Month: February 2023

OSISKO MINING CLOSES C$100 MILLION “BOUGHT DEAL” PRIVATE PLACEMENT OF UNITS, INCLUDING FULL EXERCISE OF THE UNDERWRITERS’ OPTION

(Toronto, February 28, 2023) – Osisko Mining Inc. (TSX:OSK) (“Osisko” or the “Corporation”) is pleased to announce the completion of its previously announced “bought deal” private placement of an aggregate of 32,260,000 units of the Corporation (the “Units”) at a price of C$3.10 per Unit for aggregate gross proceeds of approximately C$100 million, including the exercise in full of the underwriters’ option (the “Offering”).

Each Unit consists of one common share of the Corporation and one-half of one common share purchase warrant of the Corporation (each whole common share purchase warrant, a “Warrant”). Each Warrant entitles the holder thereof to acquire one common share of the Corporation for 18 months from the closing of the Offering at a price of C$4.00, subject to adjustment in certain circumstances.

The net proceeds received from the Offering will be used to advance the Corporation’s Windfall Project as well as for working capital and general corporate purposes. The Offering was led by Canaccord Genuity Corp., on behalf of a syndicate of underwriters that included BMO Nesbitt Burns Inc., CIBC World Markets Inc., National Bank Financial Inc., Scotia Capital Inc., Eight Capital, and Haywood Securities Inc.

All securities issued under the Offering will be subject to a hold period expiring four months and one day from the date hereof. The Offering is subject to final acceptance of the Toronto Stock Exchange.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

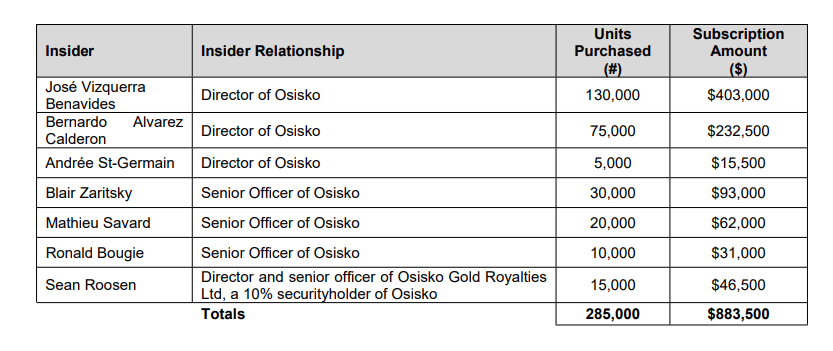

The following “insiders” of the Corporation have subscribed for Units under the Offering:

Each subscription by an “insider” is considered to be a “related party transaction” for purposes of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Corporation did not file a material change report more than 21 days before the expected closing date of the Offering as the details of the Offering and the participation therein

by each “related party” of the Corporation were not settled until shortly prior to the closing of the Offering, and the Corporation wished to close the Offering on an expedited basis for sound business reasons. The Corporation is relying on exemptions from the formal valuation and

minority shareholder approval requirements available under MI 61-101. The Corporation is exempt from the formal valuation requirement in Section 5.4 of MI 61-101 in reliance on section 5.5(a) of MI 61-101 as the fair market value of the transaction, insofar as it involves interested

parties, is not more than the 25% of the Corporation’s market capitalization. Additionally, the Corporation is exempt from minority shareholder approval requirement in Section 5.6 of MI 61-101 in reliance on Section 5.7(1)(a) of MI 61-101 as the fair market value of the transaction, insofar as it involves interested parties, is not more than the 25% of the Corporation’s market capitalization.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 100% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and

holds a 100% undivided interest in a large area of claims in the surrounding Urban Barry area and nearby Quévillon area (over 2,400 square kilometres).

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the

use of proceeds of the Offering, the timing and ability of the Corporation, if at all, to obtain final approval of the Offering from the Toronto Stock Exchange and any other information herein that is not a historical fact may be “forward-looking information”. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to

identify forward- looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation at the time such assumptions and estimates were made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Osisko to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to capital markets; the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability of Osisko to complete further exploration activities, including drilling; property interests in the Windfall Lake gold project; the ability of the Corporation to obtain required approvals and complete transactions on terms announced; the

results of exploration activities; risks relating to mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non- governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions. Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information, Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

For further information please contact:

John Burzynski

Chief Executive Officer

Telephone (416) 363-8653

OSISKO MINING CORPORATE UPDATE

(Toronto, February 22, 2023) Osisko Mining Inc. (OSK:TSX. “Osisko” or the “Corporation”) provides the following corporate update.

The Corporation continues to advance work on the Windfall project and surrounding properties, with 15 rigs in total active underground and at surface, performing a combination of infill and exploratory drilling. Detailed engineering has commenced for the planned Windfall operations with the objective of optimizing design and capital expenditures.

The exploration ramp is currently at 640 metres vertical depth, and over 13 kilometres length underground. Nine drills are active on the exploration ramp, and the advance towards the fourth bulk sample (the 800 metre level Lynx 4 sample) is planned to resume in H2 2023.

Osisko is also working towards the conclusion of the definitive agreement with Miyuukaa Corp. (“Miyuukaa”), a wholly-owned corporation of the Cree First Nation of Waswanipi (“CFNW”), with respect to the construction of proposed transmission facilities and the transport of hydroelectric power to the Windfall project. The Kuikuhaacheu transmission line from the Waswanipi substation to Windfall is located 100% on CFNW traditional lands covered by the James Bay Northern Québec Agreement. Finalization of the definitive agreement is expected before the end of this month.

The Corporation remains on schedule to submit its Environmental Impact Assessment report for Windfall (“EIA”) to the Environmental and Social Impact Review Committee (“COMEX”) in Q1 2023. The Corporation also anticipates finalizing the Impact and Benefit Agreement with the Cree First Nation of Waswanipi and the Cree Nation Government before year end 2023.

The Corporation has also begun to receive pre-ordered mill components at the port of Bécancour, Québec. Equipment is being kept in a dry and heated storage facility until required at the Windfall site.

Having completed its Feasibility Study, Osisko has begun the process of reviewing its financing options for the Windfall mine, including ongoing discussions with potential lenders and other strategic alternatives, which may include public and private debt facilities, strategic alliances, partnerships, joint ventures, and other strategic alternatives. Osisko will only provide updates on any such alternatives that advance to the point of requiring disclosure. There can be no assurances that any such arrangements can be agreed on terms acceptable to Osisko.

The recently announced “bought-deal” private placement financing (please see Osisko news release dated February 6th, 2023) is expected to close on February 28th.

Qualified Person

The scientific and technical content in this news release has been reviewed and approved by Mr. Mathieu Savard, P.Geo (OGQ #510), President of Osisko, who is a “qualified person” (within the meaning of NI 43-101).

About the Windfall Gold Deposit

The Windfall gold deposit is located between Val-d’Or and Chibougamau in the Abitibi region of Québec, Canada. The mineral resource estimate on Windfall (with an effective date of June 7, 2022 ) (the “Windfall Resource Estimate”) and the mineral reserve estimate on Windfall (with an effective date of November 25, 2022) (the “Windfall Reserve Estimate”) are described in the technical report entitled “Feasibility Study for the Windfall Project, Eeyou Istchee James Bay, Québec, Canada” (the “FS Technical Report”) and dated January 10, 2023 (with an effective date of November 25, 2022). The Windfall Resource Estimate, assuming a cut-off grade of 3.50 g/t Au, comprises 811,000 tonnes at 11.4 g/t Au (297,000 ounces) in the measured mineral resource category, 10,250,000 tonnes at 11.4 g/t Au (3,754,000 ounces) in the indicated mineral resource category and 12,287,000 tonnes at 8.4 g/t Au (3,337,000 ounces) in the inferred mineral resource category. The Windfall Mineral Reserve, assuming 3.5 g/t operating, 2.5 g/t incremental, and 1.7 g/t development cut-off grade, comprises 12,183,000 tonnes at 8.06 g/t Au (3,159,000 ounces) in the probable mineral reserves category. The key assumptions, parameters, limitations and methods used in the Feasibility Study for Windfall, including the related Windfall Resource Estimate and Windfall Reserve Estimate, are described in a technical report (the “FS Technical Report”), which was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The FS Technical Report is available on SEDAR (www.sedar.com) under Osisko’s issuer profile. The Windfall gold deposit is currently one of the highest-grade resource-stage gold projects in Canada and has world-class scale. Mineralization occurs in three principal areas: Lynx, Main, and Underdog. Mineralization is generally comprised of sub-vertical lenses following intrusive porphyry contacts plunging to the northeast. The resources are defined from surface to a depth of 1,600 metres, including the Triple 8 (TP8) zone. The reserves are defined from surface to a depth of 1,100 metres. The deposit remains open along strike and at depth. Mineralization has been identified at surface in some areas and as deep as 2,625 metres in others with significant potential to extend mineralization down-plunge and at depth.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 100% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 100% undivided interest in a large area of claims in the surrounding the Urban Barry area and nearby Quévillon area (over 2,300 square kilometres).

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always, using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “potential”, “feasibility”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This news release contains the forward-looking information pertaining to, among other things: the ; the amount and type of drilling to be completed and the timing to complete such drilling; the focus of the remaining infill drilling; the trend of grade increase; the proposed exploration and development works; the entering into and performance of the power line agreement, completion of the proposed environmental assessment, identification, negotiation and entering into of any strategic transaction to assist in the construction of the Windfall project, the Windfall gold deposit being one of the highest-grade resource-stage gold projects in Canada and having world-class scale; the key assumptions, parameters and methods used to estimate the mineral resource estimate disclosed in this news release; the prospects, if any, of the Windfall gold deposit; ; future drilling at the Windfall gold deposit. Such factors include, among others, the ability of Osisko to complete further exploration activities, including (infill) drilling; the ability to complete development activities described herein; risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability of the Corporation to complete materials, file and to obtain required approvals; risks related to the negotiation and entering into of the power line agreement; the results of exploration activities; risks related to the identification, negotiation with, and execution of any strategic transaction to support the development of the Windfall gold deposit; risks relating to mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non-governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

CONTACT INFORMATION:

John Burzynski

Chief Executive Officer

Telephone (416) 363-8653

OSISKO MINING ANNOUNCES C$75 MILLION “BOUGHT DEAL” PRIVATE PLACEMENT OF UNITS

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

(Toronto, February 6, 2023) – Osisko Mining Inc. (TSX:OSK) (“Osisko” or the “Corporation”) is pleased to announce that it has entered into an agreement with Canaccord Genuity Corp. on behalf of a syndicate of underwriters (collectively, the “Underwriters”), pursuant to which the Underwriters have agreed to purchase, on a “bought deal” private placement basis, 24,195,000 units of the Corporation (each, a “Unit”) at a price of C$3.10 per Unit (the “Offering Price”) for gross proceeds of C$75,004,500 (the “Underwritten Offering”).

Each Unit will consist of one common share of the Corporation (each, a “Unit Share”) and one-half of one common share purchase warrant of the Corporation (each whole common share purchase warrant, a “Warrant”). Each Warrant will entitle the holder to acquire one common share of the Corporation for 18 months from the closing of the Offering at a price of C$4.00.

The Corporation has also granted the Underwriters an option to purchase up to an additional 8,065,000 Units at the Offering Price for additional gross proceeds of up to C$25,001,500 exercisable at any time up to 48 hours prior to the closing of the Offering (the “Underwriters’ Option”).

The net proceeds received from the Offering will be used to advance the Corporation’s Windfall Project, as well as for working capital and general corporate purposes.

It is anticipated that closing of the Offering will occur on or about February 28, 2023, or such other date or dates as the Corporation and the Underwriters may agree. The Offering is subject to the satisfaction of certain conditions, including receipt of all applicable regulatory approvals including the approval of the Toronto Stock Exchange. The securities sold under the Offering will have a hold period in Canada of four months and one day from the closing date in accordance with applicable securities laws.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 100% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 100% undivided interest in a large area of claims in the surrounding Urban Barry area and nearby Quévillon area (over 2,400 square kilometres).

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the closing of the Offering; the use of proceeds of the Offering; the exercise of the Underwriters’ Option; the approval of the Toronto Stock Exchange relating to the Offering; and any other information herein that is not a historical fact may be “forward-looking information”. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward- looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation at the time such assumptions and estimates were made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Osisko to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to capital markets; the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability of Osisko to complete further exploration activities, including drilling; property interests in the Windfall Lake gold project; the ability of the Corporation to obtain required approvals and complete transactions on terms announced; the results of exploration activities; risks relating to mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non-governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions. Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information, Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

For further information please contact:

John Burzynski

Chief Executive Officer

Telephone (416) 363-8653