Category: Windfall

OSISKO WINDFALL 2023 DRILLING UPDATE REGIONAL EXPLORATION TO RESUME

New Results Include 413 g/t Au Over 8.0 Metres

and 623 g/t Au Over 3.0 Metres

(Toronto, October 26, 2023) Osisko Mining Inc. (OSK:TSX. “Osisko” or the “Corporation”) is pleased to provide an update from the ongoing drill program at its 50% owned Windfall gold project located in the Abitibi greenstone belt, Urban Township, Eeyou Istchee James Bay, Québec.

The 2023 drilling campaign primarily targeted infill areas. Since the start of the year, over 95,000 metres have been drilled by 8 underground rigs focused on the Lynx segment of the deposit.

Highlights from the 2023 drill program are presented below and include 320 intercepts from 248 drill holes and 1 wedge. These highlights are intercepts with a metal factor (grams*meters) greater than 20. The intercepts are all located within the defined mineral resource estimate (“MRE”) blocks as described in Osisko’s feasibility study on Windfall (see FS Technical Report (as defined herein), a copy of which is available on SEDAR+ under Osisko’s issuer profile), and have targeted upgrading inferred mineral resources to measured or indicated mineral resources or indicated minerals resources to measured mineral resources as applicable.

Osisko Chief Executive Officer John Burzynski commented: “Infill drilling at the Windfall deposit is progressing well and confirming our models. High-grade gold continues to be intercepted in the Lynx areas including Triple Lynx, once again highlighting the world-class nature of the deposit. Of note, we have more than ten intervals in this set of numbers that returned values over one kilogram per tonne of gold. Infill drilling will continue into next year. We and our joint venture partner are very much looking forward to resuming exploration on our greater than 2,300 square kilometer land package around Windfall in the coming months”.

Regional exploration in the Urban Barry area will recommence on near-deposit and regional grassroots targets. Exploration will include ground geophysics and diamond drilling of various targets.

Maps showing Windfall hole locations are available at www.osiskomining.com. Maps: Top_Intersect_2023, PR_Longsections_ 20231026_EN.

2023 Drilling

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t) uncut | Au (g/t) cut to 100 g/t | Zone |

| OSK-W-23-2671 | 112.8 | 115.0 | 2.2 | 210 | 33 | LXM |

| including | 113.2 | 113.9 | 0.7 | 658 | 100 | |

| WST-22-1082 | 425.3 | 427.6 | 2.3 | 57.9 | 56.1 | LX4 |

| including | 425.7 | 426.0 | 0.3 | 104 | 100 | |

| including | 426.0 | 426.6 | 0.6 | 105 | 100 | |

| WST-22-1154 | 113.5 | 115.8 | 2.3 | 35.2 | 31.3 | TLX |

| WST-22-1171 | 76.0 | 78.0 | 2.0 | 35.0 | 30.1 | LXM |

| 81.4 | 84.0 | 2.6 | 39.3 | 21.4 | ||

| including | 81.4 | 81.7 | 0.3 | 255 | 100 | |

| 128.0 | 130.0 | 2.0 | 15.4 | |||

| WST-22-1182A | 526.8 | 528.8 | 2.0 | 99.3 | 54.9 | TLX |

| including | 527.6 | 528.4 | 0.8 | 211 | 100 | |

| 553.0 | 556.0 | 3.0 | 15.4 | |||

| WST-22-1182A-W1 | 553.8 | 562.2 | 8.4 | 29.6 | 29.2 | TLX |

| including | 557.4 | 558.1 | 0.7 | 105 | 100 | |

| and | 558.6 | 559.3 | 0.7 | 92.5 | ||

| WST-22-1218 | 101.0 | 104.4 | 3.4 | 74.0 | 48 | TLX |

| including | 102.0 | 102.5 | 0.5 | 274 | 100 | |

| 235.3 | 238.0 | 2.7 | 223 | 15 | ||

| including | 235.8 | 236.1 | 0.3 | 1970 | 100 | |

| WST-22-1219 | 230.0 | 233.0 | 3.0 | 15.9 | TLX | |

| WST-22-1237 | 119.5 | 121.7 | 2.2 | 376 | 41.4 | LXM |

| including | 119.5 | 120.4 | 0.9 | 919 | 100 | |

| WST-22-1240 | 144.5 | 146.6 | 2.1 | 24.1 | LXM | |

| WST-22-1241 | 139.5 | 141.5 | 2.0 | 27.9 | TLX | |

| WST-22-1246 | 154.0 | 156.4 | 2.4 | 12.5 | LXM | |

| WST-22-1249A | 296.1 | 298.1 | 2.0 | 204 | 22.3 | TLX |

| including | 296.6 | 297.0 | 0.4 | 1010 | 100 | |

| WST-22-1250 | 91.0 | 93.1 | 2.1 | 11.3 | TLX | |

| WST-22-1252 | 95.8 | 99.3 | 3.5 | 192 | 75 | TLX |

| including | 95.8 | 96.4 | 0.6 | 525 | 100 | |

| WST-22-1253 | 96.0 | 99.0 | 3.0 | 90.8 | 50.8 | TLX |

| including | 96.7 | 97.1 | 0.4 | 216 | 100 | |

| and | 97.6 | 98.4 | 0.8 | 192 | 100 | |

| 216.5 | 218.5 | 2.0 | 12.0 | |||

| WST-22-1254 | 95.3 | 98.3 | 3.0 | 154 | 50.5 | TLX |

| including | 97.0 | 98.0 | 1.0 | 410 | 100 | |

| 216.1 | 218.3 | 2.2 | 20.6 | TLX | ||

| WST-22-1255 | 98.0 | 100.4 | 2.4 | 9.49 | TLX | |

| WST-22-1256 | 479.5 | 483.4 | 3.9 | 24.0 | 16.5 | TLX |

| including | 482.4 | 482.7 | 0.3 | 197 | 100 | |

| WST-22-1261 | 112.4 | 114.6 | 2.2 | 39.8 | 14.2 | LXM |

| 178.9 | 181.0 | 2.1 | 19.6 | |||

| WST-22-1262 | 138.9 | 141.1 | 2.2 | 22.7 | TLX | |

| WST-22-1264 | 126.1 | 128.5 | 2.4 | 23.8 | TLX | |

| WST-22-1265 | 135.5 | 137.9 | 2.4 | 13.2 | TLX | |

| WST-22-1266 | 133.3 | 136.5 | 3.2 | 135 | 57.2 | TLX |

| including | 133.3 | 134.5 | 1.2 | 308 | 100 | |

| WST-22-1270A | 305.8 | 308.0 | 2.2 | 12.3 | TLX | |

| WST-22-1273 | 356.9 | 358.9 | 2.0 | 21.7 | TLX | |

| 487.8 | 490.2 | 2.4 | 16.0 | |||

| 511.0 | 513.4 | 2.4 | 16.5 | |||

| WST-22-1275 | 168.6 | 174.6 | 6.0 | 9.38 | LXM | |

| WST-22-1276 | 117.4 | 119.4 | 2.0 | 12.6 | LXM | |

| WST-22-1279 | 80.0 | 82.0 | 2.0 | 57.8 | 25.3 | LXM |

| including | 80.5 | 81.0 | 0.5 | 230 | 100 | |

| 125.9 | 128.7 | 2.8 | 9.82 | |||

| WST-22-1280 | 84.2 | 86.5 | 2.3 | 14.5 | LXM | |

| WST-22-1285 | 116.1 | 120.0 | 3.9 | 25.0 | TLX | |

| WST-22-1286 | 101.7 | 105.5 | 3.8 | 101 | 37.9 | TLX |

| including | 102.5 | 103.0 | 0.5 | 577 | 100 | |

| 163.5 | 166.9 | 3.4 | 34.8 | |||

| including | 165.6 | 166.0 | 0.4 | 75.5 | ||

| WST-22-1287 | 132.0 | 134.0 | 2.0 | 171 | 56.2 | LXM |

| including | 132.6 | 133.2 | 0.6 | 483 | 100 | |

| WST-22-1288 | 214.0 | 216.0 | 2.0 | 77.8 | 41.3 | TLX |

| including | 214.9 | 215.4 | 0.5 | 241 | 100 | |

| 215.7 | 216.0 | 0.3 | 108 | |||

| WST-22-1290 | 103.0 | 105.1 | 2.1 | 10.7 | LXM | |

| WST-22-1292 | 199.1 | 201.3 | 2.2 | 18.2 | TLX | |

| WST-22-1293 | 100.3 | 102.3 | 2.0 | 127 | 35.9 | TLX |

| including | 101.0 | 101.6 | 0.6 | 405 | 100 | TLX |

| WST-22-1294 | 59.0 | 61.1 | 2.1 | 20.5 | LXM | |

| WST-22-1296 | 65.0 | 71.6 | 6.6 | 12.4 | LXM | |

| WST-22-1297 | 84.0 | 86.4 | 2.4 | 112 | 51.3 | LXM |

| including | 84.0 | 84.4 | 0.4 | 462 | 100 | |

| WST-22-1298A | 75.0 | 78.3 | 3.3 | 304 | 41.6 | LXM |

| including | 75.6 | 76.3 | 0.7 | 1335 | 100 | |

| WST-23-1304 | 46.5 | 49.4 | 2.9 | 10.9 | LXM

|

|

| 115.0 | 117.3 | 2.3 | 19.0 | |||

| WST-22-1305 | 103.0 | 105.4 | 2.4 | 17.8 | TLX | |

| WST-22-1306 | 114.9 | 123.0 | 8.1 | 24.8 | TLX | |

| including | 115.3 | 116.0 | 0.7 | 76.1 | ||

| and | 120.9 | 121.5 | 0.6 | 69.4 | ||

| WST-22-1307 | 119.0 | 121.0 | 2.0 | 30.7 | TLX | |

| 114.0 | 116.4 | 2.4 | 12.2 | LXM | ||

| WST-22-1308 | 57.0 | 59.0 | 2.0 | 13.6 | ||

| WST-23-1309 | 60.9 | 63.0 | 2.1 | 18.1 | LXM | |

| 143.0 | 145.0 | 2.0 | 16.0 | |||

| WST-23-1310 | 65.7 | 69.0 | 3.3 | 78.2 | 60.9 | LXM |

| including | 68.0 | 69.0 | 1.0 | 157 | 100 | |

| WST-23-1316 | 114.7 | 117.0 | 2.3 | 18.6 | LXM | |

| WST-23-1317 | 70.6 | 72.6 | 2.0 | 305 | 40.7 | LXM |

| including | 71.0 | 71.5 | 0.5 | 1135 | 100 | |

| 72.6 | 74.7 | 2.1 | 16.9 | |||

| WST-23-1319 | 72.2 | 74.8 | 2.6 | 16.1 | LXM | |

| WST-23-1320 | 75.2 | 78.5 | 3.3 | 11.1 | LXM | |

| WST-23-1322 | 71.4 | 74.3 | 2.9 | 138 | 43.9 | TLX |

| including | 72.0 | 73.0 | 1.0 | 372 | 100 | |

| 127.8 | 131.0 | 3.2 | 49.6 | 27.4 | ||

| including | 128.9 | 129.5 | 0.6 | 218 | 100 | |

| 126.5 | 133.0 | 6.5 | 25.7 | 14.8 | ||

| including | 128.9 | 129.5 | 0.6 | 218 | 100 | |

| 156.6 | 158.9 | 2.3 | 13.7 | |||

| WST-23-1323 | 113.4 | 116.0 | 2.6 | 56.9 | 40.8 | TLX |

| including | 114.2 | 114.7 | 0.5 | 153 | 100 | |

| and | 115.2 | 115.5 | 0.3 | 152 | 100 | |

| WST-23-1326 | 63.7 | 66.0 | 2.3 | 89.4 | 31.6 | LXM |

| including | 64.7 | 65.4 | 0.7 | 290 | 100 | |

| WST-23-1329 | 113.0 | 117.5 | 4.5 | 25.6 | TLX | |

| including | 114.0 | 114.3 | 0.3 | 53.0 | ||

| and | 116.6 | 117.2 | 0.6 | 53.8 | ||

| 120.9 | 125.0 | 4.1 | 17.8 | |||

| 145.6 | 146.0 | 2.1 | 10.8 | |||

| WST-23-1332 | 99.0 | 102.6 | 3.6 | 39.1 | 36.8 | LXM |

| including | 101.0 | 101.4 | 0.4 | 121 | 100 | |

| WST-23-1343 | 127.1 | 129.5 | 2.4 | 129 | 29.6 | LXM |

| including | 127.1 | 127.8 | 0.7 | 442 | 100 | |

| 62.0 | 64.0 | 2.0 | 20.0 | LXM | ||

| WST-23-1345 | 56.1 | 59.0 | 2.9 | 16.7 | LXM | |

| WST-23-1347 | 119.5 | 121.8 | 2.3 | 25.8 | LXM | |

| WST-23-1348 | 65.0 | 67.3 | 2.3 | 11.4 | LXM | |

| 102.3 | 104.9 | 2.6 | 9.66 | |||

| WST-23-1350 | 114.0 | 116.0 | 2.0 | 23.0 | LXM | |

| WST-23-1353 | 91.6 | 93.9 | 2.3 | 37.1 | 32.3 | LXM |

| WST-23-1354 | 93.3 | 95.8 | 2.5 | 11.1 | LXM | |

| WST-23-1357 | 89.6 | 91.6 | 2.0 | 14.3 | TLX | |

| WST-23-1358 | 92.6 | 94.8 | 2.2 | 12.8 | TLX | |

| WST-23-1360 | 46.1 | 50.3 | 4.2 | 18.0 | LXM | |

| WST-23-1364 | 46.9 | 49.0 | 2.1 | 12.0 | LXM | |

| WST-23-1365 | 56.0 | 60.6 | 4.6 | 4.61 | LXM | |

| WST-23-1366 | 57.6 | 61.7 | 4.1 | 7.90 | LXM | |

| WST-23-1371 | 87.6 | 89.7 | 2.1 | 9.58 | TLX | |

| WST-23-1373 | 184.5 | 186.6 | 2.1 | 69.7 | 47.2 | TLX |

| including | 185.4 | 186.2 | 0.8 | 159 | 100 | |

| 161.5 | 163.5 | 2.0 | 28.0 | TLX | ||

| WST-23-1374 | 77.2 | 80.0 | 2.8 | 19.9 | LXM | |

| 81.5 | 83.6 | 2.1 | 43.7 | 14.5 | LXM | |

| WST-23-1375 | 102.0 | 104.0 | 2.0 | 10.4 | LXM | |

| WST-23-1381 | 86.0 | 88.0 | 2.0 | 12.8 | LXM | |

| WST-23-1384 | 54.5 | 56.7 | 2.2 | 228 | 31.8 | LXM |

| including | 56.0 | 56.7 | 0.7 | 717 | 100 | |

| WST-23-1387 | 59.0 | 61.0 | 2.0 | 34.7 | LXM | |

| WST-23-1388 | 84.5 | 86.6 | 2.1 | 29.4 | LXM | |

| WST-23-1389 | 84.5 | 87.0 | 2.5 | 10.2 | TLX | |

| WST-23-1390 | 84.7 | 87.0 | 2.3 | 13.6 | TLX | |

| WST-23-1391A | 89.0 | 91.0 | 2.0 | 23.5 | 22.1 | TLX |

| WST-23-1395 | 125.2 | 127.5 | 2.3 | 177 | 71.6 | TLX |

| including | 126.2 | 126.8 | 0.6 | 460 | 100 | |

| 134.8 | 137.0 | 2.2 | 54.9 | 23.5 | ||

| including | 135.3 | 135.7 | 0.4 | 273 | 100 | |

| 146.0 | 150.9 | 4.9 | 4.91 | |||

| WST-23-1396 | 182.8 | 184.9 | 2.1 | 20.3 | TLX | |

| WST-23-1398 | 95.3 | 98.7 | 3.4 | 35.1 | 28.9 | LXM |

| including | 95.3 | 96.2 | 0.9 | 124 | 100 | |

| WST-23-1406 | 73.5 | 75.6 | 2.1 | 27.0 | LXM | |

| WST-23-1410 | 95.0 | 97.2 | 2.2 | 10.9 | TLX | |

| WST-23-1414 | 121.0 | 123.0 | 2.0 | 17.4 | LXM | |

| WST-23-1416 | 83.0 | 85.2 | 2.2 | 9.88 | LXM | |

| WST-23-1419 | 89.9 | 92.0 | 2.1 | 110 | 39.8 | LXM |

| including | 90.3 | 90.6 | 0.3 | 499 | 100 | |

| WST-23-1422 | 137.3 | 141.3 | 4.0 | 68.0 | 49.1 | TLX |

| including | 138.8 | 139.6 | 0.8 | 195 | 100 | |

| WST-23-1424 | 135.5 | 137.7 | 2.2 | 29.3 | TLX | |

| 130.0 | 132.7 | 2.7 | 14.5 | |||

| WST-23-1425 | 132.2 | 135.2 | 3.0 | 283 | 61.3 | TLX |

| including | 134.6 | 135.2 | 0.6 | 1165 | 100 | |

| 107.0 | 109.8 | 2.8 | 10.0 | |||

| WST-23-1426 | 121.0 | 123.6 | 2.6 | 24.3 | TLX | |

| 175.0 | 177.0 | 2.0 | 12.2 | |||

| WST-23-1427 | 61.0 | 63.0 | 2.0 | 25.4 | LXM | |

| WST-23-1429 | 63.3 | 65.5 | 2.2 | 24.2 | LXM | |

| 47.0 | 49.0 | 2.0 | 10.7 | |||

| WST-23-1430 | 69.0 | 71.5 | 2.5 | 13.6 | LXM | |

| WST-23-1432 | 88.0 | 90.5 | 2.5 | 9.85 | TLX | |

| WST-23-1441 | 203.3 | 205.8 | 2.5 | 22.5 | TLX | |

| WST-23-1442 | 338.5 | 340.6 | 2.1 | 17.4 | TLX | |

| WST-23-1443 | 166.0 | 168.3 | 2.3 | 71.9 | 25.4 | LHW |

| including | 166.0 | 166.5 | 0.5 | 314 | 100 | |

| 60.0 | 62.0 | 2.0 | 25.2 | LXM | ||

| 68.0 | 70.0 | 2.0 | 13.9 | |||

| WST-23-1444 | 61.2 | 63.3 | 2.1 | 57.3 | 40.7 | LXM |

| including | 61.7 | 62.3 | 0.6 | 158 | 100 | |

| WST-23-1445 | 61.9 | 64.0 | 2.1 | 44.7 | 28.9 | LXM |

| 64.0 | 66.4 | 2.4 | 26.8 | |||

| WST-23-1448 | 100.0 | 102.2 | 2.2 | 18.3 | TLX | |

| WST-23-1450 | 93.0 | 95.0 | 2.0 | 38.4 | 25.2 | TLX |

| WST-23-1451 | 92.7 | 94.7 | 2.0 | 46.1 | 26.5 | TLX |

| WST-23-1453 | 68.5 | 73.1 | 4.6 | 48.4 | 28.7 | LXM |

| including | 72.4 | 73.1 | 0.7 | 229 | 100 | |

| 75.2 | 85.0 | 9.8 | 18.7 | 17.8 | LXM | |

| including | 76.6 | 77.1 | 0.5 | 119 | 100 | |

| and | 81.4 | 82.8 | 1.4 | 47.2 | ||

| WST-23-1455 | 92.3 | 94.9 | 2.6 | 46.2 | 40.8 | LXM |

| including | 92.3 | 93.3 | 1.0 | 114 | 100 | |

| WST-23-1456 | 39.5 | 41.5 | 2.0 | 59.5 | 30.0 | LXM |

| including | 40.0 | 40.6 | 0.6 | 198 | 100 | |

| 64.5 | 68.9 | 4.4 | 18.2 | LXM | ||

| WST-23-1457 | 39.0 | 41.2 | 2.2 | 27.2 | LXM | |

| WST-23-1458 | 39.6 | 41.6 | 2.0 | 52.6 | 30.4 | LXM |

| including | 39.6 | 40.2 | 0.6 | 174 | 100 | |

| WST-23-1465 | 121.0 | 123.0 | 2.0 | 10.3 | TLX | |

| WST-23-1466 | 103.8 | 106.0 | 2.2 | 15.4 | TLX | |

| 92.5 | 95.4 | 2.9 | 16.7 | |||

| WST-23-1467 | 91.7 | 94.0 | 2.3 | 24.3 | TLX | |

| WST-23-1468 | 91.5 | 93.7 | 2.2 | 9.59 | TLX | |

| WST-23-1470 | 85.4 | 87.5 | 2.1 | 17.5 | LXM | |

| WST-23-1471 | 67.0 | 69.0 | 2.0 | 11.9 | LXM | |

| WST-23-1472 | 71.9 | 74.1 | 2.2 | 9.51 | LXM | |

| WST-23-1473 | 72.5 | 74.6 | 2.1 | 26.9 | LXM | |

| WST-23-1474 | 74.4 | 77.0 | 2.6 | 109 | 37.5 | LXM |

| including | 74.4 | 75.2 | 0.8 | 332 | 100 | |

| WST-23-1475 | 175.4 | 180.0 | 4.6 | 45.6 | 25.8 | LXM |

| including | 176.0 | 176.7 | 0.7 | 230 | 100 | |

| WST-23-1476 | 177.2 | 180.0 | 2.8 | 18.2 | LXM | |

| WST-23-1478 | 102.0 | 104.1 | 2.1 | 30.7 | 29.8 | TLX |

| WST-23-1480 | 100.0 | 102.0 | 2.0 | 20.5 | TLX | |

| WST-23-1482 | 171.0 | 173.0 | 2.0 | 51.4 | 40.8 | LXM |

| including | 172.2 | 173.0 | 0.8 | 127 | 100 | |

| WST-23-1484 | 89.6 | 92.0 | 2.4 | 15.3 | TLX | |

| WST-23-1485 | 89.9 | 92.0 | 2.1 | 31.0 | TLX | |

| 110.0 | 112.2 | 2.2 | 12.8 | |||

| WST-23-1486 | 88.8 | 91.0 | 2.2 | 38.1 | TLX | |

| 156.0 | 158.0 | 2.0 | 24.5 | TLX | ||

| WST-23-1487 | 152.9 | 155.0 | 2.1 | 118 | 58.2 | LXM |

| including | 152.9 | 153.3 | 0.4 | 354 | 100 | |

| WST-23-1490 | 150.0 | 152.0 | 2.0 | 10.2 | LXM | |

| WST-23-1491 | 59.3 | 61.5 | 2.2 | 80.4 | 23.2 | LXM |

| including | 59.3 | 59.6 | 0.3 | 520 | 100 | |

| WST-23-1492 | 56.3 | 59.7 | 3.4 | 35.2 | 32.3 | LXM |

| including | 56.3 | 56.9 | 0.6 | 117 | 100 | |

| WST-23-1494 | 46.0 | 48.1 | 2.1 | 22.8 | LXM | |

| WST-23-1495 | 131.8 | 134.1 | 2.3 | 14.1 | 13.1 | LXM |

| WST-23-1496 | 134.2 | 137.1 | 2.9 | 66.1 | 17.5 | LXM |

| including | 134.6 | 135.1 | 0.5 | 382 | 100 | |

| 49.4 | 51.7 | 2.3 | 17.3 | |||

| WST-23-1497 | 47.7 | 50.6 | 2.9 | 39.8 | 39.3 | LXM |

| including | 48.1 | 48.5 | 0.4 | 104 | 100 | |

| WST-23-1500 | 115.2 | 117.4 | 2.2 | 14.1 | LXM | |

| WST-23-1501 | 107.5 | 109.6 | 2.1 | 12.9 | LXM | |

| WST-23-1503 | 140.0 | 142.0 | 2.0 | 14.2 | TLX | |

| WST-23-1514 | 59.9 | 62.0 | 2.1 | 44.4 | 19.2 | LXM |

| WST-23-1515 | 64.0 | 66.1 | 2.1 | 17.4 | LXM | |

| WST-23-1516 | 65.5 | 68.6 | 3.1 | 110 | 56.0 | LXM |

| including | 67.9 | 68.6 | 0.7 | 229 | 100 | |

| 133.0 | 135.0 | 2.0 | 14.8 | |||

| WST-23-1519 | 135.0 | 137.0 | 2.0 | 24.4 | TLX | |

| WST-23-1520 | 121.0 | 123.8 | 2.8 | 85.2 | 75.3 | TLX |

| WST-23-1522 | 122.0 | 124.0 | 2.0 | 10.2 | TLX | |

| WST-23-1523 | 120.5 | 124.0 | 3.5 | 444 | 59.0 | TLX |

| including | 121.4 | 121.7 | 0.3 | 3910 | 100 | |

| WST-23-1524 | 119.1 | 121.6 | 2.5 | 121 | 50.4 | TLX |

| including | 120.7 | 121.6 | 0.9 | 296 | 100 | |

| WST-23-1525 | 148.3 | 150.4 | 2.1 | 19.6 | TLX | |

| 123.0 | 125.1 | 2.1 | 17.7 | |||

| 159.0 | 161.2 | 2.2 | 9.22 | |||

| 127.0 | 129.0 | 2.0 | 16.0 | |||

| WST-23-1530 | 89.0 | 91.1 | 2.1 | 15.1 | LXM | |

| 75.2 | 77.4 | 2.2 | 11.5 | |||

| WST-23-1532 | 77.0 | 79.5 | 2.5 | 22.7 | LXM | |

| 85.4 | 88.5 | 3.1 | 67.9 | 38.5 | ||

| including | 86.5 | 86.8 | 0.3 | 404 | 100 | |

| 91.0 | 93.1 | 2.1 | 66.0 | 49.3 | ||

| including | 91.3 | 92.2 | 0.9 | 139 | 100 | |

| WST-23-1533 | 72.0 | 74.3 | 2.3 | 15.7 | LXM | |

| WST-23-1534 | 40.0 | 42.0 | 2.0 | 19.9 | LXM | |

| WST-23-1535 | 64.8 | 68.0 | 3.2 | 23.9 | LXM | |

| WST-23-1538 | 124.6 | 126.5 | 1.9 | 32.2 | 30.9 | LXM |

| WST-23-1541 | 104.0 | 106.0 | 2.0 | 23.5 | 20.3 | LXM |

| WST-23-1542 | 55.5 | 57.5 | 2.0 | 43.7 | 30.5 | LXM |

| WST-23-1543 | 59.5 | 64.8 | 5.3 | 27.8 | 25.9 | LXM |

| including | 59.5 | 60.4 | 0.9 | 89.3 | 78.4 | |

| and | 63.4 | 63.9 | 0.5 | 80.3 | ||

| WST-23-1549 | 135.0 | 137.6 | 2.6 | 31.8 | LXM | |

| WST-23-1550 | 132.0 | 134.5 | 2.5 | 18.4 | LXM | |

| WST-23-1555 | 111.2 | 113.3 | 2.1 | 35.0 | 34.9 | TLX |

| WST-23-1557 | 83.8 | 86.1 | 2.3 | 78.0 | 24.5 | LXM |

| including | 84.1 | 84.6 | 0.5 | 346 | 100 | |

| WST-23-1560 | 94.0 | 96.0 | 2.0 | 11.5 | LXM | |

| WST-23-1575 | 44.1 | 46.5 | 2.4 | 8.38 | LXM | |

| WST-23-1577 | 63.3 | 66.3 | 3.0 | 64.9 | 36.9 | LXM |

| including | 64.0 | 64.6 | 0.6 | 240 | 100 | |

| WST-23-1578 | 41.8 | 44.2 | 2.4 | 18.1 | LXM | |

| WST-23-1579 | 47.3 | 50.8 | 3.5 | 26.9 | 26.2 | LXM |

| WST-23-1580 | 48.2 | 52.2 | 4.0 | 36.1 | LXM | |

| including | 51.6 | 52.2 | 0.6 | 97.3 | ||

| WST-23-1581 | 50.5 | 52.7 | 2.2 | 224 | 58.5 | LXM |

| including | 51.7 | 52.1 | 0.4 | 501 | 100 | |

| 136.4 | 139.6 | 3.2 | 24.7 | LXM | ||

| WST-23-1583 | 41.9 | 44.0 | 2.1 | 16.6 | LXM | |

| WST-23-1585 | 102.9 | 105.4 | 2.5 | 39.4 | LXM | |

| WST-23-1591 | 60.0 | 62.0 | 2.0 | 19.4 | LXM | |

| WST-23-1592 | 59.6 | 62.0 | 2.4 | 31.4 | 29.4 | LXM |

| WST-23-1593 | 42.0 | 44.0 | 2.0 | 10.9 | LXM | |

| WST-23-1596 | 58.0 | 60.0 | 2.0 | 117 | 25.1 | LXM |

| including | 58.0 | 58.5 | 0.5 | 466 | 100 | |

| WST-23-1602 | 129.0 | 131.1 | 2.1 | 71.5 | 52.0 | TLX |

| including | 129.8 | 130.5 | 0.7 | 159 | 100 | |

| WST-23-1603 | 123.3 | 126.1 | 2.8 | 322 | 59.1 | TLX |

| including | 123.9 | 124.8 | 0.9 | 918 | 100 | |

| WST-23-1604 | 122.2 | 125.0 | 2.8 | 21.3 | 15.4 | TLX |

| WST-23-1605 | 123.0 | 125.7 | 2.7 | 692 | 57.8 | TLX |

| including | 124.2 | 125.0 | 0.8 | 2240 | 100 | |

| WST-23-1606 | 121.7 | 124.6 | 2.9 | 183 | 42.6 | TLX |

| including | 122.0 | 122.5 | 0.5 | 916 | 100 | |

| WST-23-1607 | 119.3 | 122.4 | 3.1 | 171 | 34.1 | TLX |

| including | 121.6 | 122.1 | 0.5 | 947 | 100 | |

| 157.0 | 159.0 | 2.0 | 11.9 | TLX | ||

| WST-23-1608 | 104.9 | 107.5 | 2.6 | 43.0 | 12.0 | LXM |

| including | 106.2 | 106.5 | 0.3 | 369 | 100 | |

| WST-23-1614 | 98.0 | 100.2 | 2.2 | 20.0 | TLX | |

| WST-23-1615 | 84.0 | 87.2 | 3.2 | 33.9 | 32.7 | TLX |

| including | 85.2 | 85.6 | 0.4 | 68.0 | ||

| and | 85.9 | 86.2 | 0.3 | 113 | 100 | |

| and | 86.6 | 86.9 | 0.3 | 83.0 | ||

| WST-23-1616 | 83.0 | 85.3 | 2.3 | 85.3 | 50.9 | TLX |

| including | 84.4 | 85.0 | 0.6 | 232 | 100 | |

| WST-23-1618 | 72.0 | 74.0 | 2.0 | 16.7 | LXM | |

| WST-23-1619 | 89.4 | 92.0 | 2.6 | 28.4 | TLX | |

| WST-23-1620 | 89.5 | 91.6 | 2.1 | 23.4 | TLX | |

| WST-23-1631 | 86.6 | 88.6 | 2.0 | 21.5 | TLX | |

| WST-23-1640 | 95.0 | 97.1 | 2.1 | 18.0 | LXM | |

| 123.0 | 125.0 | 2.0 | 68.5 | 25.0 | ||

| including | 123.8 | 124.3 | 0.5 | 274 | 100 | |

| WST-23-1642 | 100.5 | 102.8 | 2.3 | 71.3 | 45.7 | LXM |

| including | 100.9 | 101.9 | 1.0 | 159 | 100 | |

| WST-23-1650 | 54.8 | 57.4 | 2.6 | 63.3 | LXM | |

| WST-23-1652 | 27.0 | 29.1 | 2.1 | 41.6 | LXM | |

| 68.4 | 75.4 | 7.0 | 124 | 37.1 | LXM | |

| including | 74.0 | 75.0 | 1.0 | 711 | 100 | |

| WST-23-1661 | 129.1 | 132.0 | 2.9 | 9.21 | LXM | |

| WST-23-1662 | 115.3 | 117.6 | 2.3 | 18.4 | LXM | |

| WST-23-1664 | 118.8 | 121.0 | 2.2 | 30.6 | 18.3 | LXM |

| WST-23-1665 | 124.3 | 126.3 | 2.0 | 16.1 | LXM | |

| 143.2 | 145.2 | 2.0 | 12.2 | |||

| WST-23-1673 | 56.0 | 58.8 | 2.8 | 77.1 | 18.0 | LXM |

| including | 58.4 | 58.8 | 0.4 | 514 | 100 | |

| WST-23-1674 | 60.0 | 62.0 | 2.0 | 108 | 37.4 | LXM |

| including | 60.5 | 61.2 | 0.7 | 302 | 100 | |

| WST-23-1675 | 60.8 | 63.0 | 2.2 | 91.0 | 39.4 | LXM |

| including | 61.3 | 62.1 | 0.8 | 242 | 100 | |

| WST-23-1676 | 62.6 | 64.6 | 2.0 | 48.5 | 30.3 | LXM |

| WST-23-1677 | 45.3 | 48.0 | 2.7 | 62.3 | 57.4 | LXM |

| including | 47.5 | 48.0 | 0.5 | 127 | 100 | |

| 64.0 | 66.0 | 2.0 | 12.8 | |||

| WST-23-1678 | 120.6 | 123.0 | 2.4 | 270 | 79.0 | TLX |

| including | 121.0 | 121.3 | 0.3 | 1435 | 100 | |

| WST-23-1679 | 122.8 | 124.9 | 2.1 | 97.7 | 53.5 | TLX |

| including | 123.2 | 124.0 | 0.8 | 216 | 100 | |

| WST-23-1680 | 127.6 | 129.6 | 2.0 | 32.5 | TLX | |

| WST-23-1681 | 133.0 | 135.0 | 2.0 | 50.9 | 16.4 | TLX |

| including | 134.2 | 134.5 | 0.3 | 330 | 100 | |

| 258.7 | 261.1 | 2.4 | 13.3 | TLX | ||

| WST-23-1683 | 129.2 | 137.0 | 7.8 | 13.0 | LXM | |

| including | 129.2 | 129.6 | 0.4 | 62.0 | ||

| and | 136.0 | 137.0 | 1.0 | 52.2 | ||

| WST-23-1687 | 107.9 | 110.3 | 2.4 | 10.4 | TLX | |

| WST-23-1688 | 113.2 | 115.3 | 2.1 | 20.2 | TLX | |

| WST-23-1690 | 124.0 | 126.0 | 2.0 | 10.4 | TLX | |

| WST-23-1692 | 373.5 | 375.5 | 2.0 | 10.0 | LX4 | |

| WST-23-1693 | 374.2 | 376.5 | 2.3 | 23.7 | TLX | |

| WST-23-1695 | 115.0 | 117.0 | 2.0 | 41.7 | 35.0 | LXM |

| WST-23-1700 | 109.3 | 111.4 | 2.1 | 31.9 | LXM | |

| WST-23-1701 | 141.7 | 143.9 | 2.2 | 18.4 | LHW | |

| WST-23-1704 | 77.9 | 79.9 | 2.0 | 21.5 | LXM | |

| 44.1 | 46.1 | 2.0 | 13.7 | |||

| WST-23-1705 | 82.7 | 91.2 | 8.5 | 55.3 | 13.4 | LXM |

| including | 82.7 | 83.3 | 0.6 | 694 | 100 | |

| 96.7 | 98.7 | 2.0 | 33.0 | 20.1 | ||

| WST-23-1706 | 74.6 | 77.0 | 2.4 | 498 | 84.6 | LXM |

| including | 74.6 | 75.4 | 0.8 | 1045 | 100 | |

| WST-23-1707* | 83.0 | 91.0 | 8.0 | 413 | LXM | |

| including | 84.4 | 85.4 | 1.0 | 1580 | 100 | |

| and | 87.6 | 88.0 | 0.4 | 962 | 100 | |

| WST-23-1714 | 105.1 | 109.6 | 4.5 | 65.0 | 58.7 | TLX |

| including | 105.5 | 106.4 | 0.9 | 132 | 100 | |

| WST-23-1715 | 93.4 | 95.4 | 2.0 | 171 | 81.9 | TLX |

| including | 95.0 | 95.4 | 0.4 | 543 | 100 | |

| WST-23-1719 | 121.5 | 123.5 | 2.0 | 77.3 | 42.3 | TLX |

| including | 121.8 | 122.6 | 0.8 | 188 | 100 | |

| 97.0 | 99.0 | 2.0 | 11.0 | TLX | ||

| WST-23-1720 | 78.6 | 80.7 | 2.1 | 44.9 | 33.6 | TLX |

| 124.3 | 126.3 | 2.0 | 232 | 45.3 | ||

| including | 124.6 | 125.3 | 0.7 | 632 | 100 | |

| WST-23-1721 | 132.1 | 135.0 | 2.9 | 54.0 | 40.8 | TLX |

| including | 133.3 | 134.2 | 0.9 | 143 | 100 | |

| WST-23-1723A | 104.0 | 106.1 | 2.1 | 17.3 | LXM | |

| 118.0 | 120.2 | 2.2 | 11.6 | LXM | ||

| WST-23-1736 | 100.3 | 103.0 | 2.7 | 16.5 | TLX | |

| 320.4 | 322.5 | 2.1 | 39.4 | LX4 | ||

| WST-23-1737 | 143.5 | 145.7 | 2.2 | 13.8 | TLX | |

| WST-23-1741 | 65.0 | 67.0 | 2.0 | 12.7 | LXM | |

| WST-23-1742 | 62.0 | 64.2 | 2.2 | 37.3 | LXM | |

| WST-23-1743 | 59.8 | 62.0 | 2.2 | 160 | 72.9 | LXM |

| including | 59.8 | 60.4 | 0.6 | 420 | 100 | |

| 134.5 | 139.0 | 4.5 | 12.4 | LXM | ||

| 51.7 | 54.4 | 2.7 | 12.5 | |||

| 129.0 | 131.0 | 2.0 | 14.7 | |||

| WST-23-1745 | 57.0 | 59.4 | 2.4 | 50.7 | ||

| WST-23-1746 | 185.9 | 188.0 | 2.1 | 22.0 | TLX | |

| 363.8 | 366.0 | 2.2 | 25.8 | 19.1 | TLX | |

| 369.9 | 372.1 | 2.2 | 282 | 15.1 | ||

| including | 370.3 | 370.6 | 0.3 | 2060 | 100 | |

| WST-23-1748 | 108.8 | 111.8 | 3.0 | 35.3 | LXM | |

| including | 110.5 | 111.0 | 0.5 | 72.7 | ||

| and | 111.4 | 111.8 | 0.4 | 92.8 | ||

| WST-23-1753 | 127.7 | 130.1 | 2.4 | 12.2 | TLX | |

| WST-23-1756 | 126.0 | 128.0 | 2.0 | 17.5 | LXM | |

| 131.4 | 133.6 | 2.2 | 46.5 | 27.1 | LXM | |

| including | 133.1 | 133.6 | 0.5 | 186 | 100 | |

| WST-23-1760 | 56.6 | 58.6 | 2.0 | 120 | 50.1 | LXM |

| including | 56.6 | 57.6 | 1.0 | 240 | 100 | |

| 192.0 | 194.0 | 2.0 | 266 | 54.8 | ||

| including | 192.6 | 192.9 | 0.3 | 1050 | 100 | |

| WST-23-1768 | 115.9 | 120.0 | 4.1 | 10.2 | TLX | |

| WST-23-1769 | 101.8 | 105.3 | 3.5 | 36.7 | TLX | |

| including | 104.5 | 105.3 | 0.8 | 84.9 | ||

| WST-23-1775 | 131.0 | 133.0 | 2.0 | 16.9 | LXM | |

| 137.1 | 139.5 | 2.4 | 100 | 38.3 | ||

| including | 139.2 | 139.5 | 0.3 | 593 | 100 | |

| 144.6 | 147.0 | 2.4 | 24.4 | |||

| WST-23-1781 | 136.1 | 138.2 | 2.1 | 38.9 | 24.3 | TLX |

| WST-23-1782 | 129.0 | 131.2 | 2.2 | 48.4 | 31.9 | TLX |

| including | 130.0 | 130.6 | 0.6 | 161 | 100 | |

| WST-23-1783 | 124.0 | 126.3 | 2.3 | 50.3 | 45.1 | TLX |

| including | 125.1 | 125.7 | 0.6 | 120 | 100 | |

| WST-23-1786 | 99.8 | 103.0 | 3.2 | 37.0 | 33.5 | TLX |

| including | 101.8 | 102.6 | 0.8 | 107 | 92.5 | |

| WST-23-1788 | 95.8 | 100.6 | 4.8 | 39.3 | 30.4 | TLX |

| including | 95.8 | 96.7 | 0.9 | 148 | 100 | |

| 111.4 | 115.5 | 4.1 | 8.68 | TLX | ||

| WST-23-1789 | 131.7 | 134.0 | 2.3 | 36.1 | 16.5 | LXM |

| WST-23-1793 | 150.0 | 152.0 | 2.0 | 10.3 | LXM | |

| WST-23-1794 | 149.7 | 151.7 | 2.0 | 32.2 | LXM | |

| WST-23-1796 | 117.8 | 120.0 | 2.2 | 12.2 | TLX | |

| WST-23-1810 | 131.5 | 133.6 | 2.1 | 167 | 43.2 | LXM |

| including | 132.3 | 133.2 | 0.9 | 388 | 100 | |

| 148.6 | 150.6 | 2.0 | 11.4 | |||

| WST-23-1812 | 124.8 | 126.8 | 2.0 | 15.6 | LXM | |

| WST-23-1829 | 116.0 | 118.0 | 2.0 | 11.7 | LXM |

Notes: True widths are estimated at 55 – 80% of the reported core length interval. See “Quality Control and Reporting Protocols” below. LXM = Lynx Main, LHW = Lynx Hanging Wall, and TLX = Triple Lynx. *0.5 meters of core not recovered in this interval.

Drill hole location

| Hole Number | Azimuth (°) | Dip (°) | Length (m) | UTM E | UTM N | Elevation | Section |

| OSK-W-23-2671 | 337 | -66 | 126 | 453338 | 5435040 | 398 | 3525E |

| WST-22-1082 | 166 | -23 | 516.6 | 453444 | 5435276 | -99 | 3725E |

| WST-22-1154 | 163 | 2 | 123.6 | 453342 | 5435282 | -187 | 3650E |

| WST-22-1171 | 139 | -13 | 242.7 | 453180 | 5435128 | 174 | 3425E |

| WST-22-1182A | 112 | -76 | 761.1 | 453647 | 5435347 | -189 | 3950E |

| WST-22-1182A-W1 | 112 | -76 | 810.6 | 453647 | 5435347 | -189 | 3950E |

| WST-22-1218 | 162 | -49 | 279.3 | 453542 | 5435311 | -173 | 3825E |

| WST-22-1219 | 163 | -42 | 243.5 | 453542 | 5435311 | -173 | 3825E |

| WST-22-1237 | 143 | -9 | 183.4 | 453701 | 5435376 | -197 | 4000E |

| WST-22-1240 | 141 | 9 | 177.5 | 453701 | 5435376 | -196 | 4000E |

| WST-22-1241 | 152 | 12 | 153.5 | 453343 | 5435283 | -186 | 3650E |

| WST-22-1246 | 159 | 7 | 183.5 | 453600 | 5435324 | -179 | 3900E |

| WST-22-1249A | 186 | -3 | 384.6 | 453442 | 5435275 | -98 | 3725E |

| WST-22-1250 | 182 | 0 | 381.7 | 453442 | 5435275 | -98 | 3725E |

| WST-22-1252 | 169 | -41 | 252.4 | 453542 | 5435311 | -173 | 3825E |

| WST-22-1253 | 165 | -38 | 252.3 | 453542 | 5435311 | -172 | 3825E |

| WST-22-1254 | 169 | -36 | 252.5 | 453541 | 5435311 | -172 | 3825E |

| WST-22-1255 | 162 | -32 | 240.5 | 453542 | 5435311 | -172 | 3825E |

| WST-22-1256 | 165 | -70 | 585.5 | 453757 | 5435406 | -208 | 4075E |

| WST-22-1261 | 163 | 2 | 204.6 | 453258 | 5435210 | 97 | 3525E |

| WST-22-1262 | 147 | 9 | 165.5 | 453344 | 5435283 | -186 | 3650E |

| WST-22-1264 | 147 | 1 | 171.5 | 453344 | 5435283 | -187 | 3650E |

| WST-22-1265 | 143 | 4 | 168.5 | 453344 | 5435283 | -187 | 3650E |

| WST-22-1266 | 140 | 1 | 168.4 | 453344 | 5435283 | -187 | 3650E |

| WST-22-1270A | 162 | -18 | 417.5 | 453278 | 5435248 | -145 | 3575E |

| WST-22-1273 | 138 | -68 | 559.1 | 453758 | 5435406 | -208 | 4075E |

| WST-22-1275 | 161 | -10 | 192.3 | 453258 | 5435210 | 97 | 3525E |

| WST-22-1276 | 161 | -11 | 192.4 | 453258 | 5435210 | 97 | 3525E |

| WST-22-1279 | 141 | -9 | 198.7 | 453180 | 5435128 | 174 | 3425E |

| WST-22-1280 | 137 | -3 | 99.5 | 453180 | 5435128 | 174 | 3425E |

| WST-22-1285 | 145 | -7 | 195.6 | 453344 | 5435283 | -187 | 3650E |

| WST-22-1286 | 152 | -55 | 183.6 | 453646 | 5435347 | -188 | 3950E |

| WST-22-1287 | 134 | -52 | 253.1 | 453758 | 5435406 | -207 | 4075E |

| WST-22-1288 | 158 | -42 | 255 | 453543 | 5435312 | -173 | 3825E |

| WST-22-1290 | 148 | 42 | 264.1 | 453646 | 5435347 | -184 | 3950E |

| WST-22-1292 | 170 | 2 | 360.5 | 453279 | 5435248 | -144 | 3575E |

| WST-22-1293 | 172 | -47 | 390.5 | 453543 | 5435311 | -173 | 3825E |

| WST-22-1294 | 173 | -22 | 159.5 | 453756 | 5435405 | -207 | 4075E |

| WST-22-1296 | 136 | -18 | 196 | 453758 | 5435406 | -207 | 4075E |

| WST-22-1297 | 136 | -17 | 150.6 | 453180 | 5435128 | 174 | 3425E |

| WST-22-1298A | 141 | -18 | 156.5 | 453179 | 5435127 | 174 | 3425E |

| WST-22-1305 | 151 | -8 | 174.6 | 453344 | 5435283 | -187 | 3650E |

| WST-22-1306 | 149 | -4 | 174.1 | 453343 | 5435283 | -187 | 3650E |

| WST-22-1307 | 152 | -1 | 177.5 | 453343 | 5435282 | -187 | 3650E |

| WST-22-1308 | 151 | -2 | 168.3 | 453601 | 5435324 | -179 | 3900E |

| WST-23-1304 | 149 | -19 | 174.6 | 453700 | 5435376 | -197 | 4000E |

| WST-23-1309 | 157 | 5 | 174.6 | 453600 | 5435324 | -179 | 3900E |

| WST-23-1310 | 152 | 10 | 177.3 | 453600 | 5435324 | -179 | 3900E |

| WST-23-1316 | 159 | -2 | 204.5 | 453259 | 5435210 | 97 | 3525E |

| WST-23-1317 | 152 | -18 | 93.6 | 453179 | 5435127 | 174 | 3425E |

| WST-23-1319 | 160 | -7 | 126.5 | 453179 | 5435127 | 174 | 3425E |

| WST-23-1320 | 164 | 0 | 129.5 | 453179 | 5435127 | 174 | 3425E |

| WST-23-1322 | 217 | -43 | 165.5 | 453540 | 5435311 | -173 | 3825E |

| WST-23-1323 | 209 | -37 | 177.5 | 453541 | 5435311 | -173 | 3825E |

| WST-23-1326 | 152 | 21 | 219.7 | 453646 | 5435347 | -186 | 3950E |

| WST-23-1329 | 143 | -7 | 180.3 | 453344 | 5435283 | -187 | 3650E |

| WST-23-1332 | 119 | -10 | 120.2 | 453180 | 5435128 | 174 | 3425E |

| WST-23-1343 | 156 | 6 | 162.5 | 453646 | 5435346 | -187 | 3950E |

| WST-23-1345 | 148 | -21 | 150.5 | 453646 | 5435347 | -187 | 3950E |

| WST-23-1347 | 159 | 8 | 144.4 | 453258 | 5435210 | 97 | 3525E |

| WST-23-1348 | 156 | -30 | 120.6 | 453757 | 5435406 | -207 | 4075E |

| WST-23-1350 | 173 | -6 | 135.5 | 453258 | 5435210 | 97 | 3525E |

| WST-23-1353 | 183 | 13 | 111.5 | 453442 | 5435275 | -98 | 3725E |

| WST-23-1354 | 180 | 19 | 114.7 | 453443 | 5435276 | -97 | 3725E |

| WST-23-1357 | 150 | -20 | 102.6 | 453542 | 5435311 | -172 | 3825E |

| WST-23-1358 | 145 | -24 | 114.7 | 453542 | 5435311 | -172 | 3825E |

| WST-23-1360 | 154 | -17 | 150.6 | 453701 | 5435376 | -197 | 4000E |

| WST-23-1364 | 156 | -2 | 156.6 | 453700 | 5435375 | -197 | 4000E |

| WST-23-1365 | 153 | 1 | 159.6 | 453700 | 5435375 | -197 | 4000E |

| WST-23-1366 | 155 | 5 | 165.6 | 453701 | 5435376 | -196 | 4000E |

| WST-23-1371 | 153 | -14 | 114.6 | 453279 | 5435248 | -145 | 3575E |

| WST-23-1373 | 138 | -59 | 249.6 | 453646 | 5435347 | -188 | 3950E |

| WST-23-1374 | 147 | -8 | 141.5 | 453179 | 5435127 | 174 | 3425E |

| WST-23-1375 | 172 | -2 | 126.5 | 453179 | 5435127 | 174 | 3425E |

| WST-23-1381 | 164 | 21 | 102.4 | 453443 | 5435276 | -97 | 3725E |

| WST-23-1384 | 170 | -14 | 84.5 | 453645 | 5435346 | -187 | 3950E |

| WST-23-1387 | 180 | -5 | 81.5 | 453645 | 5435346 | -187 | 3950E |

| WST-23-1388 | 136 | -7 | 96.5 | 453543 | 5435311 | -172 | 3825E |

| WST-23-1389 | 154 | -13 | 201.5 | 453543 | 5435311 | -172 | 3825E |

| WST-23-1390 | 150 | -15 | 201.5 | 453543 | 5435311 | -172 | 3825E |

| WST-23-1391A | 153 | -16 | 204.4 | 453542 | 5435311 | -172 | 3825E |

| WST-23-1395 | 183 | -9 | 159.5 | 453442 | 5435339 | -204 | 3750E |

| WST-23-1396 | 149 | -53 | 231.6 | 453757 | 5435406 | -207 | 4075E |

| WST-23-1398 | 185 | 20 | 123.5 | 453442 | 5435275 | -97 | 3725E |

| WST-23-1406 | 168 | -26 | 102.6 | 453179 | 5435127 | 174 | 3425E |

| WST-23-1410 | 143 | -10 | 111.3 | 453279 | 5435248 | -145 | 3575E |

| WST-23-1414 | 161 | -18 | 201.6 | 453259 | 5435210 | 97 | 3525E |

| WST-23-1416 | 173 | 24 | 117.3 | 453442 | 5435276 | -97 | 3725E |

| WST-23-1419 | 123 | 4 | 108.4 | 453446 | 5435277 | -98 | 3725E |

| WST-23-1422 | 179 | -8 | 210.4 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1424 | 176 | -7 | 210.3 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1425 | 172 | -3 | 210.2 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1426 | 168 | -12 | 201.4 | 453443 | 5435339 | -205 | 3750E |

| WST-23-1427 | 164 | 6 | 84.6 | 453645 | 5435346 | -187 | 3950E |

| WST-23-1429 | 153 | 15 | 126.4 | 453646 | 5435346 | -186 | 3950E |

| WST-23-1430 | 152 | 29 | 129.4 | 453646 | 5435347 | -186 | 3950E |

| WST-23-1432 | 165 | 1 | 102.5 | 453278 | 5435248 | -144 | 3575E |

| WST-23-1441 | 112 | -50 | 219.9 | 453759 | 5435409 | -207 | 4075E |

| WST-23-1442 | 103 | -53 | 480.3 | 453759 | 5435409 | -207 | 4075E |

| WST-23-1443 | 162 | 3 | 186.6 | 453600 | 5435324 | -179 | 3900E |

| WST-23-1444 | 145 | 5 | 168.5 | 453601 | 5435324 | -179 | 3900E |

| WST-23-1445 | 129 | -3 | 87.4 | 453602 | 5435325 | -180 | 3900E |

| WST-23-1448 | 175 | -17 | 114.5 | 453541 | 5435311 | -172 | 3825E |

| WST-23-1450 | 181 | -20 | 114.6 | 453541 | 5435311 | -172 | 3825E |

| WST-23-1451 | 183 | -29 | 111.7 | 453540 | 5435311 | -172 | 3825E |

| WST-23-1453 | 140 | 29 | 120.4 | 453646 | 5435347 | -185 | 3950E |

| WST-23-1455 | 140 | 14 | 105.6 | 453646 | 5435347 | -186 | 3950E |

| WST-23-1456 | 129 | 12 | 111.6 | 453646 | 5435347 | -186 | 3950E |

| WST-23-1457 | 129 | 24 | 117.6 | 453646 | 5435347 | -186 | 3950E |

| WST-23-1458 | 130 | 29 | 123.2 | 453646 | 5435347 | -185 | 3950E |

| WST-23-1465 | 180 | 26 | 150.4 | 453278 | 5435248 | -143 | 3575E |

| WST-23-1466 | 183 | 22 | 141.4 | 453278 | 5435248 | -143 | 3575E |

| WST-23-1467 | 182 | 17 | 144.6 | 453278 | 5435248 | -144 | 3575E |

| WST-23-1468 | 180 | 12 | 114.2 | 453278 | 5435248 | -144 | 3575E |

| WST-23-1470 | 172 | 19 | 114.5 | 453443 | 5435276 | -97 | 3725E |

| WST-23-1471 | 126 | 3 | 174.4 | 453602 | 5435325 | -179 | 3900E |

| WST-23-1472 | 129 | 11 | 90.4 | 453602 | 5435325 | -179 | 3900E |

| WST-23-1473 | 130 | 18 | 93.4 | 453601 | 5435325 | -179 | 3900E |

| WST-23-1474 | 135 | 24 | 90.4 | 453601 | 5435324 | -178 | 3900E |

| WST-23-1475 | 107 | -22 | 232.2 | 453760 | 5435409 | -207 | 4075E |

| WST-23-1476 | 105 | -27 | 232.1 | 453760 | 5435409 | -207 | 4075E |

| WST-23-1478 | 180 | -14 | 117.6 | 453541 | 5435311 | -172 | 3825E |

| WST-23-1480 | 195 | -9 | 120.6 | 453540 | 5435311 | -172 | 3825E |

| WST-23-1482 | 193 | -19 | 204.6 | 453541 | 5435311 | -172 | 3825E |

| WST-23-1484 | 176 | -7 | 138.2 | 453278 | 5435248 | -145 | 3575E |

| WST-23-1485 | 173 | -20 | 171.1 | 453278 | 5435248 | -145 | 3575E |

| WST-23-1486 | 176 | -14 | 177.2 | 453278 | 5435248 | -145 | 3575E |

| WST-23-1487 | 115 | -9 | 222.3 | 453506 | 5435326 | -89 | 3800E |

| WST-23-1490 | 123 | -3 | 162.4 | 453506 | 5435326 | -88 | 3800E |

| WST-23-1491 | 160 | 8 | 165.6 | 453701 | 5435376 | -196 | 4000E |

| WST-23-1492 | 160 | 4 | 159.5 | 453701 | 5435376 | -196 | 4000E |

| WST-23-1494 | 160 | -10 | 159.5 | 453700 | 5435375 | -197 | 4000E |

| WST-23-1495 | 158 | -14 | 160 | 453700 | 5435376 | -197 | 4000E |

| WST-23-1496 | 159 | -18 | 171.5 | 453700 | 5435376 | -197 | 4000E |

| WST-23-1497 | 154 | -21 | 189.6 | 453700 | 5435376 | -197 | 4000E |

| WST-23-1500 | 168 | -32 | 126.5 | 453259 | 5435210 | 96 | 3525E |

| WST-23-1501 | 167 | -28 | 123.5 | 453259 | 5435210 | 96 | 3525E |

| WST-23-1503 | 183 | -14 | 153.1 | 453278 | 5435248 | -145 | 3575E |

| WST-23-1514 | 135 | 3 | 93 | 453601 | 5435325 | -179 | 3900E |

| WST-23-1515 | 137 | 10 | 83 | 453601 | 5435324 | -179 | 3900E |

| WST-23-1516 | 146 | 12 | 168.3 | 453601 | 5435324 | -179 | 3900E |

| WST-23-1519 | 174 | -11 | 201.2 | 453443 | 5435339 | -205 | 3750E |

| WST-23-1520 | 170 | -7 | 330.4 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1522 | 163 | -1 | 150.4 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1523 | 164 | -6 | 147.4 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1524 | 166 | -10 | 195.4 | 453443 | 5435339 | -205 | 3750E |

| WST-23-1525 | 162 | -20 | 189.4 | 453443 | 5435339 | -205 | 3750E |

| WST-23-1530 | 134 | 34 | 117.1 | 453646 | 5435346 | -185 | 3950E |

| WST-23-1532 | 122 | 25 | 126.4 | 453647 | 5435347 | -185 | 3950E |

| WST-23-1533 | 121 | 18 | 117.4 | 453647 | 5435347 | -186 | 3950E |

| WST-23-1534 | 122 | 10 | 117.5 | 453647 | 5435347 | -186 | 3950E |

| WST-23-1535 | 118 | -2 | 83.9 | 453647 | 5435347 | -187 | 3950E |

| WST-23-1538 | 171 | -36 | 141.5 | 453259 | 5435210 | 96 | 3525E |

| WST-23-1541 | 177 | -20 | 126.6 | 453258 | 5435210 | 97 | 3525E |

| WST-23-1542 | 140 | -4 | 81.3 | 453601 | 5435324 | -180 | 3900E |

| WST-23-1543 | 129 | -12 | 75.4 | 453602 | 5435325 | -180 | 3900E |

| WST-23-1549 | 126 | -15 | 159.5 | 453506 | 5435326 | -89 | 3800E |

| WST-23-1550 | 129 | -15 | 156.5 | 453505 | 5435326 | -89 | 3800E |

| WST-23-1555 | 189 | 21 | 144.2 | 453277 | 5435248 | -143 | 3575E |

| WST-23-1557 | 182 | 12 | 99.4 | 453179 | 5435127 | 175 | 3425E |

| WST-23-1560 | 182 | 24 | 114.2 | 453179 | 5435127 | 176 | 3425E |

| WST-23-1575 | 132 | -3 | 184.5 | 453646 | 5435347 | -187 | 3950E |

| WST-23-1577 | 129 | 4 | 156.3 | 453647 | 5435347 | -187 | 3950E |

| WST-23-1578 | 142 | 6 | 153.1 | 453646 | 5435347 | -187 | 3950E |

| WST-23-1579 | 161 | 0 | 162 | 453700 | 5435375 | -197 | 4000E |

| WST-23-1580 | 165 | -2 | 177.6 | 453700 | 5435375 | -197 | 4000E |

| WST-23-1581 | 169 | -5 | 177.6 | 453700 | 5435375 | -197 | 4000E |

| WST-23-1583 | 164 | -13 | 150.5 | 453700 | 5435375 | -197 | 4000E |

| WST-23-1585 | 156 | -42 | 120.7 | 453179 | 5435127 | 173 | 3425E |

| WST-23-1591 | 143 | 1 | 180.5 | 453646 | 5435346 | -187 | 3950E |

| WST-23-1592 | 143 | -4 | 180.5 | 453646 | 5435347 | -187 | 3950E |

| WST-23-1593 | 147 | -7 | 168.5 | 453646 | 5435346 | -187 | 3950E |

| WST-23-1596 | 141 | -20 | 153.5 | 453646 | 5435347 | -187 | 3950E |

| WST-23-1602 | 155 | 2 | 147.5 | 453444 | 5435339 | -204 | 3750E |

| WST-23-1603 | 159 | -1 | 147.6 | 453444 | 5435339 | -204 | 3750E |

| WST-23-1604 | 162 | -4 | 312.5 | 453444 | 5435339 | -204 | 3750E |

| WST-23-1605 | 157 | -5 | 144.6 | 453444 | 5435339 | -204 | 3750E |

| WST-23-1606 | 159 | -10 | 231.4 | 453444 | 5435339 | -205 | 3750E |

| WST-23-1607 | 161 | -10 | 288.5 | 453442 | 5435339 | -205 | 3750E |

| WST-23-1608 | 142 | -6 | 168.6 | 453321 | 5435227 | 104 | 3600E |

| WST-23-1614 | 170 | -35 | 111.6 | 453600 | 5435324 | -180 | 3900E |

| WST-23-1615 | 158 | -39 | 108.6 | 453600 | 5435324 | -181 | 3900E |

| WST-23-1616 | 148 | -40 | 105.3 | 453601 | 5435324 | -181 | 3900E |

| WST-23-1618 | 133 | -32 | 105.5 | 453601 | 5435325 | -180 | 3900E |

| WST-23-1619 | 133 | -39 | 105.5 | 453601 | 5435325 | -181 | 3900E |

| WST-23-1620 | 134 | -44 | 117.2 | 453601 | 5435325 | -181 | 3900E |

| WST-23-1631 | 165 | -11 | 114.4 | 453542 | 5435311 | -172 | 3825E |

| WST-23-1640 | 160 | -23 | 156.6 | 453321 | 5435227 | 104 | 3600E |

| WST-23-1642 | 166 | -19 | 132.6 | 453320 | 5435227 | 104 | 3600E |

| WST-23-1650 | 176 | -15 | 75.3 | 453699 | 5435375 | -197 | 4000E |

| WST-23-1652 | 170 | -35 | 78.4 | 453700 | 5435375 | -198 | 4000E |

| WST-23-1661 | 133 | 0 | 144.5 | 453322 | 5435228 | 105 | 3600E |

| WST-23-1662 | 137 | 4 | 165.6 | 453322 | 5435228 | 105 | 3600E |

| WST-23-1664 | 138 | -4 | 165.4 | 453322 | 5435227 | 104 | 3600E |

| WST-23-1665 | 146 | 1 | 171.6 | 453321 | 5435227 | 105 | 3600E |

| WST-23-1673 | 151 | -7 | 162.6 | 453646 | 5435346 | -187 | 3950E |

| WST-23-1674 | 148 | -2 | 156.5 | 453646 | 5435347 | -187 | 3950E |

| WST-23-1675 | 149 | 3 | 177.4 | 453646 | 5435346 | -187 | 3950E |

| WST-23-1676 | 150 | 7 | 159.5 | 453646 | 5435346 | -186 | 3950E |

| WST-23-1677 | 148 | 11 | 159.5 | 453646 | 5435346 | -186 | 3950E |

| WST-23-1678 | 155 | -13 | 192.5 | 453443 | 5435339 | -205 | 3750E |

| WST-23-1679 | 150 | -13 | 177.2 | 453443 | 5435339 | -205 | 3750E |

| WST-23-1680 | 150 | -2 | 147.3 | 453444 | 5435339 | -204 | 3750E |

| WST-23-1681 | 149 | 2 | 282.3 | 453444 | 5435339 | -204 | 3750E |

| WST-23-1683 | 128 | -2 | 174.5 | 453322 | 5435228 | 105 | 3600E |

| WST-23-1687 | 194 | 11 | 123.3 | 453277 | 5435248 | -144 | 3575E |

| WST-23-1688 | 199 | 13 | 375.3 | 453277 | 5435248 | -144 | 3575E |

| WST-23-1690 | 199 | 22 | 141.4 | 453277 | 5435248 | -143 | 3575E |

| WST-23-1692 | 153 | -35 | 422.8 | 453700 | 5435375 | -198 | 4000E |

| WST-23-1693 | 159 | -34 | 393.5 | 453257 | 5435209 | 96 | 3525E |

| WST-23-1695 | 144 | -17 | 144.6 | 453504 | 5435325 | -89 | 3800E |

| WST-23-1700 | 148 | 5 | 144.6 | 453504 | 5435325 | -88 | 3800E |

| WST-23-1701 | 151 | 11 | 153.5 | 453504 | 5435325 | -88 | 3800E |

| WST-23-1704 | 151 | 35 | 102.2 | 453646 | 5435347 | -185 | 3950E |

| WST-23-1705 | 159 | 39 | 105.1 | 453645 | 5435346 | -185 | 3950E |

| WST-23-1706 | 163 | 33 | 96.4 | 453645 | 5435346 | -185 | 3950E |

| WST-23-1707 | 169 | 38 | 108.1 | 453645 | 5435346 | -185 | 3950E |

| WST-23-1714 | 130 | -53 | 198.1 | 453600 | 5435326 | -181 | 3900E |

| WST-23-1715 | 132 | -49 | 126.4 | 453601 | 5435326 | -181 | 3900E |

| WST-23-1719 | 156 | -18 | 291.3 | 453443 | 5435339 | -205 | 3750E |

| WST-23-1720 | 153 | -8 | 138.4 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1721 | 156 | 5 | 171.3 | 453443 | 5435339 | -204 | 3750E |

| WST-23-1723A | 139 | -3 | 170.8 | 453322 | 5435228 | 104 | 3600E |

| WST-23-1736 | 154 | -46 | 342.3 | 453543 | 5435312 | -173 | 3825E |

| WST-23-1737 | 184 | -3 | 210.5 | 453442 | 5435339 | -204 | 3750E |

| WST-23-1741 | 157 | 13 | 165.6 | 453646 | 5435346 | -186 | 3950E |

| WST-23-1742 | 160 | 9 | 171.4 | 453646 | 5435346 | -186 | 3950E |

| WST-23-1743 | 159 | 4 | 165.4 | 453645 | 5435346 | -187 | 3950E |

| WST-23-1745 | 153 | -4 | 162.6 | 453646 | 5435346 | -187 | 3950E |

| WST-23-1746 | 204 | 15 | 387.3 | 453277 | 5435248 | -143 | 3575E |

| WST-23-1748 | 164 | 7 | 195.6 | 453503 | 5435325 | -88 | 3800E |

| WST-23-1753 | 201 | 26 | 141.4 | 453277 | 5435248 | -143 | 3575E |

| WST-23-1756 | 146 | -2 | 171.5 | 453322 | 5435227 | 104 | 3600E |

| WST-23-1760 | 148 | -15 | 348.6 | 453646 | 5435346 | -187 | 3950E |

| WST-23-1768 | 152 | -40 | 198.4 | 453279 | 5435248 | -145 | 3575E |

| WST-23-1769 | 149 | -45 | 351.3 | 453543 | 5435312 | -173 | 3825E |

| WST-23-1775 | 152 | 1 | 174.5 | 453321 | 5435227 | 105 | 3600E |

| WST-23-1781 | 140 | -7 | 153.3 | 453444 | 5435339 | -205 | 3750E |

| WST-23-1782 | 145 | -9 | 144.5 | 453444 | 5435339 | -204 | 3750E |

| WST-23-1783 | 150 | -11 | 141.2 | 453444 | 5435339 | -205 | 3750E |

| WST-23-1786 | 161 | -40 | 189.4 | 453279 | 5435248 | -145 | 3575E |

| WST-23-1788 | 165 | -32 | 153.7 | 453278 | 5435248 | -145 | 3575E |

| WST-23-1789 | 126 | -3 | 177.1 | 453323 | 5435236 | 55 | 3600E |

| WST-23-1793 | 131 | -10 | 165.5 | 453323 | 5435236 | 55 | 3600E |

| WST-23-1794 | 127 | -13 | 168.5 | 453323 | 5435236 | 55 | 3600E |

| WST-23-1796 | 171 | -32 | 156.6 | 453278 | 5435248 | -145 | 3575E |

| WST-23-1810 | 134 | -19 | 168.5 | 453323 | 5435236 | 55 | 3600E |

| WST-23-1812 | 135 | -8 | 165.6 | 453323 | 5435236 | 55 | 3600E |

| WST-23-1829 | 140 | -23 | 165.5 | 453323 | 5435236 | 54 | 3600E |

Lynx Zone

Mineralization occurs as grey to translucent quartz-carbonate-pyrite-tourmaline veins and pyrite replacement zones and stockworks. Vein-type mineralization is associated with haloes of pervasive sericite-pyrite ± silica alteration and contain sulphides (predominantly pyrite with minor amounts of chalcopyrite, sphalerite, galena, arsenopyrite, and pyrrhotite) and local visible gold. Replacement mineralization is associated with strong pervasive silica-sericite-ankerite ± tourmaline alteration and contains disseminated pyrite from trace to 80% with local visible gold. Pyrite stockworks can form envelopes that reach several tens of metres thick. Fuchsite alteration is common and is spatially constrained to near the gabbros. Mineralization occurs at or near geological contacts between felsic porphyritic or fragmental intrusions and the host rhyolites or gabbros and locally can be hosted along the gabbro-rhyolite contact.

Qualified Person

The scientific and technical content of this news release has been reviewed, prepared, and approved by Ms. Isabelle Roy, P.Geo. (OGQ 535), Director of Technical Services for Osisko’s Windfall gold project, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Quality Control and Reporting Protocols

True width determination is estimated at 55-80% of the reported core length interval for the zone. Assays are uncut except where indicated. Intercepts occur within geological confines of major zones but have not been correlated to individual vein domains at this time. Reported intervals include minimum weighted averages of 3.5 g/t Au diluted over core lengths of at least 2.0 metres. NQ core assays were obtained by either 1-kilogram screen fire assay or standard 50-gram fire-assaying-AA finish or gravimetric finish at (i) ALS Laboratories in Val d’Or, Québec, Vancouver, British Colombia, Lima, Peru or Vientiane, Laos (ii) Bureau Veritas in Timmins, Ontario. The 1-kilogram screen assay method is selected by the geologist when samples contain coarse gold or present a higher percentage of pyrite than surrounding intervals. Selected samples are also analyzed for multi-elements, including silver, using a Four Acid Digestion-ICP-MS method at ALS Laboratories. Drill program design, Quality Assurance/Quality Control (“QA/QC”) and interpretation of results is performed by qualified persons employing a QA/QC program consistent with NI 43-101 and industry best practices. Standards and blanks are included with every 20 samples for QA/QC purposes by the Corporation as well as the lab. Approximately 5% of sample pulps are sent to secondary laboratories for check assay.

About the Windfall Gold Deposit

The Windfall gold deposit is located between Val-d’Or and Chibougamau in the Abitibi region of Québec, Canada. The mineral resource estimate on Windfall (with an effective date of June 7, 2022 ) (the “Windfall Resource Estimate”) and the mineral reserve estimate on Windfall (with an effective date of November 25, 2022) (the “Windfall Reserve Estimate”) are described in the technical report entitled “Feasibility Study for the Windfall Project, Eeyou Istchee James Bay, Québec, Canada” (the “FS Technical Report”) and dated January 10, 2023 (with an effective date of November 25, 2022). The Windfall Resource Estimate, assuming a cut-off grade of 3.50 g/t Au, comprises 811,000 tonnes at 11.4 g/t Au (297,000 ounces) in the measured mineral resource category, 10,250,000 tonnes at 11.4 g/t Au (3,754,000 ounces) in the indicated mineral resource category and 12,287,000 tonnes at 8.4 g/t Au (3,337,000 ounces) in the inferred mineral resource category. The Windfall Mineral Reserve, assuming 3.5 g/t operating, 2.5 g/t incremental, and 1.7 g/t development cut-off grade, comprises 12,183,000 tonnes at 8.06 g/t Au (3,159,000 ounces) in the probable mineral reserves category. The key assumptions, parameters, limitations and methods used in the feasibility study for Windfall, including the related Windfall Resource Estimate and Windfall Reserve Estimate, are described in the FS Technical Report, which was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The FS Technical Report is available on SEDAR+ (www.sedarplus.com) under Osisko’s issuer profile. The Windfall gold deposit is currently one of the highest-grade resource-stage gold projects in Canada and has world-class scale. Mineralization occurs in three principal areas: Lynx, Main, and Underdog. Mineralization is generally comprised of sub-vertical lenses following intrusive porphyry contacts plunging to the northeast. The resources are defined from surface to a depth of 1,600 metres, including the Triple 8 (TP8) zone. The reserves are defined from surface to a depth of 1,100 metres. The deposit remains open along strike and at depth. Mineralization has been identified at surface in some areas and as deep as 2,625 metres in others with significant potential to extend mineralization down-plunge and at depth.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 50% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 50% interest in a large area of claims in the surrounding Urban Barry area and nearby Quévillon area (over 2,300 square kilometers).

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always, using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “potential”, “feasibility”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This news release contains the forward-looking information pertaining to, among other things: the Windfall gold deposit being one of the highest-grade resource-stage gold projects in Canada and having world-class scale; the expected timing (if at all) to hook-up the power line; the expected allocation of power under the power allocation agreement being realized (if any); the expected power demand for Windfall; the assumptions limitations and qualifications in the FS Technical Report, including relating to the Windfall Resource Estimate and Windfall Reserve Estimate; reliance on third-parties for infrastructure, including power lines, with reference to the agreement with Miyuukaa for the transmission of hydroelectric power to the Windfall site; the results of the FS Technical Report, including NPV, IRR, production, tax-free cash flows, capex, AISC, milling operations, average recovery, job creation; the Lynx zone remaining open to expansion down plunge. Such factors include, among others, risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; reliance on third-parties, including governmental entities, for mining activities, including for infrastructure; the timing and ability, if at all, to obtain permits; the reliance on third-parties for infrastructure critical to build and operate the Windfall project, including power lines; our ability to obtain power for the Windfall project, if at all or on terms economic to the Corporation; the status of third-party approvals or consents; errors in management’s geological modelling; the ability of Osisko to complete further exploration activities, including (infill) drilling; property and royalty interests in the Windfall gold deposit; the ability of the Corporation to obtain required approvals; the results of exploration activities; risks relating to mining activities; the Canadian/United States dollar exchange rate; the global economic climate; metal (including gold) prices; dilution; environmental risks; and community and non-governmental actions. For additional information with respect to these and other factors and assumptions underlying the forward-looking information in this news release, please see the section entitled “Risk Factors” in the most recent annual information form of Osisko for the year ended December 31, 2022, a copy of which is available on SEDAR+ (www.sedarplus.com) under Osisko’s issuer profile. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

CONTACT INFORMATION:

John Burzynski

Chief Executive Officer

Telephone (416) 363-8653

OSISKO ANNOUNCES HYDROELECTRIC POWER ALLOCATION FOR WINDFALL

Hook-up Expected Early 2024

(Toronto, October 12, 2023) Osisko Mining Inc. (OSK:TSX. “Osisko” or the “Corporation”) is pleased to announce that “Windfall Mining Group”(its 50% jointly owned partnership with a Gold Fields Limited subsidiary), has concluded the hydro-electricity power allocation agreement with Hydro-Québec, a wholly-owned Crown corporation of the Québec Government.

The forecasted power demand and allocation for the electrical Installation is 27,400 kW for Windfall. Power will be delivered at the MICO substation located in nearby Waswanipi, Quebec, then be transported using a dedicated power line (currently under construction) from the MICO substation to Windfall by Miyuukaa Corporation (please see news release of Osisko dated March 16, 2023 entitled “Osisko Announces Definitive Agreement with Miyuukaa to transport Hydroelectric Power to Windfall Project”).

John Burzynski, Chairman and Chief executive officer commented: “Receipt of the Windfall power allocation is a major milestone, as it will significantly reduce greenhouse gas emissions and project power costs. It is well aligned with our joint-venture ESG goals.”

Power line construction work is progressing on schedule with the hook-up date anticipated in early 2024.

About the Windfall Gold Deposit

The Windfall gold deposit is located between Val-d’Or and Chibougamau in the Abitibi region of Québec, Canada. The mineral resource estimate on Windfall (with an effective date of June 7, 2022 ) (the “Windfall Resource Estimate”) and the mineral reserve estimate on Windfall (with an effective date of November 25, 2022) (the “Windfall Reserve Estimate”) are described in the technical report entitled “Feasibility Study for the Windfall Project, Eeyou Istchee James Bay, Québec, Canada” (the “FS Technical Report”) and dated January 10, 2023 (with an effective date of November 25, 2022). The Windfall Resource Estimate, assuming a cut-off grade of 3.50 g/t Au, comprises 811,000 tonnes at 11.4 g/t Au (297,000 ounces) in the measured mineral resource category, 10,250,000 tonnes at 11.4 g/t Au (3,754,000 ounces) in the indicated mineral resource category and 12,287,000 tonnes at 8.4 g/t Au (3,337,000 ounces) in the inferred mineral resource category. The Windfall Mineral Reserve, assuming 3.5 g/t operating, 2.5 g/t incremental, and 1.7 g/t development cut-off grade, comprises 12,183,000 tonnes at 8.06 g/t Au (3,159,000 ounces) in the probable mineral reserves category. The key assumptions, parameters, limitations and methods used in the feasibility study for Windfall, including the related Windfall Resource Estimate and Windfall Reserve Estimate, are described in the FS Technical Report, which was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The FS Technical Report is available on SEDAR+ (www.sedarplus.com) under Osisko’s issuer profile. The Windfall gold deposit is currently one of the highest-grade resource-stage gold projects in Canada and has world-class scale. Mineralization occurs in three principal areas: Lynx, Main, and Underdog. Mineralization is generally comprised of sub-vertical lenses following intrusive porphyry contacts plunging to the northeast. The resources are defined from surface to a depth of 1,600 metres, including the Triple 8 (TP8) zone. The reserves are defined from surface to a depth of 1,100 metres. The deposit remains open along strike and at depth. Mineralization has been identified at surface in some areas and as deep as 2,625 metres in others with significant potential to extend mineralization down-plunge and at depth.

Qualified Person

The scientific and technical content in this news release has been reviewed and approved by Mr. Mathieu Savard, P.Geo (OGQ #510), President of Osisko, who is a “qualified person” (within the meaning of NI 43-101).

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 50% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 50% interest in a large area of claims in the surrounding Urban Barry area and nearby Quévillon area (over 2,300 square kilometers).

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always, using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “potential”, “feasibility”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This news release contains the forward-looking information pertaining to, among other things: the Windfall gold deposit being one of the highest-grade resource-stage gold projects in Canada and having world-class scale; the expected timing (if at all) to hook-up the power line; the expected allocation of power under the power allocation agreement being realized (if any); the expected power demand for Windfall; the assumptions limitations and qualifications in the FS Technical Report, including relating to the Windfall Resource Estimate and Windfall Reserve Estimate; reliance on third-parties for infrastructure, including power lines, with reference to the agreement with Miyuukaa for the transmission of hydroelectric power to the Windfall site; the results of the FS Technical Report, including NPV, IRR, production, tax-free cash flows, capex, AISC, milling operations, average recovery, job creation; the Lynx zone remaining open to expansion down plunge. Such factors include, among others, risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; reliance on third-parties, including governmental entities, for mining activities, including for infrastructure; the timing and ability, if at all, to obtain permits; the reliance on third-parties for infrastructure critical to build and operate the Windfall project, including power lines; our ability to obtain power for the Windfall project, if at all or on terms economic to the Corporation; the status of third-party approvals or consents; errors in management’s geological modelling; the ability of Osisko to complete further exploration activities, including (infill) drilling; property and royalty interests in the Windfall gold deposit; the ability of the Corporation to obtain required approvals; the results of exploration activities; risks relating to mining activities; the Canadian/United States dollar exchange rate; the global economic climate; metal (including gold) prices; dilution; environmental risks; and community and non-governmental actions. For additional information with respect to these and other factors and assumptions underlying the forward-looking information in this news release, please see the section entitled “Risk Factors” in the most recent annual information form of Osisko for the year ended December 31, 2022, a copy of which is available on SEDAR+ (www.sedarplus.com) under Osisko’s issuer profile. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

CONTACT INFORMATION:

John Burzynski

Chief Executive Officer

Telephone (416) 363-8653

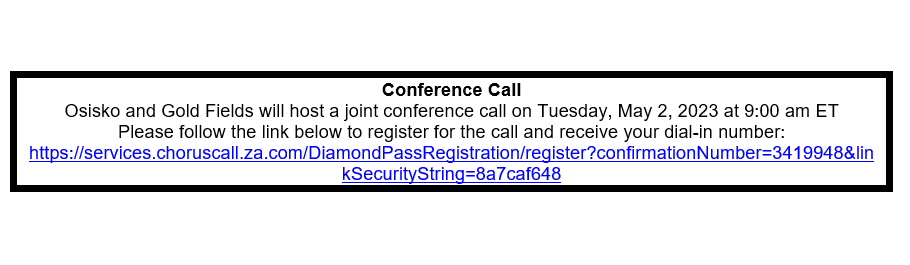

AUDIO RECORDING AND TRANSCRIPT FROM OSISKO GOLD FIELDS JOINT VENTURE CALL, MAY 2, 2023

Click here to access the audio file of this transcript.

Operator

Good day, ladies and gentlemen, and welcome to the Gold Fields and Osisko Mining joint venture to develop the Windfall project. At this time all participants are in listen only mode, and a brief question and answer session will follow the presentation. If you should require any assistance during the conference, please press * and then 0 on your telephone keypad. As a reminder, this conference is being recorded. It’s now my pleasure to introduce your host, Martin Preece. Please go ahead, sir.

Martin Preece

Thank you, Chris. Good afternoon, ladies and gentlemen. Good morning to those on the other side of the world, and welcome to this call. I think a special welcome to John and his team from Osisko, who are joining us from Toronto. In terms of the rationale for the call today it’s just to update you all on the recently announced partnership we are going into with Osisko Mining related to the Windfall project in Quebec, Canada. I’m going to finish off these introductory remarks and ask John if he’s got any further remarks to add. And then I will go through some of the basics around the deal. And then John is going to take us through the project itself. And at the end, we will take some questions. The presentation is loaded on our website for those of you who’d like to watch it. John, if I could maybe hand over to you, I’m sure you have some introductory remarks.

John Burzynski

Yes. Thank you, Martin, and welcome everybody to today’s call. I’ll keep my points brief. We’re very excited, very happy to make today’s announcement with Gold Fields. Windfall is an absolute world class deposit. I believe we’ve worked on this one for about seven and a half years, with some very stunning results in terms of the drilling, the grade, the scale of this deposit. It’s an exciting deposit and an exciting day for us. Really this kicks off the first day of marching towards mining, which we expect in about two and a half, three years’ time from now. Martin will walk you through the deal. And I will try and give you that same sense of excitement that we feel jointly both as Osisko and Gold Fields for how we see this deposit developing in the future. So back with you, Martin.

Martin Preece

Thanks, John. So, as John said, a very exciting day for all of us. We’re really pleased to be partnering with Osisko. They’ve put a lot of effort over many years into this. Our teams have been working on this jointly for the past year and a little bit. And I think what really excites us is working with Osisko. They’re an experienced partner with vast experience in that in that jurisdiction. It’s a world class asset with all in sustaining costs of just below $800 an ounce. We’ve got a 10 year reserve life on the project. I think really importantly for us is the upside we see and the analogue with our operations in Australia, where we see significant expansion and exploration potential.

And then John and his team, have got a really strong ESG track record, which dovetails with what we’re doing, the power line that they’re doing with local communities, and completely renewable power to come to the site. We are going to share in the project development exploration, each contributing skills to create a unique partnership. We’re really excited about going into a really strong jurisdiction with a great track record with Osisko with exploration permitting, construction and operating in Quebec. We know it’s a tough environment. I think the really important thing around the upside is the 50/50 joint venture over the Windfall project, but importantly, Urban Barry and Quévillon camps. That’s over 2,400 square kilometres of land package, which we believe it’s got significant upside potential.

In terms of the acquisition cost, we’re going to be buying in at $600 million Canadian, paid in two tranches, one tranche today, and the second tranche once permitting comes through. And we’ve also committed to $75 million Canadian Dollars for the exploration spend to unlock that long term upside potential. In terms of funding, we’re going to fund this through cash reserves and debt facilities. And we in no way see this affecting the payment of dividends and remain committed to paying 30% to 45% of our normalised earnings, as we had announced during the last year.

Growing the quality and value of our portfolio and strengthening our pipeline, this is really important for us, an asset coming in at under $800 all in sustaining cost with a nice long life. And I’ve touched on the ESG. In terms of commercial terms and operating structure, it’s an immediate formation of the 50/50 partnership, which will be jointly run by both parties in equal representation at both board and committee level. The partnership covers the feasibility stage Windfall Project, as well as the highly prospective Urban Barry and Quévillon camps.

In terms of the consideration, which I touched on, basically the two tranches of $300 million, the first of which is transferring to today, which is approximately $220 million US Dollars. In terms of development, we have a 50/50 share in the interim programmes and the construction costs going forward, which is Canadian Dollars $1.1 billion on 100% basis. And then as I’ve touched on the exploration part, we will for the first seven years fund an amount of $75 million Canadian Dollars to drive the exploration. I think the headline for us is that this is a measured entry into tier one jurisdiction on an exceptional asset, which John referenced in his introduction, and something that we really excited about.

I think just touching very briefly on our strategy, this transaction supports both pillar three and pillar two, around growing the value and quality of our portfolio of assets and then building on our leading commitment to ESG. So, fully aligned to our strategy and where we’re going as a business. I think just in summary, I think in terms of our strategic criteria for improving the value and quality of our portfolio, I think asset quality, the first one, at $800 all in sustaining cost and below, a life of mine of 10 years just on reserves, not including resources.

So, we’ve got asset quality, we’ve got jurisdictional quality, being in Quebec in Canada. The strengthening the pipeline, as we’ve touched on. The exploration assets and growth potential at camp scale. Long life. And the project is at the construction stage already. Osisko has invested a lot of money in getting the site to where it is. And then we touched lastly on the ESG practices. Osisko is ranked very highly and their MSCI rating was an A in 2021. So, for us it’s an accretive incremental portfolio improvement that follows the same principles as the AngloGold Ashanti JV in Ghana that we announced some weeks ago. John, if I could maybe hand it to you to talk more competently about the project.

John Burzynski

Thank you, Martin. As I mentioned, Windfall is truly an exceptional deposit. As it stands right now with our 7.4 million ounce total all combined resource, it is the largest high grade underground deposit ever found in Quebec in the last 100 years of exploration. It’s located in a similar Archaean Greenstone belt to the well-known or at least better known Val D’Or camps and Timmins camps, both of which have produced over 100 million ounces in the last 100 years. There’s really no difference between the potential for the Windfall belt. It’s just been less explored, literally a fraction of the exploration of the last 100 years as those other belts.

On slide seven, you can see on the top left corner, there’s a comparison of Windfall to other Canadian gold discoveries. It ranks within the top 10% of Superior Province discoveries that were over 5 million ounces. So, it’s already a highly ranked deposit as it stands. We expect it will grow over time and continue to move to the top of that list. Where we stand today, if we were in production at the current reserve grade that we used in the feasibility of 11.4 grams per ton, it would be in the top 10 high grade producers globally. We have good reason to believe that that head grade as we go into mining may increase and increase substantially. That’ll be the big question as we get into the first 12 to 18 months of mining.

We’ve employed a very strict triple capping on this deposit because of the preponderance of coarse gold. We’ve taken three bulk samples today of about 15,000 tonnes total and recovered 15,000 ounces of gold. We’ve had recoveries and positive reconciliation with between plus 26% up to plus 89%. So, it is an exceptional deposit as it stands capped. We fully expect to commence at what we stated in our feasibility of 306,000 plus or minus ounces per year. We have good reason to believe that once we get mining, we may actually see additional grade come in. And just as a note, every 1 gram of additional grade that we do capture, and we have been capping out about 25% of the gold metal from our resource, every additional 1 gram of grade that we capture would add about another 35,000 ounces per year. So, there’s good reason to believe that as we move forward with additional work on the deposit, we see this thing to creep up and surpass things like 400,000 ounces a year plus.

Where this deposit sits, compared to other very well-known Canadian gold camps and gold mines like Red Lake, Macassa, LaRonde. We’ve drilled the deposit over the past seven years with 2 million metres of drilling. It’s very well drilled. Some of you on the call may not be familiar or as familiar with Osisko Mining. But our group, Bob Wares, Sean Rosen and myself started Osisko back in 2003. In the space of six years and a month, we defined the Canadian Malartic deposit, Canada’s current largest single gold producer, about 700,000 ounces a year, put that into production. A very big mine. So, we know this is a little different in terms of it’s a high grade mine. But where Windfall sits right now, with 2 million metres of drilling we have it defined from surface down to 1,200 metres.

We’ve done extensive drilling on the deposit with some deeper holes as well below that. We have good reasonably we can double that resource as we go forward. We literally have to pick a place to stop. The target over the last two or three years was to come up with something just over 4 million ounces, so that by the time we added mine dilution, we were starting with a 3 million ounce reserves that we could then project a 10 year mine life on. But the deposit certainly doesn’t stop at 1,500 metres. We’ve drilled the deepest hole in Canada. It’s about 3.4 kilometres long. We wanted to take a look at the roots of the system. And we have economic intercepts as deep as 2.8 kilometres vertical. So, there’s a lot of room for this deposit to grow. We could probably spend the next five years plus just expanding the deposit internally even above that 1,200 metre level. But certainly, as we go down plunge, we are seeing higher grades and wider widths of this deposit. So, it is very truly a very exceptional deposit. And I think it stands alone in its class globally today is as one of the very highest grade near term development assets.

On the next slide on slide eight, the feasibility highlights. Again, we chose a 10 year life of mine based on that 4.1 million ounce reserve that we diluted down to 3.2 million. But we didn’t include 3.5 million of the other ounces. They are still there. Our conversion success has been well over 90% in terms of bringing those ounces from inferred into measured and Indicated. And there’s at least another half the deposit in our minds as we go down plunge and laterally to add on as we move forward with the mining. We’re looking at first production in 2025. Permitting was commenced in March. It’s typically about an 18 month plus process. We have some hopes that it might be shorter. But once we come out of permitting, we’re looking at a few months to get the actual construction release from the Quebec government, and then about a 12 month construction cycle. So, that would put us into late 2024, early 2025 if everything works perfectly, which we all know happens every single time in the business, with exceptions.

The feasibility was predicted 306,000 ounces per year, based on a diluted grade of 8.1g from that initial 11.4g per ton grade in the reserve. We added some inferred material in there that we’re obliged to mine through as part of the development. We counted it as zero. We know it’s not zero. It’s actually about the same resource reserve grade, subject to more drilling before we can add it to the M&I categories. If we were to include that as drilled out material, we’re probably looking at something more like 326,000 ounces per year on that basis. And this is before we start thinking about adding additional grammes that we may see come into the mine as we move forward.

Construction costs in the feasibility were estimated at $789 million Canadian. We are seeing some cost reduction. We have seen some cost reduction in the past three to four months as we move through detailed engineering. We’re currently about 30% to 40% through the detailed engineering. We’re looking for like $720 million Canadian as capex costs. That includes about $50 million Canadian of contingency. The AISC at $758 US per ounce is certainly very good AISC. But again, adding those other ounces that we excluded and counted as zero, we do expect that number to come down. And certainly, if we see additional grade, we’re getting one for free and just dividing by a bigger number. So, we should see the AISC, if we are correct about that additional grade coming in, drop below $700.

As Martin mentioned, we are in partnership with the First Nations in a very big way. The Waswanipi Economic Development Corporation is currently building a hydro line to site from their substation in their town. This is about maybe a five kilometre long hydro line. They are currently about 20% complete. It’s spring break up there right now. So, there’s a couple of weeks from when big trucks are allowed to move around. We are expecting that hydro line to be complete by the end of this year or early in 2024, all on schedule.

The new mine will be creating over 1,000 direct and indirect jobs during construction, and about 670 direct jobs during operations. We currently employ about 30% as First Nations employees from the region. Our workforce is very diverse. We have very good balance from the board of directors through management, to our technical and operations staff at site of all genders, and certainly a big First Nations component and many, if not most of the employees are Quebec based.