2022 (with an effective date of June 1, 2022) prepared for Bonterra by SLR Consulting (Canada). Reference should be made to the full text of the Technical Report for the assumptions, qualifications and limitations set forth therein, a copy of which is available on SEDAR+ (www.sedarplus.com) under Bonterra’s issuer profile.

Qualified Person

The scientific and technical content in this news release has been reviewed and approved by Mr. Mathieu Savard, P.Geo. (OGQ #510), President of Osisko, who is a “Qualified Person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 50% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 50% interest in a large area of claims in the surrounding Urban Barry area and nearby Quévillon area (over 2,300 square kilometers).

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, assumptions and projections as at the date of this news release. The information in this news release about the timing and ability of Osisko and Bonterra to complete the definitive documentation in respect of the Exploration Earn-In and satisfy the conditions precedent to executing the definitive documentation, if at all; the work expenditures expected to be incurred by Osisko over a three-year period, if at all; the formation of a joint venture on the Urban-Barry Properties following the completion of the Exploration Earn-In, if at all; the respective ownership interests of Osisko and Bonterra in the joint venture entity; and any other information herein that is not a historical fact may be “forward looking information”. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information.

This forward-looking information is based on reasonable assumptions and estimates of management of Osisko, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Osisko to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the timing and ability of Osisko and Bonterra to complete the definitive documentation relating to the Exploration Earn-In, satisfy the conditions precedent to executing the definitive documentation, if at all, and close the Exploration Earn-In, if at all; risks relating to changes in tax laws; risks relating to property interests; the global economic climate; metal prices; dilution; ability of Osisko to complete further acquisitions; environmental risks; and community and non-governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, Osisko cannot assure shareholders and prospective purchasers that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

For further information, please contact:

John Burzynski

Chief Executive Officer

Telephone: (416) 363-8653

OSISKO MINING PROVIDES CORPORATE UPDATE

Toronto, June 5, 2023 – Osisko Mining Inc. (TSX:OSK. “Osisko” or the “Corporation“) would like to provide the following update on the ongoing forest fire situation affecting the communities in Abitibi and Eeyou Istchee James Bay, where the Windfall gold project is located. On June 2 and 3, 2023, Quebec’s Ministry of Natural Resource and Forests announced prohibitions regarding forest access on Crown lands, and closed forestry roads for reasons of public safety, given the current situation related to wildfires in the Abitibi and Eeyou Istchee James Bay regions.

John Burzynski, Chairman and Chief Executive Officer of Osisko Mining commented: “We have withdrawn our staff and continue to monitor our facilities remotely and on the ground in accordance with local directives. Our team is in constant communication with local and provincial authorities to coordinate all efforts in this difficult time. All personnel are safe, and the Windfall facilities are secure. While all activities at site are currently suspended, we do not anticipate any material impact on our business.”

Osisko will update the market in the event of any material change to Osisko arising in relation to the wildfires.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 50% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 50% interest in a large area of claims in the surrounding Urban Barry area and nearby Quévillon area (over 2,300 square kilometers).

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always, using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “scheduled”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information.

This news release contains the forward-looking information pertaining to, among other things: the potential impact of wildfires on our business, operations or assets; the impact of the wildfires and regulatory responses thereto on the business of Osisko the prospects, if any, of the Windfall gold deposit; the ability to realize upon any mineralization in a manner that is economic; the amount and type of drilling to be completed and the timing to complete such drilling; future drilling and advancement at the Property.

Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, among others, risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability to continue current operations and exploration; risks relating to exploration, development and mining activities; reliance on third-parties for infrastructure, including power lines; and community and non-governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

For further information please contact:

John Burzynski

Chief Executive Officer

Telephone (416) 363-8653

OSISKO MINING AND GOLD FIELDS ANNOUNCE 50/50 JOINT VENTURE ON WINDFALL GOLD PROJECT

Osisko Fully-Funded to Mine Production

Project to Benefit From Mine Building and Operating Experience of a Senior Gold Producer

Significant Investment by Gold Fields Validates Quality and Robustness of Windfall

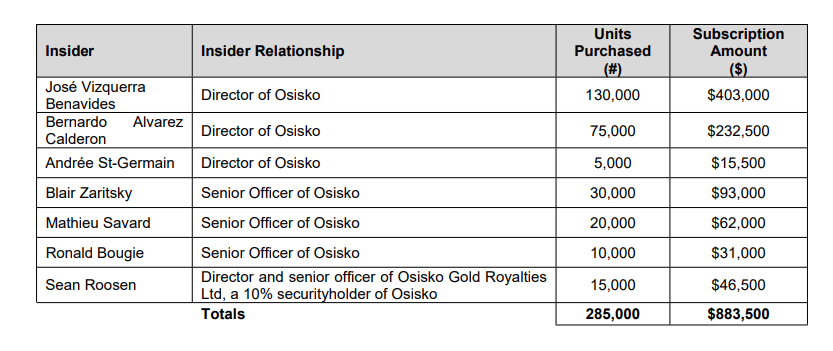

(Toronto, May 2, 2023) Osisko Mining Inc. (OSK:TSX. “Osisko” or the “Corporation“) is pleased to announce it has concluded a 50/50 joint venture agreement with a subsidiary of Gold Fields Limited (“Gold Fields“) for the joint ownership and development of Osisko’s Windfall gold project, located in the Abitibi greenstone belt, Urban Township, Eeyou Istchee James Bay, Québec (the “Transaction“).

Transaction Highlights

- Gold Fields initial cash payment to Osisko of C$300 million on signing.

- Gold Fields additional (“Deferred”) cash payment to Osisko of C$300 million on issuance of the applicable permits authorizing the construction, operation and mining of the Windfall Project.

- Gold Fields to sole fund expenditures for regional exploration up to a maximum of C$75 million, after which regional exploration programs would be proportionately funded by each of Osisko and Gold Fields.

- In addition to the initial cash payment and the Deferred cash payment, Gold Fields to make two additional separate C$17 million cash payments to Osisko (C$34 million in total, the first on July 31, 2023 and the second on December 31, 2023). These represent reimbursement of items already incurred by Osisko as part of pre-construction spend.

- Gold Fields and Osisko share all pre-construction costs (provisional budget estimated at C$250 million) and construction costs (feasibility capital expenditure estimated at C$789 million) on a 50/50 basis going forward.

- Governance arrangements with equal representation in the Partnership from Osisko and Gold Fields, to leverage each party’s skillsets.

Osisko’s Chairman and Chief Executive Officer, John Burzynski, stated: “We are very pleased to partner with Gold Fields on the Windfall project and our exploration property portfolio. Today is the start of what we believe will prove to be a long and fruitful partnership with Gold Fields at Windfall, and in what we both believe is a significant emerging gold district in Québec. This partnership further strengthens our strong balance sheet, allows us to significantly de-risk Windfall and brings us a very important step closer to realizing our objective of becoming a leading Canadian gold producer. With the proceeds from this Transaction, Osisko is fully-funded for our share of development capital to bring Windfall into production. Osisko shareholders retain considerable upside in the project while also benefiting from the mine building, operating and technical expertise of Gold Fields. Assuming the project is ultimately permitted and approved by the partners consistent with the Windfall Feasibility Study, Gold Fields’ acquisition cost, exploration commitment, and contribution to pre-construction and project capital would ultimately represent an investment of C$1.2 billion to acquire its interest, bring Windfall into production and further unlock the regional exploration upside. This Transaction is highly compelling on many fronts and represents the best path forward to maximize value for all stakeholders.”

Mr. Burzynski continued: “Osisko Mining would like to acknowledge and thank Sean Roosen in particular and the directors of Osisko Gold Royalties Ltd. (“OGR”) for their forward-looking vision in supporting the 2015 re-creation of Osisko Mining – one of the key first investment decisions in OGR’s very innovative and successful “accelerator model” concept to create new high-value negative-cost royalties tied to equity investment in new exploration companies. OGR holds a 2% – 3% NSR royalty on the Windfall area claims and 13% of the undiluted equity in the Corporation.”

Transaction Details

The Transaction closed on May 2, 2023, with Gold Fields acquiring a 50% partnership interest in the “Windfall Mining Group”, a partnership formed under the laws of the Province of Ontario (the “Partnership“), which will develop the Windfall project and the surrounding Urban Barry and Quévillon exploration properties (collectively, the “Property“). The Transaction was implemented in accordance with, among other things, a framework agreement dated May 2, 2023 (the “Framework Agreement“) among Osisko, Gold Fields, Gold Fields Holdings Company Limited, Windfall Mining Group and 1000516419 Ontario Inc., the manager of the Partnership (the “Manager“). Pursuant to the terms of the Framework Agreement, Gold Fields acquired 50% interest in the Partnership for an aggregate consideration of C$600 million in cash to Osisko. The Partnership Agreement also requires Gold Fields to sole fund up to C$75 million in contributions to the Partnership for regional exploration. Prior to the acquisition of the 50% Partnership interest by Gold Fields, Osisko had contributed to the Partnership the Property together with any claims, permits, leases, all other real property, personal property, contractual rights and other assets currently held or acquired for the benefit of the Property.

The Framework Agreement contains customary representations and warranties, covenants and indemnification provisions for a transaction of this nature. The obligations of Gold Fields are guaranteed by Gold Fields Holdings Company Ltd, a significant intermediate holding company with material indirect interests in a number of Gold Fields operations.

About Windfall Mining Group

The business and affairs of the Partnership are managed by the Manager, which has the exclusive right to act on behalf of the Partnership. Each of Osisko and Gold Fields holds 50% of the common shares in the Manager, as well as a 50% partnership interest in the Partnership (apart from a nominal interest in the Partnership held by the Manager).

The relationship among the parties is governed by a second amended and restated partnership agreement (the “Partnership Agreement“) and a shareholders’ agreement (together with the Partnership Agreement, the “Governing Documents“). The Governing Documents contain customary transfer rights restrictions, governance and decision-making mechanisms which are typical in a transaction of this nature. The Partnership Agreement contains provisions relating to programs and budgets in respect of the Property, funding obligations and remedies for breaches of funding obligations, cost overruns as well as a mutual standstill.

Advisors

Maxit Capital LP acted as financial advisor to Osisko and Bennett Jones LLP acted as Osisko’s legal counsel.

About the Windfall Gold Deposit