Category: Uncategorised

OSISKO ANNOUNCES TSX APPROVAL TO RENEW NORMAL COURSE ISSUER BID

(Toronto, December 28, 2023) Osisko Mining Inc. (TSX:OSK) (the “Corporation” or “Osisko“) today announces that the Toronto Stock Exchange (the “TSX”) has approved the Corporation’s notice of intention to make a normal course issuer bid (the “NCIB Program”). Under the terms of the NCIB Program, Osisko may acquire up to 36,465,404 of its common shares (“Common Shares”) from time to time in accordance with the normal course issuer bid procedures of the TSX.

The normal course issuer bid will be conducted through the facilities of the TSX or alternative trading systems, if eligible, and will conform to their regulations. Purchases under the normal course issuer bid will be made by means of open market transactions or such other means as a securities regulatory authority may permit, including pre-arranged crosses, exempt offers and private agreements under an issuer bid exemption order issued by a securities regulatory authority.

Repurchases under the NCIB Program may commence on January 2, 2024 and will terminate on January 1, 2025 or on such earlier date as the NCIB Program is complete. Daily purchases will be limited to 191,304 Common Shares, other than block purchase exemptions, representing 25% of the average daily trading volume of the Common Shares on the TSX for the six-month period ending November 30, 2023, being 765,219 Common Shares.

The price that the Corporation may pay for any Common Shares purchased in the open market under the NCIB Program will be the prevailing market price at the time of purchase (plus any brokerage fees) and any Common Shares purchased by the Corporation will be cancelled. In the event that the Corporation purchases Common Shares by pre-arranged crosses, exempt offers, block purchases or private agreements, the purchase price of the Common Shares may be, and will be in the case of purchases by private agreements, as may be permitted by the securities regulatory authority, at a discount to the market price of the Common Shares at the time of acquisition.

The board of directors of Osisko believes that the underlying value of the Corporation may not be reflected in the market price of the Common Shares from time to time and that, accordingly, the purchase of Common Shares will increase the proportionate interest in the Corporation of, and be advantageous to, all remaining shareholders of the Corporation.

As of December 19, 2023, there were 370,797,070 Common Shares issued and outstanding. The 36,465,404 Common Shares that may be repurchased under the NCIB Program represent approximately 10% of the public float of the Corporation as of December 19, 2023, being 364,654,047 Common Shares.

During the prior NCIB Program of the Corporation, which will end on January 1, 2024, the Corporation obtained approval to purchase 29,053,640 Common Shares, and actually purchased 13,992,324 Common Shares at a weighted average price of approximately $2.93 per Common Share through the facilities of the TSX and alternative trading systems in Canada.

Osisko has appointed Canaccord Genuity Corp. to make any purchases under the NCIB Program on its behalf.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 50% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 50% interest in a large area of claims in the surrounding Urban Barry area and nearby Quévillon area (over 2,300 square kilometres).

Cautionary Note Regarding Forward-Looking Information

This news release contains forward-looking statements. These forward-looking statements, by their nature, require the Corporation to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Words such as “may”, “will”, “would”, “could”, “expect”, “believe”, “plan”, “anticipate”, “intend”, “estimate”, “continue”, or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward-looking statements including the fact that the Corporation “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential”, “scheduled” and similar expressions or variations (including negative variations), or that events or conditions “will”, “would”, “may”, “could” or “should” occur including, without limitation, statements about the board of directors of Osisko’s belief that the NCIB Program is advantageous to shareholders and that underlying value of the Corporation may not be reflected in the market price of the Common Shares, the Corporation’s intentions regarding the NCIB Program and whether the Corporation will receive the requisite acceptance of the TSX in respect of the NCIB Program. Although Osisko believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements involve known and unknown risks, uncertainties and other factors and are not guarantees of future performance and actual results may accordingly differ materially from those in forward looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include, without limitation: fluctuations in the prices of the commodities; fluctuations in the value of the Canadian dollar relative to the U.S. dollar; regulatory changes by national and local government, including corporate law, permitting and licensing regimes and taxation policies; continued availability of capital and financing and general economic, market or business conditions; business opportunities that become available to, or are pursued by Osisko; other uninsured risks. The forward looking statements contained in this news release are based upon assumptions management believes to be reasonable, including, without limitation: the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability of Osisko to complete further exploration activities, including drilling; property interests in the Windfall gold project; the ability of the Corporation to obtain required approvals and complete transactions on terms announced; the results of exploration activities; risks relating to mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non-governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions. Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information, Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

For further information on Osisko please contact:

John Burzynski

Chief Executive Officer

Telephone: (416) 363-8653

OSISKO MINING INC. FILES EARLY WARNING REPORT IN RESPECT OF O3 MINING INC.

OSISKO MINING INC. FILES EARLY WARNING REPORT IN RESPECT OF O3 MINING INC.

Toronto, Ontario (December 14, 2023) – Osisko Mining Inc. (TSX: OSK) (the “Corporation“) announces that it has filed an early warning report in respect of its holdings in O3 Mining Inc. (“O3 Mining“). On December 13, 2023, Osisko acquired an aggregate of 2,430,556 common shares of O3 Mining (“O3 Shares“), by way of private placement, representing approximately 2.8% of the issued and outstanding O3 Shares, for aggregate consideration of $3,500,000.64 (or $1.44 per O3 Share) (the “Transaction“). Immediately prior to the Transaction, the Corporation had beneficial ownership of, or control and direction over, 15,861,298 O3 Shares, representing approximately 21.2% of the issued and outstanding O3 Shares. Immediately after giving effect to the Transaction, the Corporation had beneficial ownership of, or control and direction over, 18,291,854 O3 Shares, representing approximately 21.3% of the issued and outstanding O3 Shares on an undiluted basis (based on there being 86,048,823 O3 Shares outstanding as of the date hereof).

The O3 Shares were acquired for investment purposes. The Corporation intends to review, on a continuous basis, various factors related to its investment in O3 Mining, and may decide to acquire or dispose of additional securities of O3 Mining as future circumstances may dictate.

This news release is being issued in accordance with National Instrument 62-103 – The Early Warning System and Related Take-Over Bid and Insider Reporting Issues in connection with the filing of an early warning report dated December 13, 2023. The early warning report respecting the Transaction has been filed on SEDAR+ (www.sedarplus.ca) under O3 Mining’s issuer profile. To obtain a copy of the early warning report filed by the Corporation, please contact John Burzynski at (416) 363-8653 or refer to SEDAR+ (www.sedarplus.ca) under O3 Mining’s issuer profile.

For further information on the Corporation please contact:

John Burzynski

Chief Executive Officer

Telephone: (416) 363-8653

The Corporation’s head office is located at 155 University Avenue, Suite 1440, Toronto, Ontario M5H 3B7.

OSISKO MINING CORPORATE UPDATE

(Toronto, July 18, 2023) Osisko Mining Inc. (OSK:TSX. “Osisko” or the “Corporation”) is pleased toprovide the following corporate update.

Wildfire Situation in Eeyou Istchee James Bay

On July 17, Québec’s Ministry of Natural Resources and Forests lifted the access restriction to forests and roads on Crown land in the Eeyou Istchee James Bay area surrounding the Windfall site. To help and support provincial fire-fighting efforts, Windfall camp is lodging over 100 firefighters from the Québec fire-fighting agency, Société de Protection des Forêts Contre le Feu (SOPFEU), who are using the Corporation’s facilities as a base to fight regional fires. Windfall will resume underground drilling activities later this week, and increase all other regular site activities back to normal levels as the local fire situation continues to improve in the coming weeks.

John Burzynski, Chairman and Chief Executive Officer, commented: “The Windfall team has done a fantastic job during the past six weeks – a difficult and challenging period, working hand-in-hand and maintaining constant communications with local and provincial authorities to coordinate efforts. Their combined efforts helped maintain the Windfall site infrastructure intact. We were very fortunate that the forest fires passed within the immediate vicinity of the camp facilities several times, but did not cause any material damage to Windfall. Our thoughts and those of our joint-venture partner Gold Fields remain with those local community members and neighbors who were displaced, and those who lost their hunting and fishing cabins in the past month.“

Sustainable Development Report

The Corporation published its 2022 Sustainable Development Report on July 18, 2023, which provides a detailed overview of the environmental, social, and governance performance (ESG) and economic contributions in the communities in which we operate. The report is available on the Osisko website (www.osiskomining.com) in English and French.

Sustainability is anchored in Osisko’s business strategy through the Health and Safety, Human Resources, Environmental, Community Relations, Human Rights and Responsible Procurement policies. In 2022, Osisko Mining achieved several milestones and made significant organizational progress. In addition, Osisko has strengthened its support for renewable energies through its agreement with Miyuu Kaa for the transmission of hydroelectric power to the Windfall site. The 2022 Sustainable Development Report covers Osisko’s activities on our Windfall, Quévillon, and Urban Barry projects. It describes our ESG performance from January 1 to December 31, 2022, and provides comparative data from previous years.

Osisko would like to thank employees, First Nations, host communities, financial and government partners, as well as shareholders, for their continued trust and support in its drive towards sustainable development.

Permitting Process and IBA

The Windfall Environmental Impact Assessment review process by the COMEX is following its course and the Corporation is expecting that the Windfall Mining Group will receive the first round of follow-up questions in the coming months.

In parallel, the Corporation expects to finalize the Impact and Benefit Agreement with the Cree First Nation of Waswanipi and the Cree Nation Government in 2023.

Receipt of Mill Shells

The Windfall Mining Group took delivery of their mill shells last month. All equipment is being stored at a warehouse located in Saint-Gabriel de Brandon, Québec until its final installation at the Windfall Project.

Hyperlink to picture of the shells.

Qualified Person

The scientific and technical content in this news release has been reviewed and approved by Mr. Mathieu Savard, P.Geo (OGQ #510), President of Osisko, who is a “qualified person” (within the meaning of NI 43-101).

About the Windfall Gold Deposit

The Windfall gold deposit is located between Val-d’Or and Chibougamau in the Abitibi region of Québec, Canada. The mineral resource estimate on Windfall (with an effective date of June 7, 2022 ) (the “Windfall Resource Estimate”) and the mineral reserve estimate on Windfall (with an effective date of September 1, 2022) (the “Windfall Reserve Estimate”) are described in the technical report entitled “Feasibility Study for the Windfall Project, Eeyou Istchee James Bay, Québec, Canada” (the “FS Technical Report”) and dated January 10, 2023 (with an effective date of November 28, 2022). The Windfall Resource Estimate, assuming a cut-off grade of 3.50 g/t Au, comprises 811,000 tonnes at 11.4 g/t Au (297,000 ounces) in the measured mineral resource category, 10,250,000 tonnes at 11.4 g/t Au (3,754,000 ounces) in the indicated mineral resource category and 12,287,000 tonnes at 8.4 g/t Au (3,337,000 ounces) in the inferred mineral resource category. The Windfall Reserve Estimate, assuming 3.5 g/t operating, 2.5 g/t incremental, and 1.7 g/t development cut-off grade, comprises 12,183,000 tonnes at 8.06 g/t Au (3,159,000 ounces) in the probable mineral reserves category. The key assumptions, parameters, limitations and methods used in the FS Technical Report, including the related Windfall Resource Estimate and Windfall Reserve Estimate, are described in the FS Technical Report, which was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The FS Technical Report is available on SEDAR (www.sedar.com) under Osisko’s issuer profile. The Windfall gold deposit is currently one of the highest-grade resource-stage gold projects in Canada and has world-class scale. Mineralization occurs in three principal areas: Lynx, Main, and Underdog. Mineralization is generally comprised of sub-vertical lenses following intrusive porphyry contacts plunging to the northeast. The resources are defined from surface to a depth of 1,600 metres, including the Triple 8 (TP8) zone. The reserves are defined from surface to a depth of 1,100 metres. The deposit remains open along strike and at depth. Mineralization has been identified at surface in some areas and as deep as 2,625 metres in others with significant potential to extend mineralization down-plunge and at depth.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 50% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 50% interest in a large area of claims in the surrounding Urban Barry area and nearby Quévillon area (over 2,300 square kilometers).

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always, using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “potential”, “feasibility”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This news release contains the forward-looking information pertaining to, among other things: the Windfall gold deposit being one of the highest-grade resource-stage gold projects in Canada and having world-class scale; the future impact of the wildfire situation in Québec; the timing and ability of the Corporation to resume normal levels of activity at Windfall; the Corporation’s expectations of the Environmental Impact Assessment review process by COMEX; the Corporation’s expectation (timing and ability) to finalize an Impact Benefit Agreement with Cree First Nation of Waswanipi and the Cree Nation Government; reliance on third-parties for infrastructure, including power lines, with reference to the agreement with Miyuu Kaa for the transmission of hydroelectric power to the Windfall site; the timing and progress of the mine permitting process; the results of the FS Technical Report, including NPV, IRR, production, tax-free cash flows, capex, AISC, milling operations, average recovery, job creation; the key assumptions, parameters and methods used to estimate the mineral resource and reserve estimates relating to the FS Technical Report; the Lynx zone remaining open to expansion down plunge. Such factors include, among others, risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; reliance on third parties, including governmental entities; the timing and ability, if at all, to obtain permits; the reliance on third-parties for infrastructure critical to build and operate the Windfall project, including power lines; our ability to obtain power for the project, if at all or on terms economic to the Corporation; the status of third-party approvals or consents; errors in management’s geological modelling; the ability of Osisko to complete further exploration activities, including (infill) drilling; property and royalty interests in the Windfall gold deposit; the ability of the Corporation to obtain required approvals; the results of exploration activities; risks relating to mining activities; the Canadian/United States dollar exchange rate; the global economic climate; metal (including gold) prices; dilution; environmental risks; and community and non-governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

CONTACT INFORMATION:

John Burzynski

Chief Executive Officer

Telephone (416) 363-8653

OSISKO MINING PROVIDES CORPORATE UPDATE

Toronto, June 5, 2023 – Osisko Mining Inc. (TSX:OSK. “Osisko” or the “Corporation“) would like to provide the following update on the ongoing forest fire situation affecting the communities in Abitibi and Eeyou Istchee James Bay, where the Windfall gold project is located. On June 2 and 3, 2023, Quebec’s Ministry of Natural Resource and Forests announced prohibitions regarding forest access on Crown lands, and closed forestry roads for reasons of public safety, given the current situation related to wildfires in the Abitibi and Eeyou Istchee James Bay regions.

John Burzynski, Chairman and Chief Executive Officer of Osisko Mining commented: “We have withdrawn our staff and continue to monitor our facilities remotely and on the ground in accordance with local directives. Our team is in constant communication with local and provincial authorities to coordinate all efforts in this difficult time. All personnel are safe, and the Windfall facilities are secure. While all activities at site are currently suspended, we do not anticipate any material impact on our business.”

Osisko will update the market in the event of any material change to Osisko arising in relation to the wildfires.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 50% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 50% interest in a large area of claims in the surrounding Urban Barry area and nearby Quévillon area (over 2,300 square kilometers).

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always, using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “scheduled”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information.

This news release contains the forward-looking information pertaining to, among other things: the potential impact of wildfires on our business, operations or assets; the impact of the wildfires and regulatory responses thereto on the business of Osisko the prospects, if any, of the Windfall gold deposit; the ability to realize upon any mineralization in a manner that is economic; the amount and type of drilling to be completed and the timing to complete such drilling; future drilling and advancement at the Property.

Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, among others, risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability to continue current operations and exploration; risks relating to exploration, development and mining activities; reliance on third-parties for infrastructure, including power lines; and community and non-governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

For further information please contact:

John Burzynski

Chief Executive Officer

Telephone (416) 363-8653

OSISKO ANNOUNCES RESULTS OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

Toronto, Ontario (May 29, 2023) – Osisko Mining Inc. (TSX:OSK. “Osisko” or the “Corporation“) is pleased to announce the results of its annual and special meeting of shareholders (the “Meeting“) held earlier today. A total of 291,356,722 common shares of the Corporation were represented at the Meeting, representing approximately 75.9% of the total number of common shares of the Corporation issued and outstanding.

All matters presented for approval at the Meeting were duly authorized and approved, as follows:

- PricewaterhouseCoopers LLP was appointed as the auditor of the Corporation for the ensuing year, and the board of directors of the Corporation was authorized to fix their remuneration;

- all of the management nominees were elected to the board of directors of the Corporation to serve for the ensuing year or until their successors are duly elected or appointed (details in table below); and

- the omnibus equity incentive plan of the Corporation and the unallocated options and other entitlements thereunder was ratified, confirmed and approved.

Detailed voting results regarding the election of directors are as follows:

| Name | Voted For | Voted Withhold | ||

| (#) | (%) | (#) | (%) | |

| John Burzynski | 265,554,040 | 96.876% | 8,563,343 | 3.124% |

| José Vizquerra Benavides | 262,197,094 | 95.651% | 11,920,289 | 4.349% |

| Patrick F.N. Anderson | 271,914,557 | 99.196% | 2,202,826 | 0.804% |

| Keith McKay | 268,701,463 | 98.024% | 5,415,920 | 1.976% |

| Amy Satov | 269,249,967 | 98.224% | 4,867,416 | 1.776% |

| Bernardo Alvarez Calderon | 270,172,278 | 98.561% | 3,945,105 | 1.439% |

| Andrée St-Germain | 268,993,302 | 98.131% | 5,124,081 | 1.869% |

| Cathy Singer | 271,743,619 | 99.134% | 2,373,764 | 0.866% |

Further details on the above matters, including the report of voting results thereon, are available on SEDAR (www.sedar.com) under Osisko’s issuer profile.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 50% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 50% interest in a large area of claims in the surrounding Urban Barry area and nearby Quévillon area (over 2,300 square kilometers).

For further information please contact:

John Burzynski

Chief Executive Officer

Telephone (416) 363-8653

OSISKO MINING INC. AMENDS OMNIBUS PLAN

Toronto, Ontario (May 1, 2023) – Osisko Mining Inc. (TSX:OSK) (the “Corporation” or “Osisko“) announces that its Board of Directors has approved minor amendments to the omnibus equity incentive plan of the Corporation (the “Omnibus Plan“), which is proposed for approval by the shareholders of the Corporation at Osisko’s annual and special meeting of shareholders to be held on May 29, 2023 (the “Meeting“), to address comments from ISS Proxy Advisory Services on the Omnibus Plan.

The Omnibus Plan, the adoption of which shareholder approval is being sought at the Meeting, has been amended to include language in Section 7.3(2) of the Omnibus Plan to require shareholder approval for the following:

- any amendment to the non-transferability of awards set out in Section 6.1(6) (General Conditions Applicable to Awards – Non-Transferrable Awards) of the Omnibus Plan; and

- any amendment to Article 7 (Adjustments and Amendments) of the Omnibus Plan.

These amendments will be included in the Omnibus Plan proposed to be considered and voted upon by shareholders at the Meeting.

For further information on the Corporation, please contact:

John Burzynski

Chief Executive Officer

Telephone: (416) 363-8653

The Corporation’s head office is located at 155 University Avenue, Suite 1440, Toronto, Ontario M5H 3B7.

OSISKO MINING INC. FILES EARLY WARNING REPORT

Toronto, Ontario (March 30, 2023) – Osisko Mining Inc. (TSX:OSK) (the “Corporation” or “Osisko“) announces that in accordance with regulatory requirements it has filed an early warning report in respect of its holdings in Vior Inc. (“Vior“). In connection with private placement (the “Private Placement“) by Vior of flow-through common shares on March 30, 2023, Osisko acquired from the initial subscribers in the Private Placement an aggregate of 6,983,765 common shares in the capital of Vior (the “Common Shares“) at a price of $0.145 per Common Share for an aggregate purchase price of $1,012,645.84 (the “Acquisition“).

Immediately following the completion of the Acquisition, Osisko has beneficial ownership of, or control and direction over 13,831,764 Common Shares and 1,224,000 Warrants representing approximately 13.6% of the issued and outstanding Common Shares on a non-diluted basis (approximately 14.7% on a partially diluted basis, assuming the exercise of all Warrants held by Osisko) after giving effect to the Private Placement.

Osisko acquired the securities of Vior for investment purposes and intends to review, on a continuous basis, various factors related to this investment, and may decide to purchase additional securities of Vior or may decide in the future to sell all or part of its investment, as future circumstances may dictate.

This news release is being issued in accordance with National Instrument 62-103 – The Early Warning System and Related Take-Over Bid and Insider Reporting Issues in connection with the filing of an early warning report dated March 30, 2023. The early warning report in respect of the Acquisition has been filed on SEDAR (www.sedar.com) under Vior’s issuer profile. To obtain a copy of the early warning report filed by the Corporation, please contact John Burzynski at (416) 363-8653 or refer to SEDAR (www.sedar.com) under Vior’s issuer profile.

For further information on the Corporation, please contact:

John Burzynski

Chief Executive Officer

Telephone: (416) 363-8653

The Corporation’s head office is located at 155 University Avenue, Suite 1440, Toronto, Ontario M5H 3B7.

OSISKO MINING CLOSES C$100 MILLION “BOUGHT DEAL” PRIVATE PLACEMENT OF UNITS, INCLUDING FULL EXERCISE OF THE UNDERWRITERS’ OPTION

(Toronto, February 28, 2023) – Osisko Mining Inc. (TSX:OSK) (“Osisko” or the “Corporation”) is pleased to announce the completion of its previously announced “bought deal” private placement of an aggregate of 32,260,000 units of the Corporation (the “Units”) at a price of C$3.10 per Unit for aggregate gross proceeds of approximately C$100 million, including the exercise in full of the underwriters’ option (the “Offering”).

Each Unit consists of one common share of the Corporation and one-half of one common share purchase warrant of the Corporation (each whole common share purchase warrant, a “Warrant”). Each Warrant entitles the holder thereof to acquire one common share of the Corporation for 18 months from the closing of the Offering at a price of C$4.00, subject to adjustment in certain circumstances.

The net proceeds received from the Offering will be used to advance the Corporation’s Windfall Project as well as for working capital and general corporate purposes. The Offering was led by Canaccord Genuity Corp., on behalf of a syndicate of underwriters that included BMO Nesbitt Burns Inc., CIBC World Markets Inc., National Bank Financial Inc., Scotia Capital Inc., Eight Capital, and Haywood Securities Inc.

All securities issued under the Offering will be subject to a hold period expiring four months and one day from the date hereof. The Offering is subject to final acceptance of the Toronto Stock Exchange.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

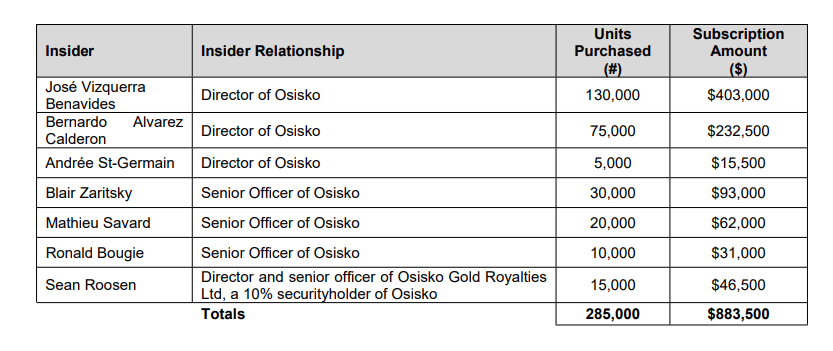

The following “insiders” of the Corporation have subscribed for Units under the Offering:

Each subscription by an “insider” is considered to be a “related party transaction” for purposes of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Corporation did not file a material change report more than 21 days before the expected closing date of the Offering as the details of the Offering and the participation therein

by each “related party” of the Corporation were not settled until shortly prior to the closing of the Offering, and the Corporation wished to close the Offering on an expedited basis for sound business reasons. The Corporation is relying on exemptions from the formal valuation and

minority shareholder approval requirements available under MI 61-101. The Corporation is exempt from the formal valuation requirement in Section 5.4 of MI 61-101 in reliance on section 5.5(a) of MI 61-101 as the fair market value of the transaction, insofar as it involves interested

parties, is not more than the 25% of the Corporation’s market capitalization. Additionally, the Corporation is exempt from minority shareholder approval requirement in Section 5.6 of MI 61-101 in reliance on Section 5.7(1)(a) of MI 61-101 as the fair market value of the transaction, insofar as it involves interested parties, is not more than the 25% of the Corporation’s market capitalization.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 100% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and

holds a 100% undivided interest in a large area of claims in the surrounding Urban Barry area and nearby Quévillon area (over 2,400 square kilometres).

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the

use of proceeds of the Offering, the timing and ability of the Corporation, if at all, to obtain final approval of the Offering from the Toronto Stock Exchange and any other information herein that is not a historical fact may be “forward-looking information”. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to

identify forward- looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation at the time such assumptions and estimates were made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Osisko to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to capital markets; the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability of Osisko to complete further exploration activities, including drilling; property interests in the Windfall Lake gold project; the ability of the Corporation to obtain required approvals and complete transactions on terms announced; the

results of exploration activities; risks relating to mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non- governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions. Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information, Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

For further information please contact:

John Burzynski

Chief Executive Officer

Telephone (416) 363-8653

OSISKO MINING CORPORATE UPDATE

(Toronto, February 22, 2023) Osisko Mining Inc. (OSK:TSX. “Osisko” or the “Corporation”) provides the following corporate update.

The Corporation continues to advance work on the Windfall project and surrounding properties, with 15 rigs in total active underground and at surface, performing a combination of infill and exploratory drilling. Detailed engineering has commenced for the planned Windfall operations with the objective of optimizing design and capital expenditures.

The exploration ramp is currently at 640 metres vertical depth, and over 13 kilometres length underground. Nine drills are active on the exploration ramp, and the advance towards the fourth bulk sample (the 800 metre level Lynx 4 sample) is planned to resume in H2 2023.

Osisko is also working towards the conclusion of the definitive agreement with Miyuukaa Corp. (“Miyuukaa”), a wholly-owned corporation of the Cree First Nation of Waswanipi (“CFNW”), with respect to the construction of proposed transmission facilities and the transport of hydroelectric power to the Windfall project. The Kuikuhaacheu transmission line from the Waswanipi substation to Windfall is located 100% on CFNW traditional lands covered by the James Bay Northern Québec Agreement. Finalization of the definitive agreement is expected before the end of this month.

The Corporation remains on schedule to submit its Environmental Impact Assessment report for Windfall (“EIA”) to the Environmental and Social Impact Review Committee (“COMEX”) in Q1 2023. The Corporation also anticipates finalizing the Impact and Benefit Agreement with the Cree First Nation of Waswanipi and the Cree Nation Government before year end 2023.

The Corporation has also begun to receive pre-ordered mill components at the port of Bécancour, Québec. Equipment is being kept in a dry and heated storage facility until required at the Windfall site.

Having completed its Feasibility Study, Osisko has begun the process of reviewing its financing options for the Windfall mine, including ongoing discussions with potential lenders and other strategic alternatives, which may include public and private debt facilities, strategic alliances, partnerships, joint ventures, and other strategic alternatives. Osisko will only provide updates on any such alternatives that advance to the point of requiring disclosure. There can be no assurances that any such arrangements can be agreed on terms acceptable to Osisko.

The recently announced “bought-deal” private placement financing (please see Osisko news release dated February 6th, 2023) is expected to close on February 28th.

Qualified Person

The scientific and technical content in this news release has been reviewed and approved by Mr. Mathieu Savard, P.Geo (OGQ #510), President of Osisko, who is a “qualified person” (within the meaning of NI 43-101).

About the Windfall Gold Deposit

The Windfall gold deposit is located between Val-d’Or and Chibougamau in the Abitibi region of Québec, Canada. The mineral resource estimate on Windfall (with an effective date of June 7, 2022 ) (the “Windfall Resource Estimate”) and the mineral reserve estimate on Windfall (with an effective date of November 25, 2022) (the “Windfall Reserve Estimate”) are described in the technical report entitled “Feasibility Study for the Windfall Project, Eeyou Istchee James Bay, Québec, Canada” (the “FS Technical Report”) and dated January 10, 2023 (with an effective date of November 25, 2022). The Windfall Resource Estimate, assuming a cut-off grade of 3.50 g/t Au, comprises 811,000 tonnes at 11.4 g/t Au (297,000 ounces) in the measured mineral resource category, 10,250,000 tonnes at 11.4 g/t Au (3,754,000 ounces) in the indicated mineral resource category and 12,287,000 tonnes at 8.4 g/t Au (3,337,000 ounces) in the inferred mineral resource category. The Windfall Mineral Reserve, assuming 3.5 g/t operating, 2.5 g/t incremental, and 1.7 g/t development cut-off grade, comprises 12,183,000 tonnes at 8.06 g/t Au (3,159,000 ounces) in the probable mineral reserves category. The key assumptions, parameters, limitations and methods used in the Feasibility Study for Windfall, including the related Windfall Resource Estimate and Windfall Reserve Estimate, are described in a technical report (the “FS Technical Report”), which was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The FS Technical Report is available on SEDAR (www.sedar.com) under Osisko’s issuer profile. The Windfall gold deposit is currently one of the highest-grade resource-stage gold projects in Canada and has world-class scale. Mineralization occurs in three principal areas: Lynx, Main, and Underdog. Mineralization is generally comprised of sub-vertical lenses following intrusive porphyry contacts plunging to the northeast. The resources are defined from surface to a depth of 1,600 metres, including the Triple 8 (TP8) zone. The reserves are defined from surface to a depth of 1,100 metres. The deposit remains open along strike and at depth. Mineralization has been identified at surface in some areas and as deep as 2,625 metres in others with significant potential to extend mineralization down-plunge and at depth.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 100% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 100% undivided interest in a large area of claims in the surrounding the Urban Barry area and nearby Quévillon area (over 2,300 square kilometres).

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always, using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “potential”, “feasibility”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This news release contains the forward-looking information pertaining to, among other things: the ; the amount and type of drilling to be completed and the timing to complete such drilling; the focus of the remaining infill drilling; the trend of grade increase; the proposed exploration and development works; the entering into and performance of the power line agreement, completion of the proposed environmental assessment, identification, negotiation and entering into of any strategic transaction to assist in the construction of the Windfall project, the Windfall gold deposit being one of the highest-grade resource-stage gold projects in Canada and having world-class scale; the key assumptions, parameters and methods used to estimate the mineral resource estimate disclosed in this news release; the prospects, if any, of the Windfall gold deposit; ; future drilling at the Windfall gold deposit. Such factors include, among others, the ability of Osisko to complete further exploration activities, including (infill) drilling; the ability to complete development activities described herein; risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability of the Corporation to complete materials, file and to obtain required approvals; risks related to the negotiation and entering into of the power line agreement; the results of exploration activities; risks related to the identification, negotiation with, and execution of any strategic transaction to support the development of the Windfall gold deposit; risks relating to mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non-governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

CONTACT INFORMATION:

John Burzynski

Chief Executive Officer

Telephone (416) 363-8653

OSISKO MINING ANNOUNCES C$75 MILLION “BOUGHT DEAL” PRIVATE PLACEMENT OF UNITS

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

(Toronto, February 6, 2023) – Osisko Mining Inc. (TSX:OSK) (“Osisko” or the “Corporation”) is pleased to announce that it has entered into an agreement with Canaccord Genuity Corp. on behalf of a syndicate of underwriters (collectively, the “Underwriters”), pursuant to which the Underwriters have agreed to purchase, on a “bought deal” private placement basis, 24,195,000 units of the Corporation (each, a “Unit”) at a price of C$3.10 per Unit (the “Offering Price”) for gross proceeds of C$75,004,500 (the “Underwritten Offering”).

Each Unit will consist of one common share of the Corporation (each, a “Unit Share”) and one-half of one common share purchase warrant of the Corporation (each whole common share purchase warrant, a “Warrant”). Each Warrant will entitle the holder to acquire one common share of the Corporation for 18 months from the closing of the Offering at a price of C$4.00.

The Corporation has also granted the Underwriters an option to purchase up to an additional 8,065,000 Units at the Offering Price for additional gross proceeds of up to C$25,001,500 exercisable at any time up to 48 hours prior to the closing of the Offering (the “Underwriters’ Option”).

The net proceeds received from the Offering will be used to advance the Corporation’s Windfall Project, as well as for working capital and general corporate purposes.

It is anticipated that closing of the Offering will occur on or about February 28, 2023, or such other date or dates as the Corporation and the Underwriters may agree. The Offering is subject to the satisfaction of certain conditions, including receipt of all applicable regulatory approvals including the approval of the Toronto Stock Exchange. The securities sold under the Offering will have a hold period in Canada of four months and one day from the closing date in accordance with applicable securities laws.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused on the acquisition, exploration, and development of precious metal resource properties in Canada. Osisko holds a 100% interest in the high-grade Windfall gold deposit located between Val-d’Or and Chibougamau in Québec and holds a 100% undivided interest in a large area of claims in the surrounding Urban Barry area and nearby Quévillon area (over 2,400 square kilometres).

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the closing of the Offering; the use of proceeds of the Offering; the exercise of the Underwriters’ Option; the approval of the Toronto Stock Exchange relating to the Offering; and any other information herein that is not a historical fact may be “forward-looking information”. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward- looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation at the time such assumptions and estimates were made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Osisko to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to capital markets; the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability of Osisko to complete further exploration activities, including drilling; property interests in the Windfall Lake gold project; the ability of the Corporation to obtain required approvals and complete transactions on terms announced; the results of exploration activities; risks relating to mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non-governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions. Osisko cannot assure shareholders and prospective purchasers of securities of the Corporation that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Osisko nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information, Osisko does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

For further information please contact:

John Burzynski

Chief Executive Officer

Telephone (416) 363-8653